Updated: 27-Dec-10 08:05 ET

Market is acting a bit funny….reason i am saying that is that we are trading at relatively HIGH prices, over 52 weeks highs, yet the volatility is at a very low level….

What i have noticed over the years is the wave pattern of volatility….from extremely high volatility to extremely low volatility and goes again….so now the question is when is the next wave of higher volatility starts?

Have a great weekend, successful trading week ahead ( only 4 trading days next week, with Thursday packed with economic numbers).

I will be out of the office until Jan. 3rd but you will receive levels and reports published by colleague here at cannon.

happy Holidays and great trading in 2011! Continue reading “Futures Trading Levels and Economic Reports for December 20, 2010”

We are heading into the last two weeks of 2010 with only 4 days of trading next week and generally lower volume during this period of the year. Keep that in mind when trading.

Some days you will see very slow, choppy trading while other days you may see some volatile and exaggerated moves because of the lower volume.

Keep a trading journal, write notes on how this time of the year is affecting the markets and trading and refer back to these notes when needed. Continue reading “Futures Trading Levels and Economic Reports for December 17, 2010”

Market feels bit heavy right now but then again it felt heavy more than a few times over past few weeks only to find some more legs and go higher….so either way you plan on trading this market, make it exactly that….have a plan and then trade your plan.

Our Weekly Newsletter is Ready for Your Review:

**************************************************************

https://www.cannontrading.com/community/newsletter/

************************************************************** Continue reading “Futures Trading Levels and Weekly Newsletter for December 16th 2010”

FOMC is behind us and the market is heading into the final little stretch of the year, going into that last two weeks of 2010 along with the holiday season and what may be lower volume period.

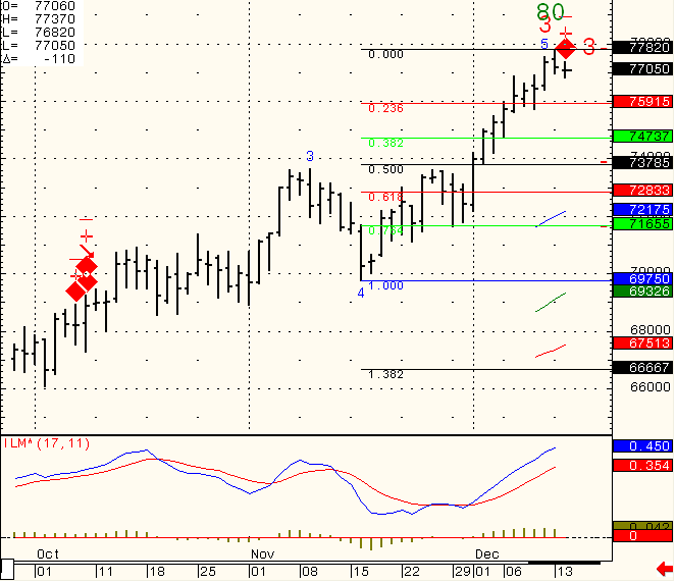

In between, I see a possibility for a pull back on the Mini Russell 2000 if prices can break below 767.00 basis the march contract. Daily chart for your review below:

Continue reading “Futures Trading Levels and Economic Reports for December 15, 2010”

Continue reading “Futures Trading Levels and Economic Reports for December 15, 2010”

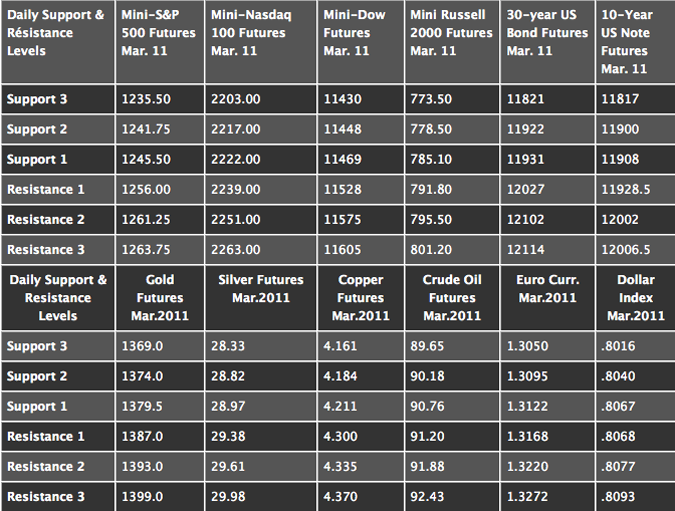

We are now trading MARCH contracts for all e-minis, stock indices, financials and CURRENCIES.

FOMC tomorrow and before that more than a few economic numbers.

FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow.

if you are a newcomer, take a more conservative approach and make sure you understand that the news can really move the market.

My observations suggest choppy, low volume up until announcement, followed by some some sharp volatile moves right during and after the announcement. However, with tomorrow early morning reports, we may see more volatility duirng first couple of hours as well. Continue reading “Futures Trading Levels and Economic Reports Schedule for December 14th 2010”

We are now trading MARCH contracts for all e-minis, stock indices, financials and CURRENCIES.

I think next week we should see some volatility with economic reports due along with FOMC. Please see next reports below.

I think the following quote is so appropriate in our business….

“One cannot do anything about yesterday”

Wishing you a great weekend. Continue reading “Futures Trading Levels and Economic Reports for December 13th 2010”

December to March Rollover Notice

We are now trading MARCH contracts for all e-minis and stock indices.

Weekly chart of the CASH SP index for your review below: