Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

* The Dow Jones has rallied over 4,000 points since the U.S. elections. This will not continue forever. Consider allocating some gains into alternative investments like trading systems shared below offered by Cannon Trading, a 29 year veteran.

TRADE SMART / BASE TRADING ON ACTUALS ONLY — for the current rankings as well as actual performance of trading systems traded at Cannon, click here.

Cannon Trading Company Inc. is registered with the CFTC and a member of the NFA.

** Updates to E-Futures Int’l: Our FREE trading platform now offers theoretical values ( delta, gamma, theta) on option chains!

Add this to margin calculator, news, server side advanced orders and MUCH more to make this the BEST free trading platforms in our opinion!

Try it for FREE if you have not done so yet.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

10-11-2017

| Contract December 2017 |

SP500 |

Nasdaq100 |

Dow Jones |

Mini Russell |

BitCoin Index |

| Resistance 3 |

2561.17 |

6110.50 |

22826 |

1531.53 |

5408.32 |

| Resistance 2 |

2555.83 |

6097.25 |

22789 |

1524.77 |

5137.18 |

| Resistance 1 |

2549.92 |

6081.25 |

22751 |

1516.33 |

4957.44 |

| Pivot |

2544.58 |

6068.00 |

22714 |

1509.57 |

4686.30 |

| Support 1 |

2538.67 |

6052.00 |

22676 |

1501.13 |

4506.56 |

| Support 2 |

2533.33 |

6038.75 |

22639 |

1494.37 |

4235.42 |

| Support 3 |

2527.42 |

6022.75 |

22601 |

1485.93 |

4055.68 |

|

|

|

|

|

|

| Contract |

December Gold |

Dec. Silver |

Nov. Crude Oil |

Dec. Bonds |

Dec. Euro |

| Resistance 3 |

1301.1 |

17.35 |

50.49 |

152 25/32 |

1.1846 |

| Resistance 2 |

1294.5 |

17.19 |

50.14 |

152 18/32 |

1.1823 |

| Resistance 1 |

1290.8 |

17.09 |

49.83 |

152 11/32 |

1.1808 |

| Pivot |

1284.2 |

16.93 |

49.48 |

152 4/32 |

1.1785 |

| Support 1 |

1280.5 |

16.82 |

49.17 |

151 29/32 |

1.1771 |

| Support 2 |

1273.9 |

16.66 |

48.82 |

151 22/32 |

1.1748 |

| Support 3 |

1270.2 |

16.56 |

48.51 |

151 15/32 |

1.1733 |

|

|

|

|

|

|

| Contract |

Dec. Corn |

Dec. Wheat |

November Beans |

Dec. SoyMeal |

Nov. Nat Gas |

| Resistance 3 |

352.3 |

445.8 |

983.75 |

324.27 |

2.93 |

| Resistance 2 |

351.2 |

443.7 |

979.75 |

322.43 |

2.91 |

| Resistance 1 |

350.3 |

439.8 |

973.25 |

318.97 |

2.87 |

| Pivot |

349.2 |

437.7 |

969.25 |

317.13 |

2.85 |

| Support 1 |

348.3 |

433.8 |

962.8 |

313.7 |

2.8 |

| Support 2 |

347.2 |

431.7 |

958.75 |

311.83 |

2.79 |

| Support 3 |

346.3 |

427.8 |

952.25 |

308.37 |

2.75 |

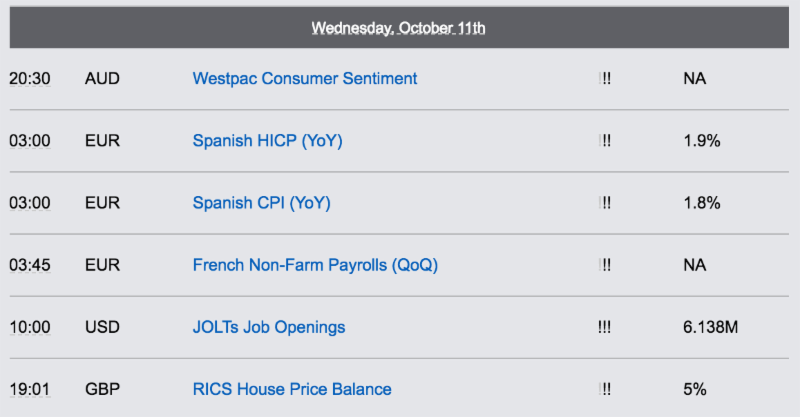

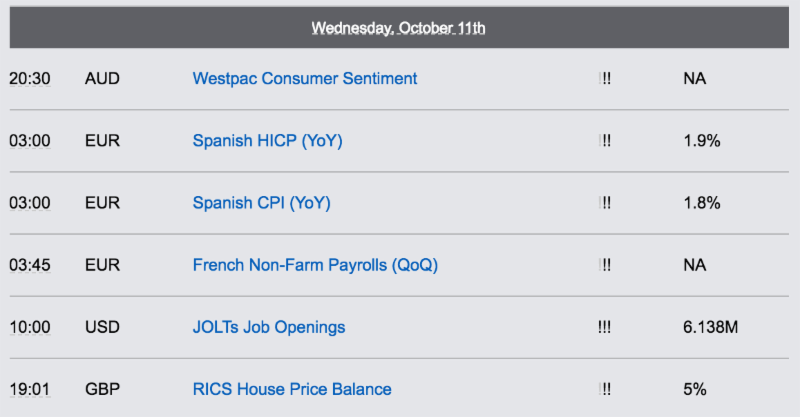

Economic Reports, source:

http://app.bettertrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.