Jump to a section in this post:

1. Market Commentary

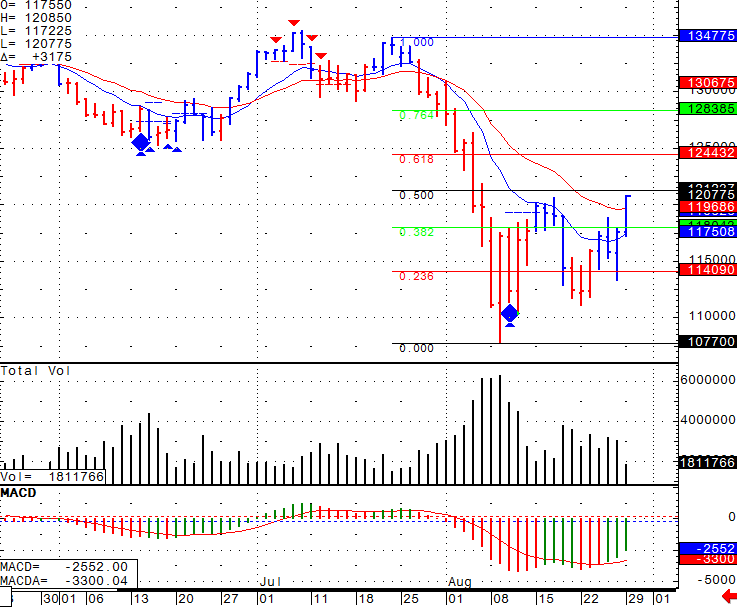

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Daily Mini S&P Chart

5. Economic Reports for Friday, November 18, 2011

1. Market Commentary

We tested the lower borders of this wide band I have talked about over the last few days.

1204.50 to the psychological 1200 level are the first line of defense.

Volatility is picking up another notch again and we saw a sharp sell off in matter of minutes intraday around 11 AM central.

Brings me to a point I have mentioned before many times….and while I hate sounding like a broken record, I hope that by repeating this I may help clients and traders:

ALWAYS EXPECT THE UNACCEPTED! When volatility skyrockets like now, moves become extreme, the speed of the market really picks up and this is when one must adjust their trading size lower to accommodate for the wilder and wider moves.

It is my opinion to have AUTOMATIC stops entered if you are a daytrader. All our trading platforms offer “auto brackets” that allow you to place limits and stops as soon as position entered. Please contact your broker if you need help with this feature. Continue reading “Futures Trading Advice | Support and Resistance Levels”