As far as GDP revisions go, the market doesn’t often take notice. With the latest developments in the US economy, however, the latest set of numbers is set to make quite an impact, even though America’s attention has been otherwise focused on the debt crisis and the narrow escape of a US default.

Historically, the numbers on just about every report are revised. That’s fair, as institutions (the government included) are rushed to get out their headline numbers for the current quarter and they must keep their numbers relevant; that is not to say, however, that the revisions aren’t important. Take a look here:

GROSS DOMESTIC PRODUCT (GDP) GROWTH, ANNUALIZED

| QUARTER |

INITIAL # |

REVISED |

∆ (in percentage) |

| Q3 2010 |

2.6% |

2.5% |

-0.1 |

| Q4 2010 |

3.1% |

2.3% |

-0.8 |

| Q1 2011 |

1.9% |

0.4% |

-1.5 |

| Q2 2011 |

1.3% |

— |

— |

The initial numbers here show somewhat severe fluctuation and indicate a steady slide over the past three quarters. This is troubling enough, but when you look at the revised numbers to the right, you can see that there was no recovery from the downward trend in the fourth quarter in 2010. In fact, the numbers have fallen steadily since the middle of last year, with the last revised number bringing the US GDP to a near stall at 0.4% growth.

Looking forward, one can only wonder what this new 1.3% growth for the second quarter of 2011 might be revised to; is a double-dip recession is inevitable? Recently financial advisors (even Warren Buffett) have said the double dip was not coming, that we have been through the worst of what the recession had to offer and we’re moving forward from here on out. The numbers, however, might lead one to believe the ultimate investor himself may have been wrong.

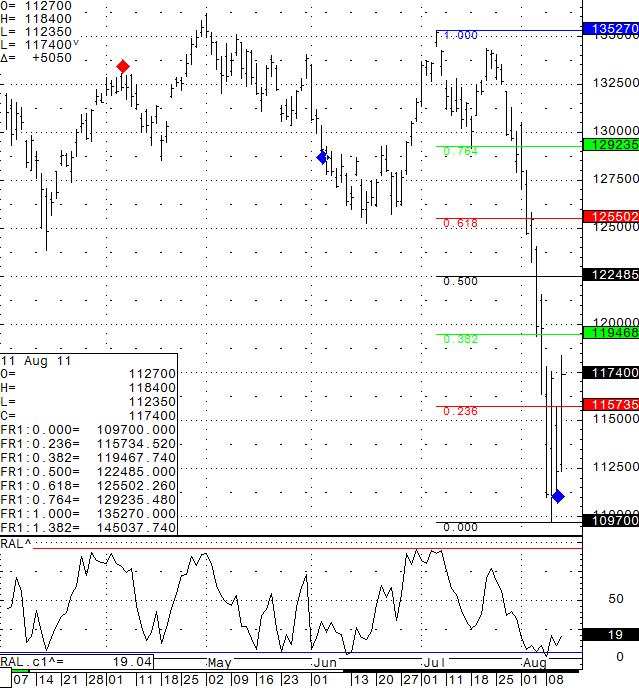

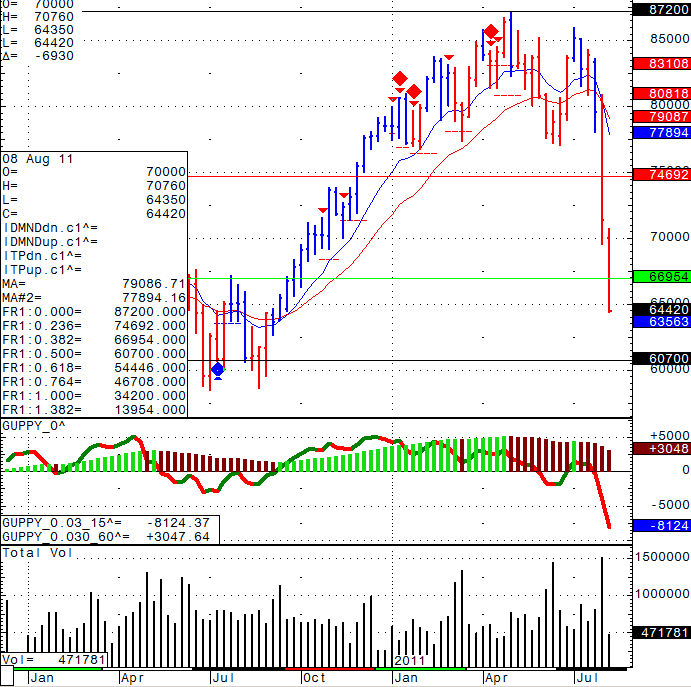

With a debt deal finally negotiated today, the markets might find a very near-term move upward; however once the market figures out that only $917 billion will be cut over 10 years time, it’s inevitable that this decline will continue. Unless there is an immediate and unexpected reverse in all the disappointing numbers coming out (ISM Mfg Index 50.9 v 55.3 prior; Real disposable income grew only 0.1% this month; Non Farm Payroll numbers are due Friday), we are set to continue the negative trend. The only question is, what exactly do we consider a double-dip, and are we already there?

The market has already taken an enormous hit from the paltry GDP report this past Friday, and even after the deal was negotiated successfully today the Mini S&P 500 finished down 2.52% at 1247.50. We might find a very short term recovery in the indices and a slight drawback on metals, but it looks as though the current trends are on course to continue.

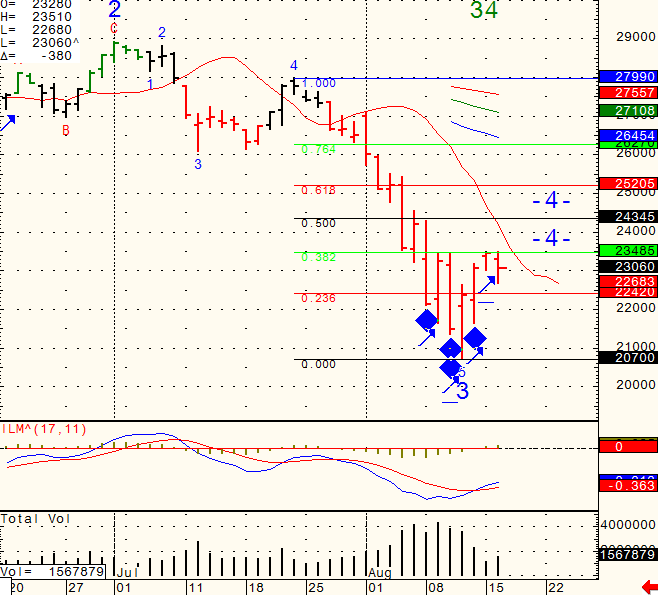

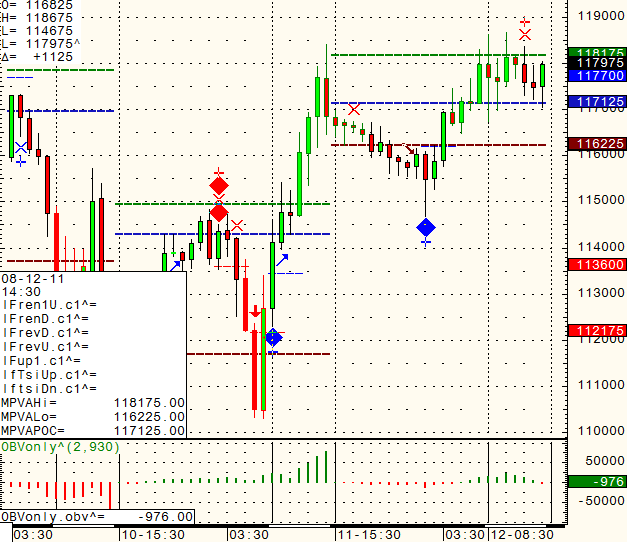

As far as technical analysis, below is the mini SP chart, 15 minutes from today:

15 Minute Chart of the Mini S&P 500 from August 3rd, 2011

Would you like to have access to my DIAMOND ALGO as shown above and be able to apply for any market and any time frame? The screen shot above is of the Mini SP500 from today.

If so, please send me an email with the following information:

- Are you currently trading futures?

- Charting software you use?

- If you use sierra or ATcharts, please let me know the user name so I can enable you.

- Markets you currently trading? Continue reading “Futures Trading Levels, GDP Report”