Cannon Trading / E-Futures.com

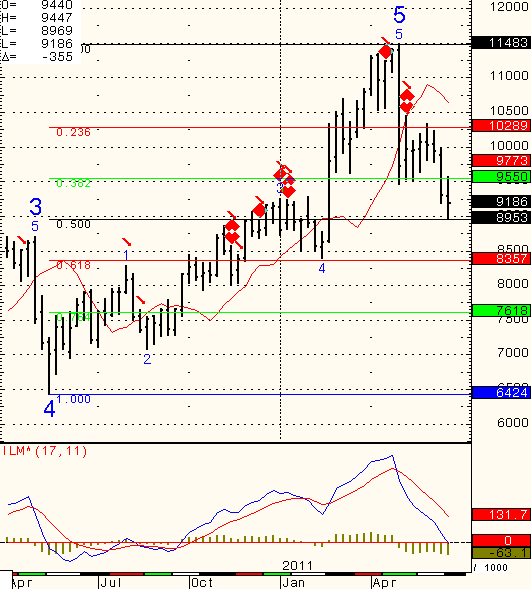

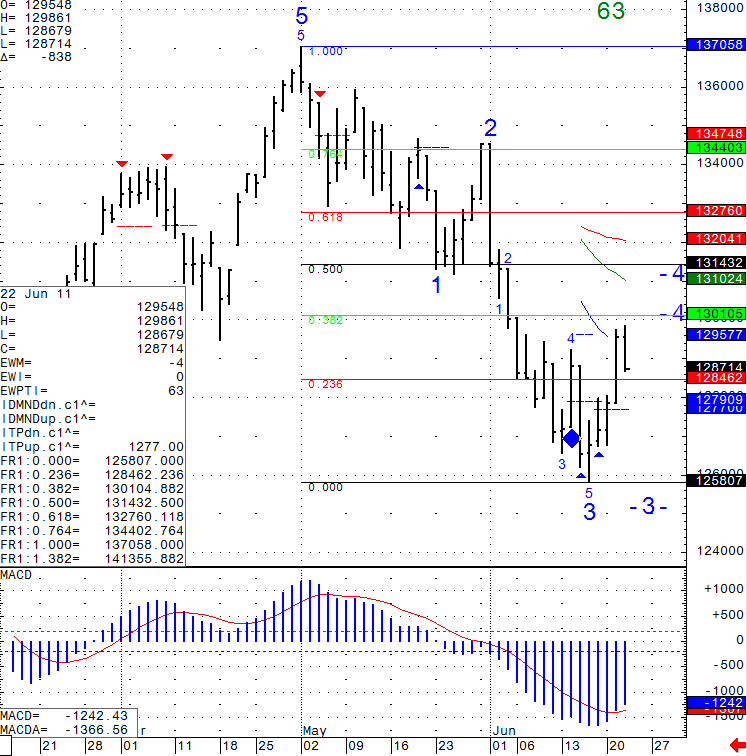

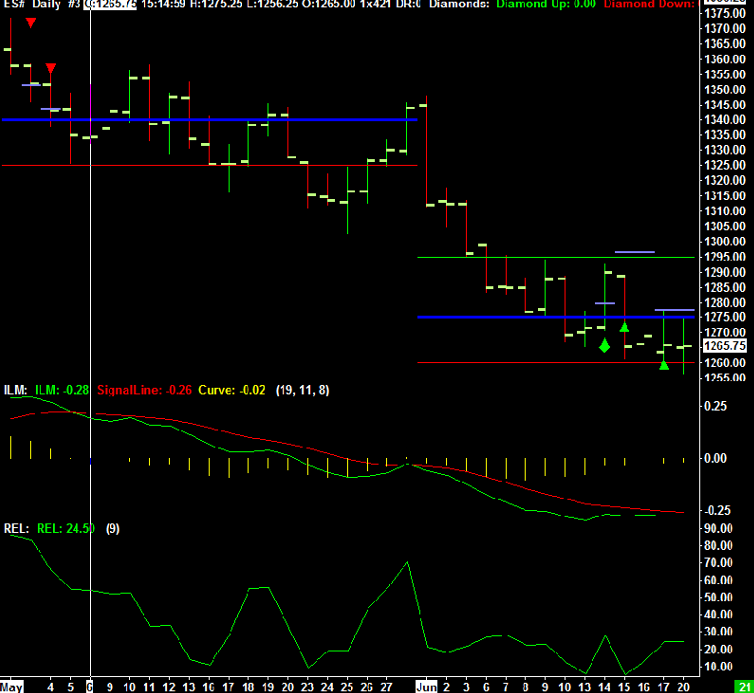

Day-Trading the Mini S&P 500, Crude Oil and other Futures using Volume Charts and the DIAMOND ALGORITHM

This Wednesday, June 29th, Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 9:00 AM central time.

During the webinar, Ilan will:

- Share his approach to day trading futures and review other markets he scans for day trading in addition to the ES. (mini SP 500)

- Explain his day trading strategies that can be applied to MANY futures markets such as crude oil futures, Euro, DAX and more.

- Review the LEVEX family of technical indicators and the DIAMOND ALGO which are now available via Sierra charts.

- Detail his day trading money management philosophy.

- Walks through live trade set ups as they happen real-time.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

- Title:

- Day-Trading the Mini S&P 500, Crude Oil and other Futures using Volume Charts and the DIAMOND ALGORITHM

- Date:

- Wednesday, June 29, 2011

- Time:

- 7:00 AM – 8:00 AM PDT

Space is limited: Reserve your Webinar seat now!

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.4.11 (Tiger®) or newer Continue reading “Futures Trading Levels, Invitation to Exclusive Day Trading Webinar”