Cannon Trading / E-Futures.com

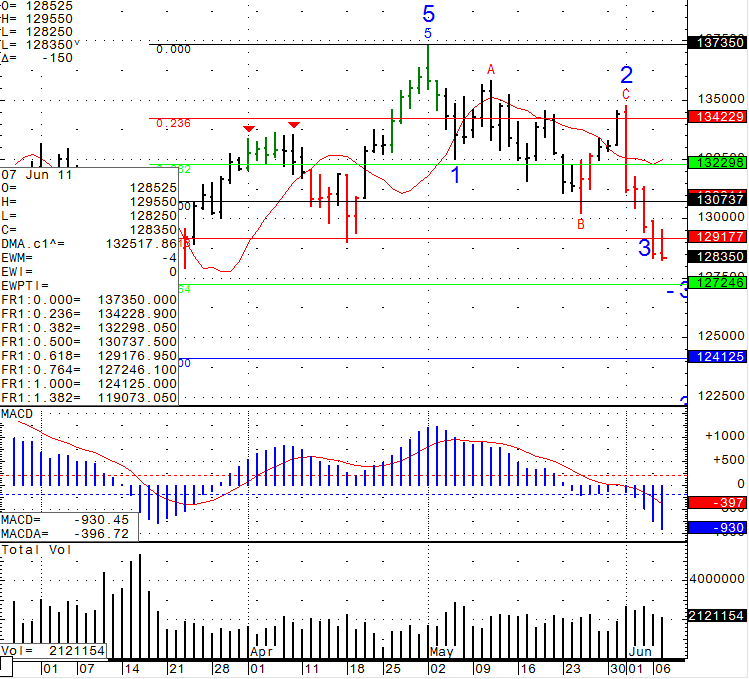

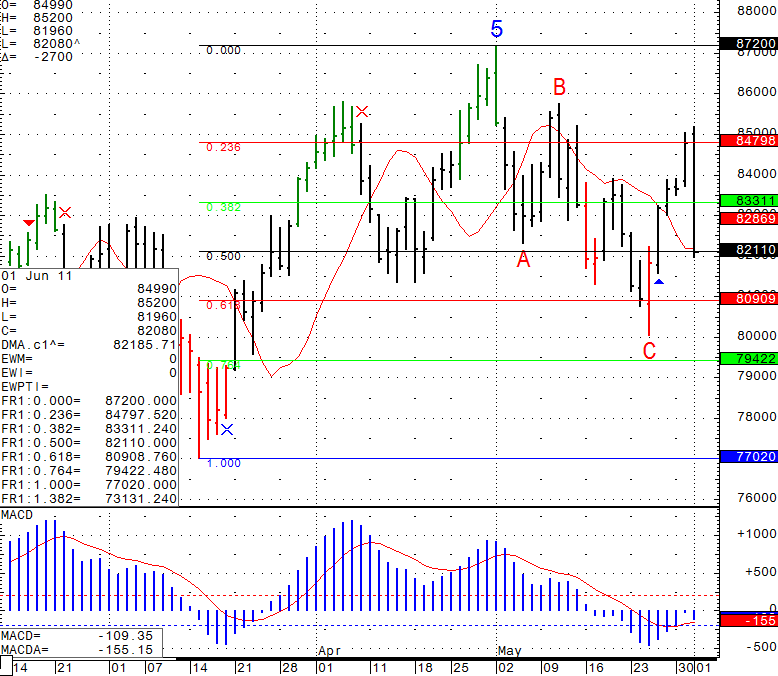

Daily chart of the mini SP500 along with potential levels below and above for you review below.

I think the current level we are at, 1267 is a pivot level. It is a 76.4% Fibonacci level between the lows made back on March 17th 2011 and the highs made on May 2nd 2011. If we can trade above it and start moving higher, we may see a bounce to 1286, if we can pick up steam below, we may see retest of 1235.75 Continue reading “Futures Trading Levels, Fibonacci Used in Context”