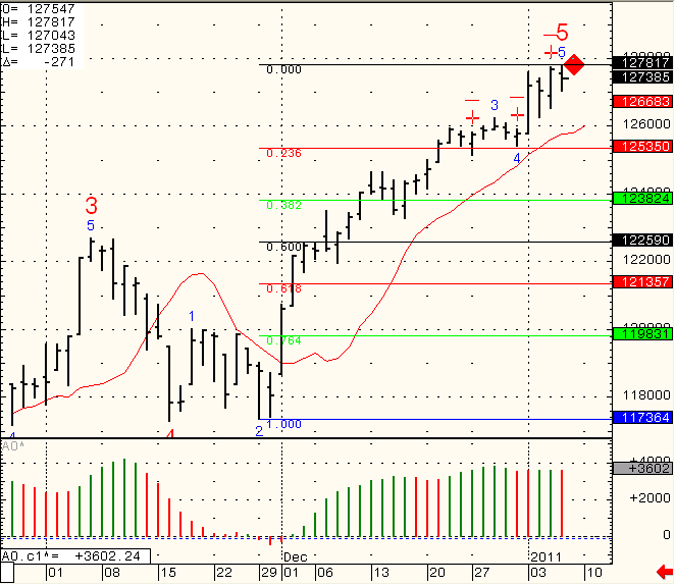

Daily chart of the SP cash index below….I got a potential sell set up if CASH goes below 1270.

We have monthly unemployment tomorrow before the CASH market opens, so it will be interesting to see how the market reacts.

Either way, make sure you have a trading plan and that you are comfortable with the risk – reward associated with your trading plan so you can have the confidence to execute it.

Continue reading “Futures Trading Levels and Economic Reports for January 7, 2010”

Continue reading “Futures Trading Levels and Economic Reports for January 7, 2010”