|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (306)

- Commodity Brokers (589)

- Commodity Trading (845)

- Corn Futures (64)

- Crude Oil (229)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,159)

- Future Trading Platform (326)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,265)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (140)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (429)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (223)

Tag: precious metals

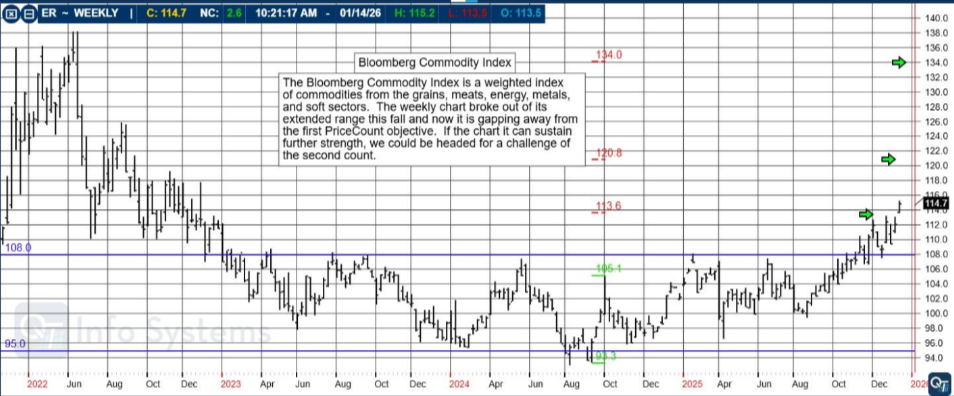

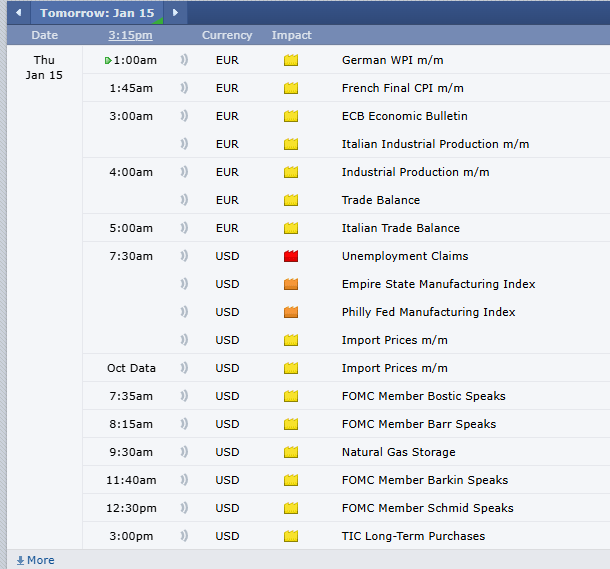

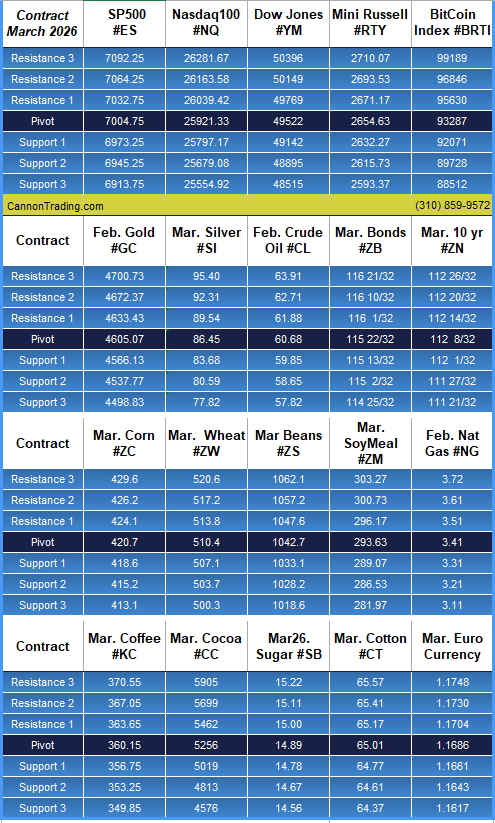

Precious Metals Continue Roaring!!!!! PLUS: Cannon Edge, Bloomberg Commodity Index, Levels, Reports; Your 5 Important Can’t-Miss Need-To-Knows for Trading Futures on January 15th, 2026

|

Metals!By Mark O’Brien, Senior Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

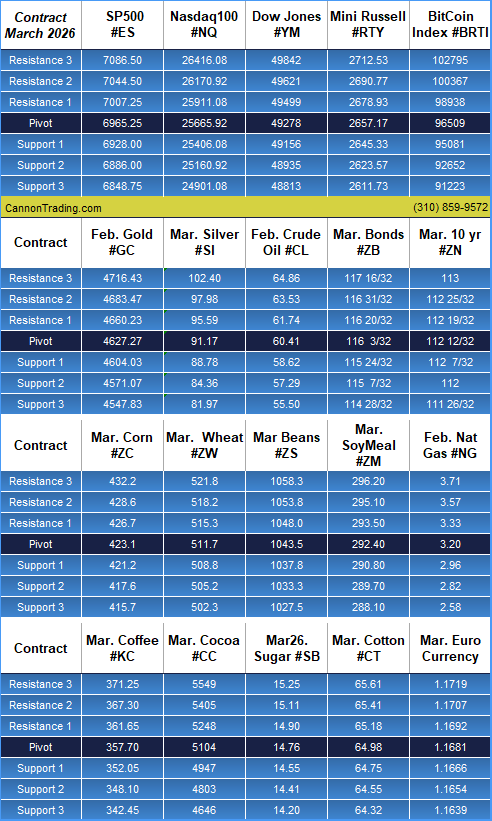

Precious Metals Continue to ROAR!!!! Crude Oil Numbers, Levels, Reports; Your 4 Important Can’t-Miss Need-To-Knows for Trading Futures on January 14th, 2026

|

PPI, Business Inventories, Fed Speakers,Crude Oil Numbers& moreLook for a volatile trading day tomorrow! |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

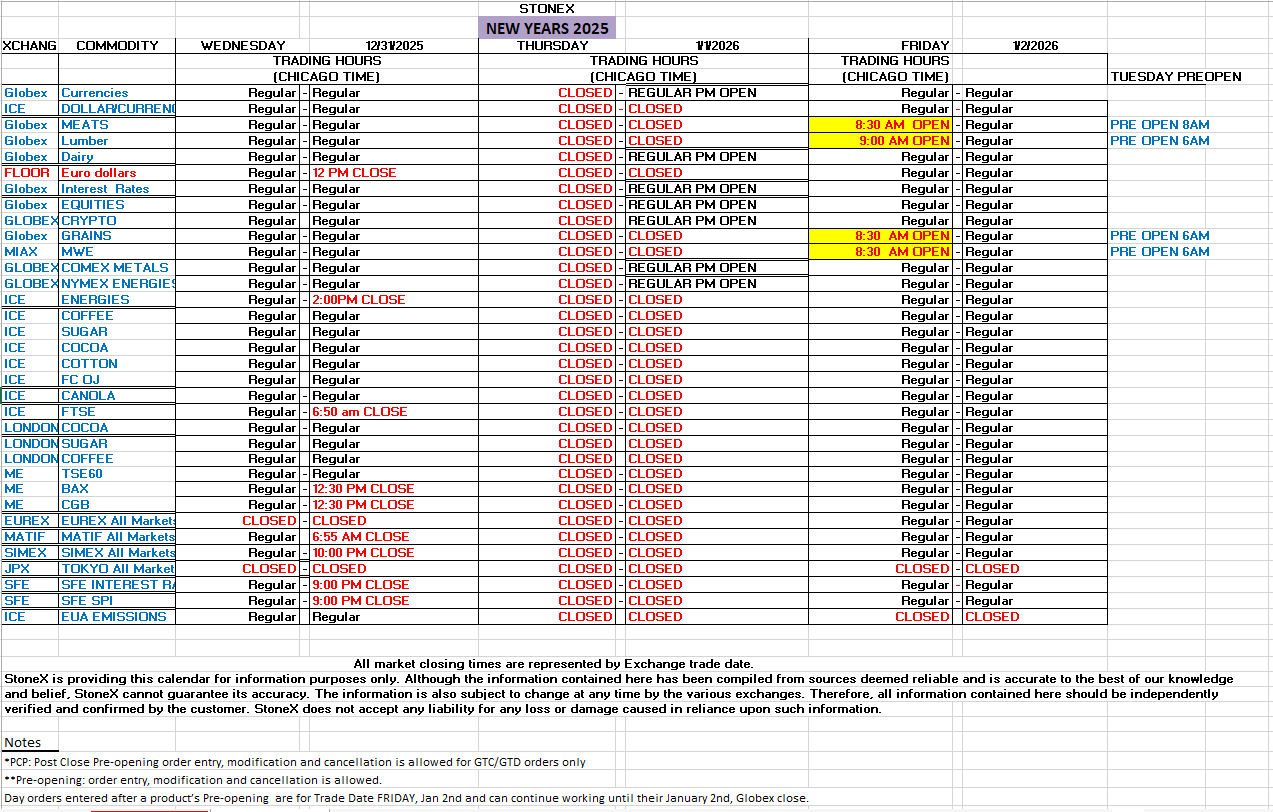

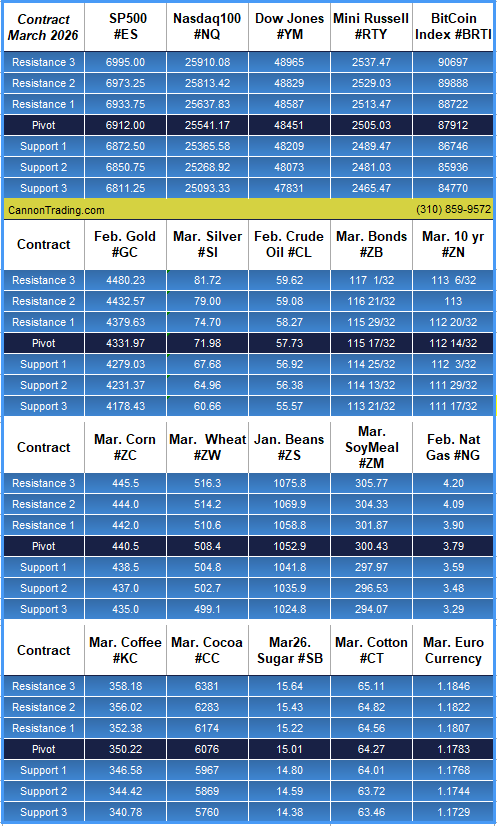

Here’s to a Happy 2026! Precious Metals – Silver Gold Palladium, Trading Hours for the rest of the Week, Levels, Reports; Your 5 Important Can’t-Miss Need-To-Knows for Trading Futures on January 2nd, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trading Gold Futures: Strategies, Exchanges, and Techniques

Read more about trading gold futures with Cannon Trading Company here.

Trading gold futures offers traders the opportunity to capitalize on the price movements of one of the world’s most cherished and sought-after precious metals. In this comprehensive guide, we will delve into the intricacies of trading gold futures, exploring the prominent gold futures exchanges in the US and globally, discussing day trading techniques specific to gold futures, examining gold futures options, and highlighting Cannon Trading Company’s renowned customer service and impressive TrustPilot rating.

Understanding Gold Futures Trading

Gold, often referred to as a “safe-haven” asset, has historically been valued for its ability to retain its worth during economic uncertainties. Gold futures contracts allow traders to speculate on the future price of gold, whether they anticipate the price to rise or fall. These contracts offer a standardized way to buy or sell a specific quantity of gold at a predetermined price on a future date.

Exchanges for Gold Futures

Gold futures are actively traded on several exchanges around the world, providing liquidity and price discovery for traders. Notable exchanges for trading gold futures include:

- Commodity Exchange (COMEX): Operated by the Chicago Mercantile Exchange (CME) Group, COMEX offers gold futures contracts that are among the most widely recognized and traded in the world. The contracts are denominated in troy ounces.

- Multi Commodity Exchange (MCX): Based in India, MCX offers gold futures contracts that cater to the Indian market’s demand for gold trading. These contracts are popular among both retail and institutional traders.

- Tokyo Commodity Exchange (TOCOM): TOCOM provides gold futures contracts to traders in Asia, particularly Japan. These contracts are traded in yen per gram.

- Shanghai Gold Exchange (SGE): The SGE is one of the world’s largest physical gold exchanges and offers gold futures contracts denominated in grams. It primarily serves the Chinese market.

Day Trading Techniques for Gold Futures

Day trading gold futures involves taking advantage of short-term price movements within the trading session. Successful day traders employ various strategies and techniques tailored to the unique characteristics of gold futures.

- Technical Analysis: Utilizing technical indicators, chart patterns, and candlestick analysis can help traders identify potential entry and exit points. Moving averages, relative strength index (RSI), and Fibonacci retracement levels are commonly used tools.

- Volatility Analysis: Gold can exhibit significant price volatility, influenced by economic data, geopolitical events, and market sentiment. Traders can use volatility indicators like the Average True Range (ATR) to gauge potential price swings.

- News and Economic Data: Day traders should stay informed about economic releases, central bank decisions, and geopolitical developments that can impact gold prices. Unexpected news events can lead to rapid price changes.

- Range Trading: Range-bound markets can provide day trading opportunities. Traders can look for support and resistance levels and trade within the range, aiming to profit from price fluctuations between these levels.

- Scalping and Breakout Strategies: Scalping involves making quick trades to capture small price movements, while breakout strategies focus on entering trades when prices break out of established levels. Both approaches require rapid decision-making.

Trading Gold Futures Options and Options on Futures

Gold futures options provide traders with the flexibility to speculate on gold price movements while managing risk. Options on gold futures allow traders to establish positions that benefit from price increases (call options) or price decreases (put options) without the obligation to buy or sell the underlying futures contract.

- Speculation: Traders can use gold futures options to speculate on the future price direction of gold. Buying call options can provide exposure to potential price increases, while buying put options can provide exposure to potential price declines.

- Risk Management: Gold futures options can be employed as a form of risk management. Gold producers, for example, can use put options to hedge against potential price declines that could impact their profitability.

- Spread Strategies: Options spread strategies involve trading multiple options contracts simultaneously to capitalize on price differentials. Vertical spreads and calendar spreads are commonly used strategies to manage risk and profit from price movements.

Cannon Trading Company: Customer Service and TrustPilot Rating

Cannon Trading Company is a reputable brokerage firm known for its services in facilitating various types of trading, including gold futures and options on futures. The company is recognized for its dedication to delivering top-notch customer service and support to traders of all experience levels.

Customer Service Excellence: Cannon Trading Company’s experienced brokers provide personalized assistance, market insights, and trading strategies to clients. Their commitment to customer service ensures that traders have the resources they need to make informed decisions.

TrustPilot Rating: The company boasts an impressive TrustPilot rating of 4.9 out of 5 stars, reflecting the high level of customer satisfaction it consistently achieves. This rating is indicative of positive customer experiences and the value that Cannon Trading Company provides to its clients.

Trading gold futures offers traders the opportunity to engage with a precious metal that holds both historical significance and contemporary economic relevance. Understanding the intricacies of gold futures trading, employing effective day trading techniques, and considering options on gold futures can enhance a trader’s ability to navigate this dynamic market. Choosing a reputable brokerage partner like Cannon Trading Company, known for its exceptional customer service and TrustPilot rating, can provide traders with the support and resources needed to succeed in trading gold futures and related derivatives.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Gold Futures: A Comprehensive Analysis

Find out more about trading gold futures with Cannon Trading Company here.

Gold futures represent an essential segment of the global financial landscape, attracting investors, traders, and central banks seeking to manage risk and speculate on the precious metal’s price. This comprehensive analysis delves into the world’s top producers of gold, central banks holding gold reserves, exchanges where gold is traded globally, and the historical evolution of gold futures. Additionally, we explore gold’s unique status as a safe-haven asset and compare it to other precious metals, particularly platinum.

Top Producers of Gold in the World

- China: China consistently ranked as the largest producer of gold, with significant mining operations throughout the country.

- Russia: Russia stood as the second-largest producer, with vast gold reserves and mining activities in Siberia and the Far East.

- Australia: Australia was a major player in the gold mining industry, with substantial deposits in Western Australia.

- United States: The US boasted significant gold reserves, with mining operations in states like Nevada, Alaska, and South Dakota.

- Canada: Canada held substantial gold reserves, with mining activities in provinces like Ontario and Quebec.

- Peru: Peru was a prominent gold producer, with mining operations in the Andes region.

- South Africa: South Africa, historically a major gold producer, faced challenges due to declining production and increased depth of mining operations.

- Ghana: Ghana was a leading gold producer in Africa, with rich deposits and well-established mining operations.

Central Banks Holding Gold Bullion in Reserves

Central banks have historically viewed gold as a reliable store of value and a means to diversify their reserve assets. As of September 2021, some of the largest holders of gold bullion in their reserves included:

- United States: The United States held the largest gold reserves among central banks, primarily stored at the Fort Knox Bullion Depository and other secure locations.

- Germany: Germany was the second-largest holder of gold reserves, with significant portions stored domestically and abroad.

- Italy: Italy ranked among the top holders of gold bullion in its central bank reserves.

- France: France also held considerable gold reserves, stored in various locations.

- China: China had been steadily increasing its gold reserves in recent years, aiming to diversify its foreign exchange holdings.

- Russia: Russia significantly increased its gold reserves, strategically diversifying away from traditional reserve currencies.

Exchanges Where Gold is Traded Around the World

Gold is actively traded on various exchanges worldwide, providing a liquid and accessible market for participants. Some of the prominent exchanges for gold trading include:

- COMEX (Commodity Exchange, Inc.): Located in the United States and part of the CME Group, COMEX is one of the largest and most influential exchanges for gold futures trading.

- London Bullion Market Association (LBMA): The LBMA is an over-the-counter market based in London, where gold is traded through a network of dealers.

- Shanghai Gold Exchange (SGE): The SGE, based in China, has gained significance as a major exchange for physical gold trading.

- Tokyo Commodity Exchange (TOCOM): TOCOM facilitates gold futures trading in Japan.

- Dubai Gold & Commodities Exchange (DGCX): DGCX serves as a significant platform for gold futures trading in the Middle East.

History of Gold Futures

The concept of gold futures traces back to ancient civilizations, where contracts for future delivery of gold were used to facilitate trade and secure prices. However, the modern history of gold futures can be traced back to the 1970s when the US officially ended the convertibility of the US dollar into gold (the gold standard).

This pivotal moment marked the beginning of a new era for gold futures, as the precious metal shifted from being the basis of currency to a financial instrument for investment and hedging. In 1974, the first-ever gold futures contract was launched on the COMEX exchange, revolutionizing the way gold was traded and priced.

Since then, gold futures have evolved to become a cornerstone of global financial markets. Investors and traders use gold futures to speculate on price movements, hedge against inflation and currency risk, and diversify their portfolios. Gold futures remain popular due to their high liquidity, ease of trading, and their status as a safe-haven asset in times of economic uncertainty.

Gold as a Safe Haven

One of the most enduring attributes of gold is its role as a safe-haven asset. In times of economic and geopolitical uncertainty, investors often flock to gold as a store of value and a hedge against market volatility. The precious metal has a historical track record of preserving purchasing power during periods of inflation and financial crises.

During the 2008 global financial crisis, for example, gold prices surged as investors sought refuge from the turmoil in traditional financial markets. Similarly, during the COVID-19 pandemic in 2020, gold experienced a significant rally as central banks implemented stimulus measures and investors sought safety amid economic uncertainty.

Gold vs. Platinum

Gold and platinum are two of the most valuable and sought-after precious metals globally. While they share certain characteristics, they also exhibit key differences.

- Supply and Demand: Gold has a long history as a store of value and is highly liquid due to its wide acceptance as a monetary asset and jewelry component. Platinum, on the other hand, has a more limited history as a precious metal and is primarily used in industrial applications, particularly in catalytic converters for vehicles.

- Price and Market Dynamics: Gold generally commands a higher price per ounce than platinum. The gold market is more extensive and active, with higher trading volumes and more significant price fluctuations.

- Safe Haven Status: Both gold and platinum can act as safe-haven assets, but gold’s status is more established and widely recognized.

- Industrial Demand: Platinum’s primary industrial applications give it some exposure to economic cycles and industrial demand, which can impact its price.

- Jewelry and Investment Demand: Gold has a stronger association with jewelry and investment demand, making it more appealing to a broader range of investors and consumers.

Gold futures have a rich historical legacy that stretches back centuries, from facilitating trade to becoming a financial instrument for hedging and speculation. As one of the top producers of gold, the United States plays a significant role in the global gold market. Central banks across the world hold substantial gold reserves, recognizing the precious metal’s enduring value. Gold’s status as a safe-haven asset cements its place in investors’ portfolios during times of economic uncertainty. While platinum shares some attributes with gold, it remains primarily associated with industrial applications. As global financial markets evolve, gold futures will continue to be a critical component, offering participants an avenue for risk management and investment diversification.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey at Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010