The New Standard in Futures Trading

In the ever-evolving landscape of futures trading, staying ahead means leveraging powerful, versatile, and adaptable technology. Among the wide array of platforms available today, the Quantower futures trading platform has emerged as a standout choice for both retail and institutional traders. Designed to provide advanced functionality without compromising on user experience, Quantower blends the flexibility of custom strategy development with robust infrastructure designed for speed, reliability, and cross-asset compatibility.

This article will examine in detail what makes the Quantower trading platform a leader in its class, how a skilled futures broker can enhance your execution experience on the platform, what exciting innovations may lie ahead in the second half of the 2020s, and why Cannon Trading Company—a leader in futures contract trading for nearly four decades—represents the ideal brokerage to partner with when trading through Quantower.

Try a FREE Demo!

Quantower: Setting a New Benchmark in the Industry

The Quantower futures platform was designed from the ground up to support multi-asset, multi-broker, and multi-data feed connectivity in a single intuitive interface. Unlike many futures trading platforms that are built around legacy infrastructure or fixed broker integrations, Quantower’s architecture is modular and dynamic, offering unparalleled flexibility. This makes it suitable not only for retail traders but also as an institutional trading platform.

Key Features of Quantower

- Broker and Data Feed Agnosticism:

Quantower supports a wide variety of brokers and data providers, including Rithmic, CQG, LMAX, Interactive Brokers, and more. This flexibility allows traders to connect to their preferred provider for real-time data and trade execution. - Advanced Charting and Technical Analysis:

Traders gain access to a rich library of chart types, over 200 indicators, custom scripting through C# API, and full tick charting capabilities. This allows for precise execution, particularly useful in emini trading, where tick-level analysis is critical. - Customizable Workspace and Layouts:

Quantower enables traders to fully personalize their interface across multiple monitors. Docking panels, custom alerts, heatmaps, and time & sales data can be tailored for any asset class, including the ever-popular e mini contracts. - Automated and Algorithmic Trading Tools:

Through native scripting, plug-in architecture, and integration with APIs like REST and FIX, Quantower empowers systematic and high-frequency traders to implement and test their strategies with low latency. - Market Depth and Order Flow Tools:

DOM Trader, Volume Analysis, TPO Profile Charts, and Order Flow Surface are tools specifically designed for futures contract trading, providing clarity and precision needed by scalpers and day traders alike.

In short, the Quantower trading platform doesn’t just replicate features from other platforms—it reimagines them, creating a professional-grade environment suitable for trading futures at any scale.

Try a FREE Demo!

What Makes Quantower Unique Among Other Futures Trading Platforms?

While many futures trading platforms cater to beginner or intermediate users, Quantower’s architecture was built with scalability and professional-grade capabilities in mind. This makes it a true hybrid platform—accessible to individuals while offering tools sophisticated enough for hedge funds and proprietary trading desks.

Comparative Edge:

- Cross-Platform Strategy Deployment: Unlike platforms that silo strategies into proprietary environments, Quantower allows users to develop, test, and execute trading algorithms across multiple brokers and asset classes.

- One Interface, Infinite Possibilities: With Quantower, users avoid platform-hopping and reconfiguring interfaces. A single login offers access to all connected accounts, trading instruments, and analytics tools.

- Built for Evolving Markets: Quantower stays ahead by integrating new trading instruments (crypto, options, FX) while still providing legacy support for key derivatives like the e mini S&P 500 and NASDAQ contracts.

- Data Transparency: Full access to time & sales, order flow, and historical tick data allows emini traders to capture and act on microstructure patterns often invisible on less sophisticated platforms.

This commitment to flexibility and innovation firmly cements Quantower’s position as a leading futures trading platform.

Try a FREE Demo!

Broker Integration: How Your Futures Broker Can Help You Maximize Quantower

Selecting the right futures broker is just as important as choosing the right platform. A futures trading platform as powerful as Quantower reaches its full potential only when paired with a brokerage that provides seamless connectivity, low-latency execution, competitive commissions, and experienced support.

Broker Contributions:

- Direct Market Access (DMA):

A top-tier broker offers DMA through low-latency feeds like Rithmic or CQG, critical for active emini trading and scalping strategies. - Infrastructure Support:

Brokers like Cannon Trading Company ensure robust, redundant infrastructure, so there’s minimal downtime or lag in execution. - Custom Server Deployment:

For institutional clients using Quantower as an institutional trading platform, a quality broker may offer VPS or dedicated servers close to exchange data centers for ultra-low latency. - Personalized Service:

From setting up Quantower API credentials to helping traders configure custom indicators or DOM settings, experienced brokers can tailor the onboarding and ongoing trading experience. - Compliance and Regulatory Guidance:

Traders gain peace of mind knowing that their broker ensures full compliance with regulatory bodies such as the CFTC and NFA, especially when engaging in high-leverage trading futures activity.

Quantower in the 2nd Half of the 2020s: What’s Next?

As we look ahead to the remainder of the 2020s, the future for the Quantower futures platform is bright. Market trends and trader expectations are pushing platforms toward more integration, real-time AI-enhanced analytics, and cloud-based strategy execution.

Expected Advancements:

- AI-Powered Market Analysis:

Quantower is expected to integrate machine learning modules that help identify trading patterns, detect anomalies, and suggest automated responses. - Cloud-Based Strategy Hosting:

As traders demand 24/7 strategy uptime without the hassle of managing local systems, Quantower is likely to expand its cloud-hosted trading solutions. - Deeper Broker and Exchange Integration:

We anticipate tighter integration with non-traditional exchanges, alternative assets, and DeFi markets—further broadening its appeal. - Advanced Risk Management Tools:

As algorithmic futures contract trading becomes the norm, real-time risk management dashboards and dynamic margin controls will likely be embedded within the platform. - Education and Community Expansion:

A broader suite of webinars, documentation, and community forums will continue making Quantower more accessible to novice and experienced trading futures professionals alike.

These developments will further reinforce Quantower’s status as a leading-edge trading platform in a constantly evolving marketplace.

Try a FREE Demo!

Why Cannon Trading Company Is the Ideal Broker for Quantower Users

Selecting the right broker is just as important as the right platform. Cannon Trading has partnered

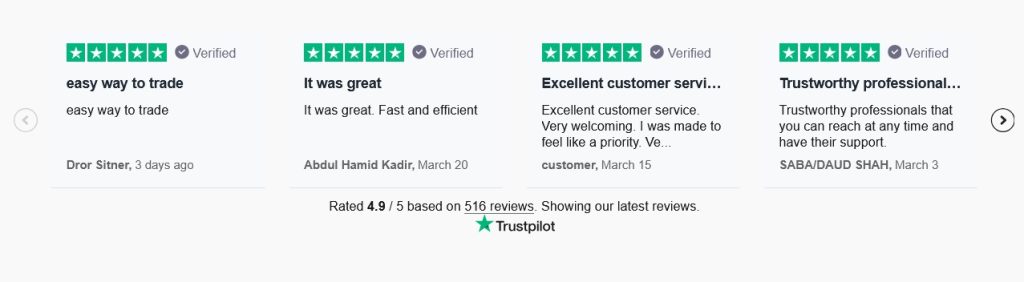

With nearly 40 years of experience in futures trading, Cannon Trading Company is widely recognized as a pioneering force in online and algorithmic trading. Their perfect 5-star ratings on TrustPilot, extensive range of supported platforms, and top-tier client service underscore their value as a broker for every type of trader.

Highlights of Cannon Trading Company:

- Platform Diversity and Support:

Cannon offers not only the Quantower futures platform, but also other high-performance platforms such as CQG, Rithmic, Bookmap, and TradingView, all accessible via a single brokerage relationship. - Industry Recognition:

Cannon’s spotless regulatory record with the CFTC and NFA, combined with its frequent accolades from trade publications, adds credibility and trust. - Client-Centric Approach:

Whether you are a beginner navigating emini trading for the first time or a hedge fund deploying a custom strategy, Cannon provides tailored support—including one-on-one walkthroughs, 24/7 support, and dedicated account reps. - Low Margins and Transparent Fees:

Competitive commission structures, real-time margin transparency, and flexible account funding make Cannon ideal for high-frequency trading futures and swing trading alike. - Education and Resources:

Cannon’s commitment to educating traders is unmatched. Through blogs, webinars, and real-time support, they ensure that traders using Quantower or any other platform are well-equipped for success.

In short, Cannon is more than just a futures broker—they’re a strategic partner committed to helping traders harness the full power of the quantower trading platform.

Quantower and Cannon Trading — A Powerful Combination

The Quantower futures trading platform has redefined what traders can expect from modern futures trading technology. From its flexible infrastructure and institutional-grade tools to its emphasis on speed, customizability, and data transparency, Quantower meets the needs of every type of trader—from independent day traders to algorithmic trading firms.

But a platform is only as powerful as the broker supporting it. This is where Cannon Trading Company excels, bringing unmatched experience, customer satisfaction, and execution reliability. Their proactive integration of platforms like Quantower, deep regulatory knowledge, and client-first approach make them the ideal choice for traders seeking the ultimate futures contract trading experience.

As the 2020s continue to unfold—with greater demands for connectivity, data insights, and execution precision—the combination of Quantower and Cannon Trading positions traders for continued success in the fast-moving world of trading futures.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading