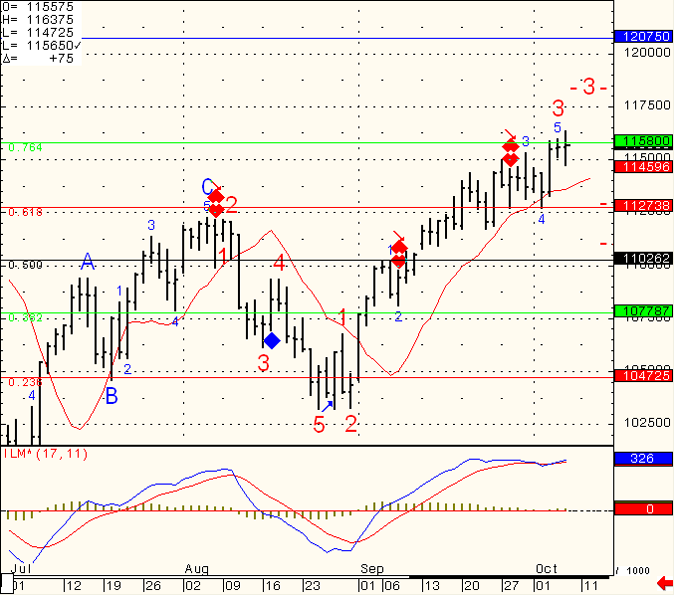

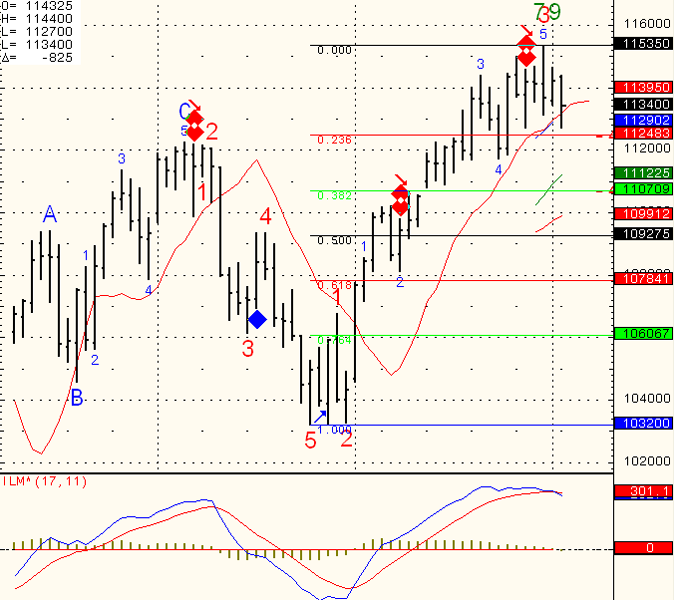

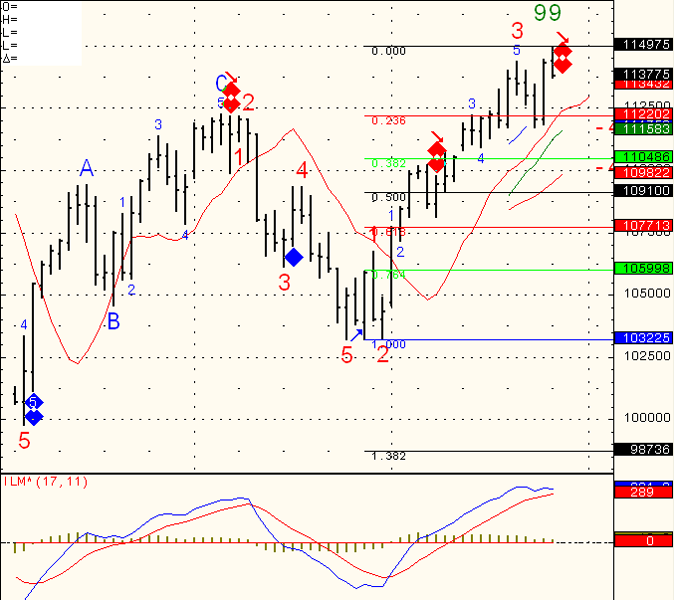

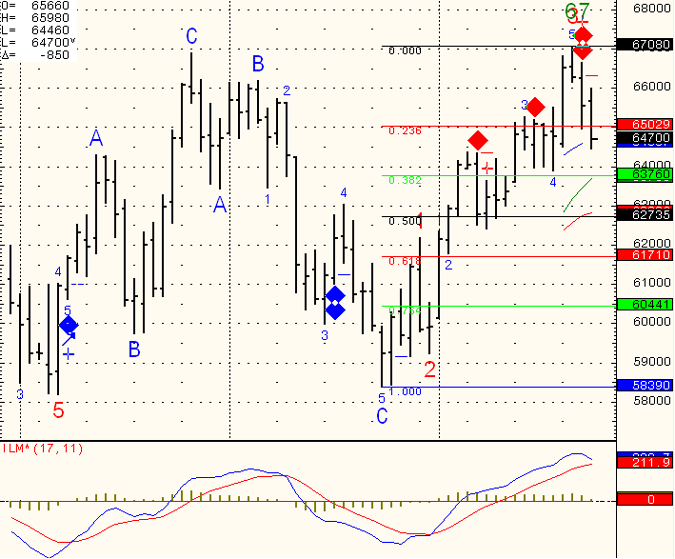

Market finally broke to the upside but like always “tries to make it harder” for us traders…. The upside breakout lacked momentum and / or continuation, at least today. However, I have shifted my swing trading stance to cautiously bullish as long as SP500 can hold above 1105.75….

FOMC next Tuesday along with busy Thursday / Friday economic and speaking schedule.

Have a great weekend, take time to recharge the brain and “clean it” from all the ” I should have placed a stop at this price and i should have taken that trade” etc….Once a trader has a concept they feel good about, the rest of the battle is mostly mental one with yourself.

Continue reading “Futures and Commodity Trading Blog, September 20th 2010”