Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

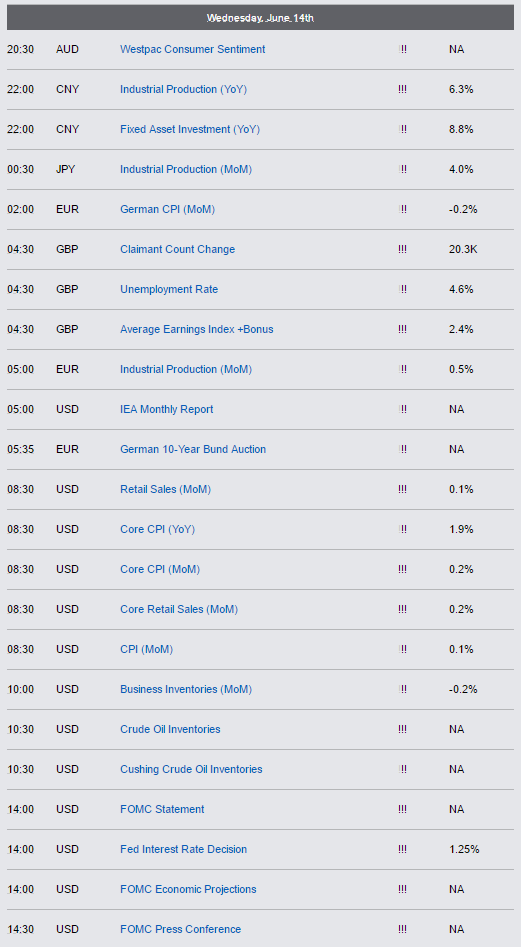

Possible volatile day ahead tomorrow. More than a few reports as well as crude oil inventories and FOMC tomorrow!! Be careful, read your notes, reach out to your contact at Cannon if you need any feedback!

WEBINAR: Please register for “Market Dynamics – Trade Location in all the right places” on Jun 14, 2017 1:00 PM PDT at:

https://attendee.gotowebinar.com/register/8190670416999391491

Join us for a 60 -minute webinar on Wednesday June 14th at 3:00 P.M., Central Time.

As traders, we are often given a choice between Technical and Fundamental analysis. Two different methods that try to help us anticipate moves in the markets. There isn’t much discussion about the dynamics of a move in the market. How does a move occur? How does a move reverse? Who is trading the moves?

Understanding the dynamics, the driving forces behind the market is essential if we want to benefit from moves in any market. It’s also essential in validating if our approach to the markets is realistic.

This webinar looks at some seldom considered aspects of trading

1. what exactly is it we are trying to do as traders?

2. What are we trying to take advantage of that occurs intra-day?

3. What are moves in the market and who is dominating?

4. What is the ‘smart money’ doing?

5. Where should we look to enter the market?

6. Is it the same every day?

This knowledge gives us a framework within which to use any trading method or tool. It helps us take a critical look at any trading method to see if it fits within the dynamics of the markets.

A trader with poor understanding of market dynamics will be losing a high percentage of their trades, typically losing more trades than if they’d traded just by tossing a coin.

You might not be looking for answers in market dynamics but they are there anyway. Ignore them at your peril!

Space is limited – Reserve your seat now!

After registering, you will receive a confirmation email containing information about joining the webinar.

Brought to you by GoToWebinar®

Webinars Made Easy®

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

6-14-2017

| Contract September 2017 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2456.92 | 5832.33 | 21426 | 1439.30 | 97.53 |

| Resistance 2 | 2448.08 | 5800.42 | 21357 | 1434.00 | 97.39 |

| Resistance 1 | 2442.92 | 5778.83 | 21315 | 1430.60 | 97.19 |

| Pivot | 2434.08 | 5746.92 | 21246 | 1425.30 | 97.06 |

| Support 1 | 2428.92 | 5725.33 | 21204 | 1421.90 | 96.86 |

| Support 2 | 2420.08 | 5693.42 | 21135 | 1416.60 | 96.72 |

| Support 3 | 2414.92 | 5671.83 | 21093 | 1413.20 | 96.52 |

| Contract | August Gold | July Silver | July Crude Oil | Sept. Bonds | June Euro |

| Resistance 3 | 1283.6 | 17.22 | 47.87 | 154 28/32 | 1.1270 |

| Resistance 2 | 1277.3 | 17.09 | 47.22 | 154 17/32 | 1.1249 |

| Resistance 1 | 1273.1 | 16.97 | 46.86 | 154 8/32 | 1.1230 |

| Pivot | 1266.8 | 16.84 | 46.21 | 153 29/32 | 1.1209 |

| Support 1 | 1262.6 | 16.72 | 45.85 | 153 20/32 | 1.1190 |

| Support 2 | 1256.3 | 16.59 | 45.20 | 153 9/32 | 1.1169 |

| Support 3 | 1252.1 | 16.47 | 44.84 | 153 | 1.1150 |

| Contract | July Corn | July Wheat | July Beans | July SoyMeal | July Nat Gas |

| Resistance 3 | 390.3 | 458.1 | 948.50 | 309.93 | 3.15 |

| Resistance 2 | 387.0 | 452.2 | 945.00 | 308.17 | 3.11 |

| Resistance 1 | 384.0 | 448.6 | 938.75 | 304.83 | 3.04 |

| Pivot | 380.8 | 442.7 | 935.25 | 303.07 | 2.99 |

| Support 1 | 377.8 | 439.1 | 929.0 | 299.7 | 2.9 |

| Support 2 | 374.5 | 433.2 | 925.50 | 297.97 | 2.88 |

| Support 3 | 371.5 | 429.6 | 919.25 | 294.63 | 2.80 |

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.