Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday June 29, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

Below is an intra-day update I receive from TradeTheNews.com

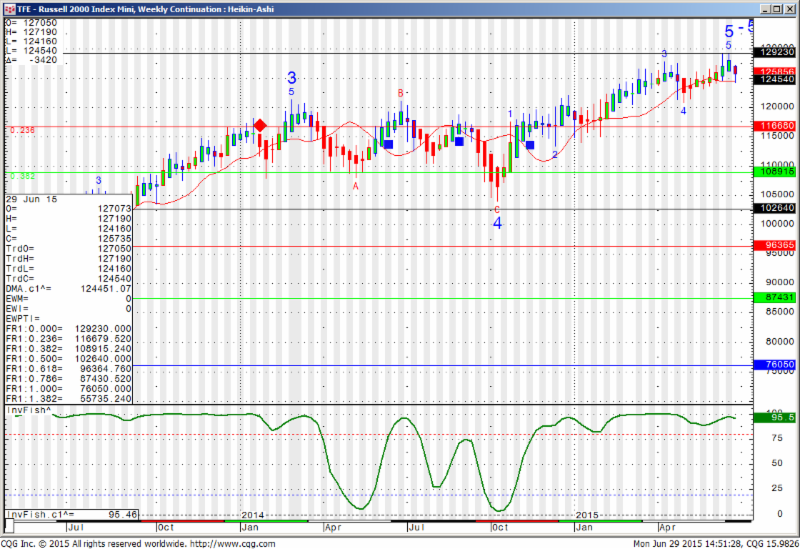

It summarize the “main winds that are blowing the market right now”. Below that you will see my weekly chart of the mini Russell with some levels to watch. Today’s closed below 1244 may trigger longer term correction in my opinion.

US equity losses have been relatively subdued this morning, although the VIX volatility index has crept up to its highest level in more than 3.5 months. At their worst levels, the DAX and the CAC were down more than 4% a piece, but they are well off their lows heading into the close of European trading. The 10-year bund yield is down 12.8 bps to trade around 0.793%, while the 10-year yield is down more than 10 bps to trade 2.369%. Hanging over markets is the gloomy prospect of the Shanghai Composite down 3.3% today, putting it officially in bear market territory, despite the PBoC action this weekend. As of writing, the DJIA and S&P500 are both down more than 1%, while the Nasdaq is off 1.23%.

With Greece’s solvency hanging in the balance, the divide between Greece and its creditors is only worsening. The EU Commission’s Juncker accused Greece of unilaterally breaking off negotiations, even as Greek officials accused him of lying about Athens’s negotiating positions. Tsipras said he would campaign for a no vote in the referendum, further alienating his European partners. It is looking highly doubtful that the IMF payment due tomorrow will be made, however the ECB’s Nowotny stated that Greece missing the payment does not necessarily mean default. Reports suggest that neither the IMF nor the EU will make any move to reach a last-minute deal until the referendum takes place on July 5th. After trading as low as 1.0950 yesterday, EUR/USD has steadily climbed back to 1.1177 today.

Recall that Puerto Rico is also having a debt crisis moment of its own. Over the weekend, Puerto Rico Governor Padilla, the country can no longer make payments on its $73 billion in debt. Prices of highly rated municipal bonds are sharply higher this morning, as yields on some maturities fell by as much as six basis points as uncertainty over both Puerto Rico and Greece fueled a flight-to-safety trade.

The Supreme Court struck down the EPA’s new, more stringent mercury emission regulations.The Supreme Court ruled that the Obama Administration unlawfully failed to consider costs when deciding to regulate mercury pollution from power plants. The vote was 5-4, with Scalia writing the majority opinion. Recall that in making the rules, the EPA argued that public health was the only criteria to be considered, not the industry cost of compliance, which the agency estimated at nearly $10B annually. Coal names spiked more than 10% a piece on the ruling.

Sysco said it would abandon its $8.2bn takeover of US Foods after the deal was blocked by a federal judge last week. Sysco will now pay a $300 million break-up fee to US Foods. The deal between Sysco and US Foods, announced back in December 2013, would have created the largest food service distributor in the US. The proposed merger quickly came under scrutiny from the FTC, which ultimately moved to block the deal amid concerns it would “significantly reduce” competition. Along with the announcement, Sysco authorized a new $3 billion share buyback.

Weekly Heiken-Ashi chart of mini Russell 2000 for your review below:

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract Sept. 2015 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2109.08 | 4511.17 | 17950 | 1294.23 | 98.06 |

| Resistance 2 | 2096.17 | 4481.33 | 17853 | 1283.07 | 97.38 |

| Resistance 1 | 2073.08 | 4427.92 | 17685 | 1263.93 | 96.21 |

| Pivot | 2060.17 | 4398.08 | 17588 | 1252.77 | 95.53 |

| Support 1 | 2037.08 | 4344.67 | 17420 | 1233.63 | 94.37 |

| Support 2 | 2024.17 | 4314.83 | 17323 | 1222.47 | 93.69 |

| Support 3 | 2001.08 | 4261.42 | 17155 | 1203.33 | 92.52 |

| Contract | Aug. Gold | Sept. Silver | Aug. Crude Oil | Sept. Bonds | Sept. Euro |

| Resistance 3 | 1200.9 | 16.31 | 60.18 | 154 18/32 | 1.1707 |

| Resistance 2 | 1194.2 | 16.18 | 59.73 | 153 4/32 | 1.1500 |

| Resistance 1 | 1186.5 | 15.93 | 58.95 | 152 3/32 | 1.1377 |

| Pivot | 1179.8 | 15.80 | 58.50 | 150 21/32 | 1.1170 |

| Support 1 | 1172.1 | 15.55 | 57.72 | 149 20/32 | 1.1047 |

| Support 2 | 1165.4 | 15.42 | 57.27 | 148 6/32 | 1.0840 |

| Support 3 | 1157.7 | 15.17 | 56.49 | 147 5/32 | 1.0717 |

| Contract | Dec. Corn | Sept. Wheat | Nov Beans | Dec. SoyMeal | Aug Nat Gas |

| Resistance 3 | 413.9 | 586.8 | 996.58 | 334.73 | 2.96 |

| Resistance 2 | 411.1 | 585.2 | 992.67 | 332.27 | 2.90 |

| Resistance 1 | 406.7 | 584.3 | 986.33 | 329.23 | 2.85 |

| Pivot | 403.8 | 582.7 | 982.42 | 326.77 | 2.79 |

| Support 1 | 399.4 | 581.8 | 976.1 | 323.7 | 2.7 |

| Support 2 | 396.6 | 580.2 | 972.17 | 321.27 | 2.69 |

| Support 3 | 392.2 | 579.3 | 965.83 | 318.23 | 2.64 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.