Cannon Futures Weekly Newsletter Issue # 1169

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

- Important Notices – FOMC Next Week

- Trading Resource of the Week – Bitcoin and Crypto Currency Futures

- Hot Market of the Week – December Heating Oil

- Broker’s Trading System of the Week – ES Day Trading System

- Trading Levels for Next Week

- Trading Reports for Next Week

-

Important Notices – FOMC Meeting and NFP Next Week!

-

Trading Resource of the Week: Bitcoin & Ether Futures Volume Rises!

See volume and open interest below article

Trading Bitcoin futures and trading cryptocurrencies directly represent two distinct approaches to engaging with the digital asset market. Each method offers its own set of advantages and disadvantages, catering to different types of traders and investors. In this discussion, we will explore the differences between trading Bitcoin futures and trading cryptocurrencies.

Bitcoin futures represent a derivative financial product that allows traders to speculate on the future price of Bitcoin without actually owning the underlying cryptocurrency. Here are some key points to consider when trading Bitcoin futures:

1. Regulation and Legitimacy: Bitcoin futures are traded on the Chicago Mercantile Exchange (CME). This provides a high level of valuable legitimacy and oversight for institutional and risk-averse investors.

2. Leverage and Margin: Futures contracts offer leverage, allowing traders to control a larger position with a relatively smaller amount of capital. While this can amplify profits, it also increases the potential for significant losses.

3. Risk Management: Futures contracts are standardized and come with risk management tools like stop-loss orders, which can help traders limit their exposure to losses.

4. Speculative Nature: Trading Bitcoin futures is primarily a speculative activity. It’s more about predicting price movements rather than investing in the long-term potential of Bitcoin as a technology or store of value.

5. Market Hours: Futures markets have specific trading hours and are closed on weekends. This can limit access to trading opportunities and reactiveness to global events.

6. Settlement: Bitcoin futures contracts typically settle in cash, which means that traders receive the equivalent value in US dollars at contract expiry, rather than the actual Bitcoin.

Trading Cryptocurrencies:

Trading cryptocurrencies directly involves buying and selling the digital assets themselves on various cryptocurrency exchanges. Here are some key considerations when trading cryptocurrencies:

1. Lack of Regulation: Cryptocurrency markets are generally less regulated than traditional financial markets. While this offers more freedom, it also exposes traders to potential risks, including fraud and market manipulation.

2. Volatility: Cryptocurrency markets are known for their extreme price volatility. This can present both opportunities and risks, attracting traders with a high-risk tolerance.

3. Long-Term Investment: Some traders and investors choose to buy cryptocurrencies with the intention of holding them for the long term, believing in their potential as a store of value, technology, or financial innovation.

4. 24/7 Availability: Cryptocurrency markets operate 24/7, allowing traders to respond to market developments at any time. This can be advantageous for those who want to trade outside traditional market hours.

5. Security: Trading cryptocurrencies directly also comes with the responsibility of securing your assets in a wallet, protecting them from hacking, theft, and loss.

In summary, the choice between trading Bitcoin futures and trading cryptocurrencies directly depends on an individual’s investment goals, risk tolerance, and trading strategies. Bitcoin futures offer a more regulated and structured approach to speculate on Bitcoin’s price, while trading cryptocurrencies directly provides ownership and exposure to the digital asset’s intrinsic value. It’s essential for traders to carefully assess their preferences and risk profiles before deciding which approach aligns with their objectives. Moreover, diversification within one’s portfolio can also be a prudent strategy to mitigate risks associated with both trading Bitcoin futures and holding cryptocurrencies directly.

-

Hot Market of the Week – December Heating Oil

Hot market of the week is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

December Heating Oil rallied after completing the second downside PriceCount objective early this month but found tough overhead against the September highs and settled back. At this point, IF the chart can resume its break with new sustained lows, the third count would project a run to the 2.71 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

-

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

SYSTEM TYPE

Swing

Recommended Cannon Trading Starting Capital

$9,500

COST

USD 50 / monthly

|

|

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data. Please read full disclaimer HERE.

Sign Up for a Free Personalized Consultation with a Broker from Cannon Trading Company

Questions about the markets? trading? platforms? technology? trading systems? Get answers with a complimentary, confidential consultation with a Cannon Trading Company series 3 broker.

-

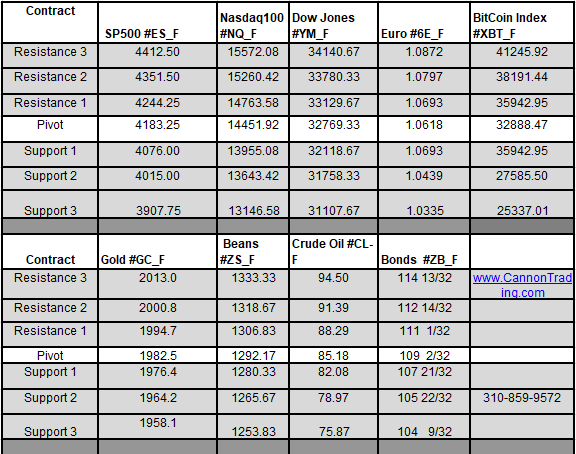

Trading Levels for Next Week

Daily Levels for October 30th, 2023

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week: www.mrci.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.