Cannon Futures Weekly Letter Issue # 1218

In this issue:

- Important Notices – Week Ahead – What to expect

- Holiday Trading Schedule – Thanksgiving Schedule

- Hot Market of the Week – March Coffee

- Trading Levels for Next Week

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

503 corporate earnings reports and a number of meaningful Economic data releases.

FOMC Minutes 1:00P.M. Central this upcoming Tuesday!, highlights Thanksgiving week data points. No Fed speakers.

Prominent Earnings this Week:

- Mon. quiet

- Tue. Dell, Crowdstrike

- Wed. quiet

- Thu. Thanksgiving Day Mkts closed

- Fri. quiet

FED SPEECHES:

- Mon. quiet

- Tue. quiet

- Wed. quiet

- Thu. Thanksgiving Day Mkts closed

- Fri. quiet

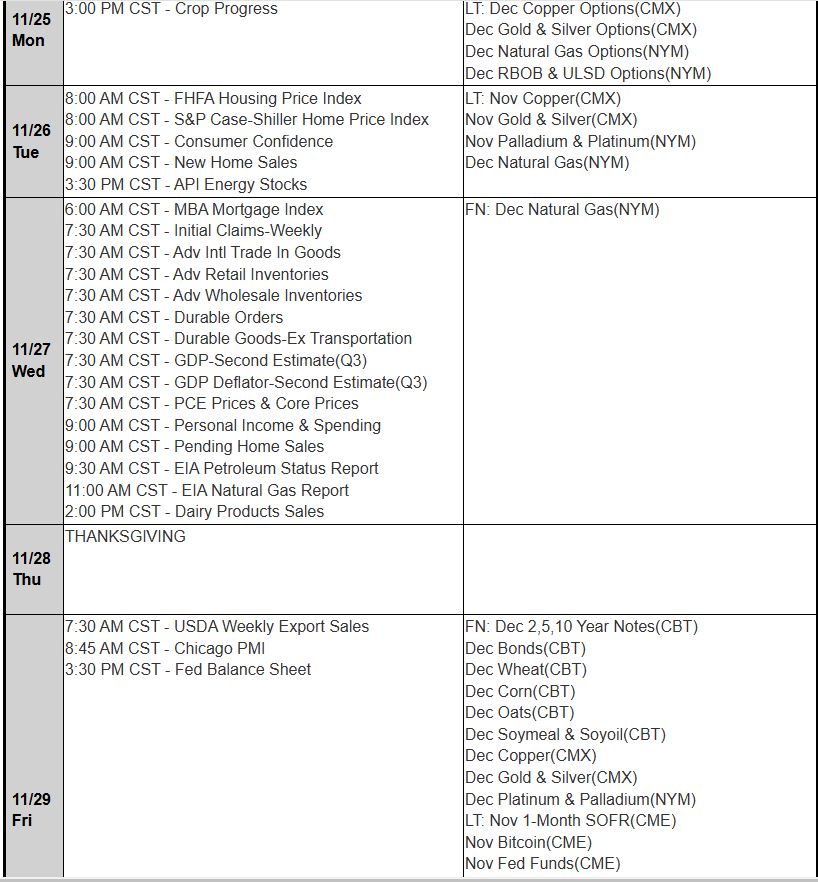

Economic Data week:

- Mon. Chicago Fed National Activity Index, Dallas Fed Manufacturing Index

- Tues. Bldg Permits, Housing Starts, RedBook, Case Schiller Home PX. Consumer confidence, New Home Sales, Richmond Fed.

- Wed. Core PCER Price index, Durable goods, Initial Jobless claims, Retail Inventories, Chicago PMI.

- Thur. Thanksgiving Day Mkts closed

- Fri. Early closes for the futures markets

Thanksgiving 2024 Holiday Schedule for CME Exchange HoursClick here for the detailed schedule

|

-

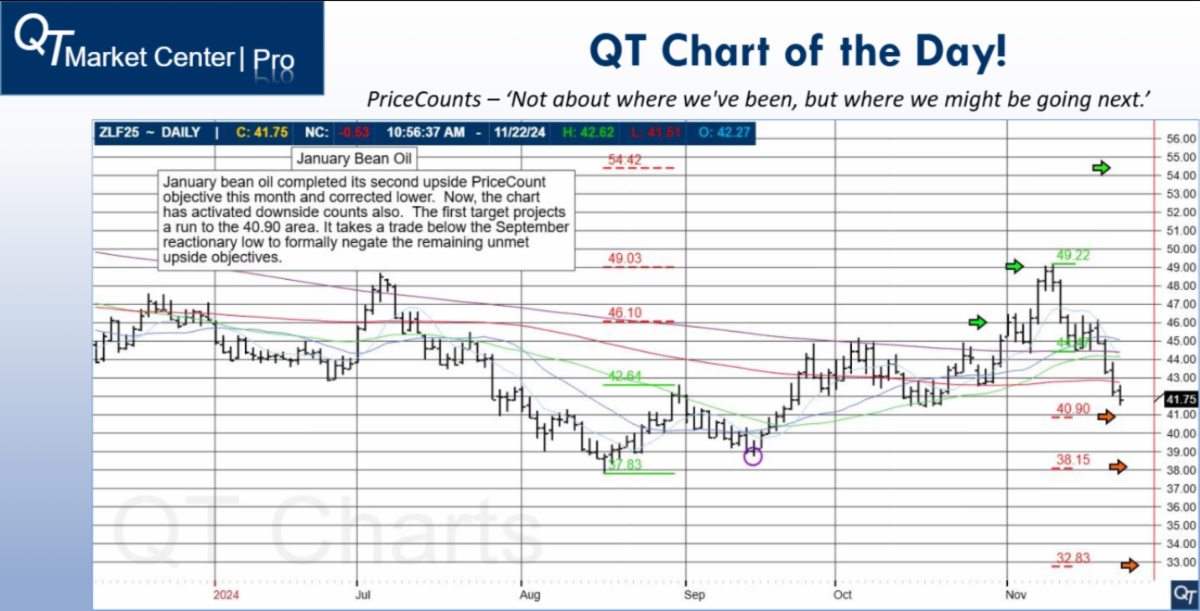

- Hot Market of the Week – January Bean Oil

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

January Bean Oil

January bean oil completed its second upside PriceCount objective this month and corrected lower. Nw, the chart has activated downisde counts also. The first target projects a run to the 40.90 area. It takes a trade below the September reactionary low to formally negate the remaining unmet upside objectives.

PriceCounts – Not about where we’ve been , but where we might be going next!

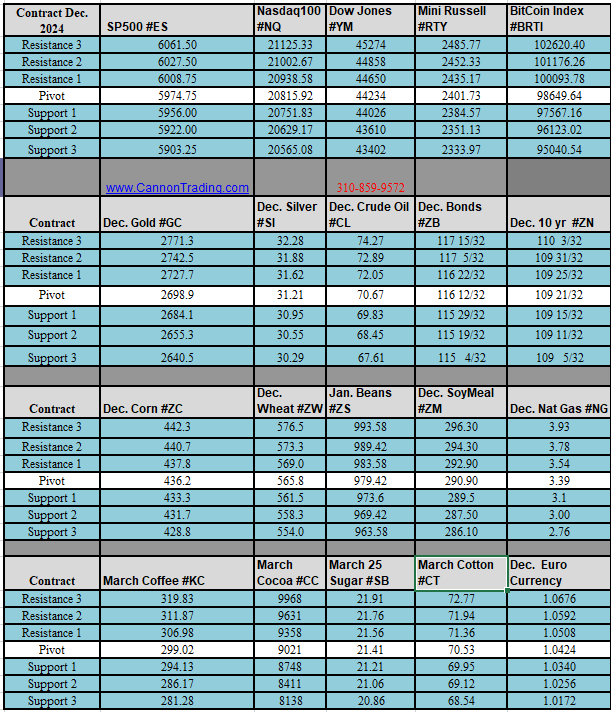

Daily Levels for November 25th, 2024

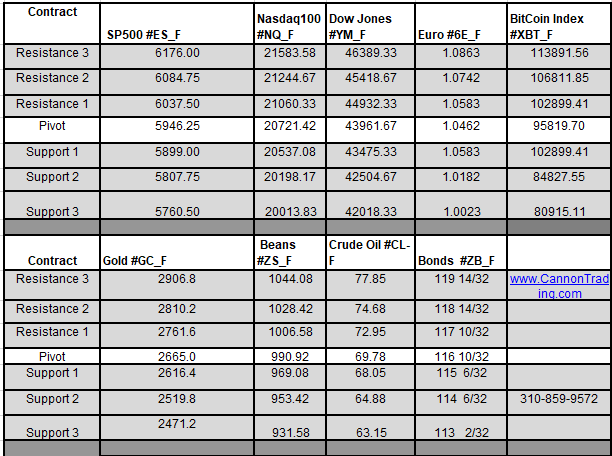

Weekly Levels for the week of November 25th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.