Cannon Futures Weekly Letter Issue # 1220

In this issue:

- Important Notices – Earnings, CPI, WASDE, The Week Ahead.

- Futures 102 – Crude Oil Outlook + Premium Daily Research

- Hot Market of the Week – March 10 Year Notes

- Broker’s Trading System of the Week – Mid Cap Swing System

- Trading Levels for Next Week

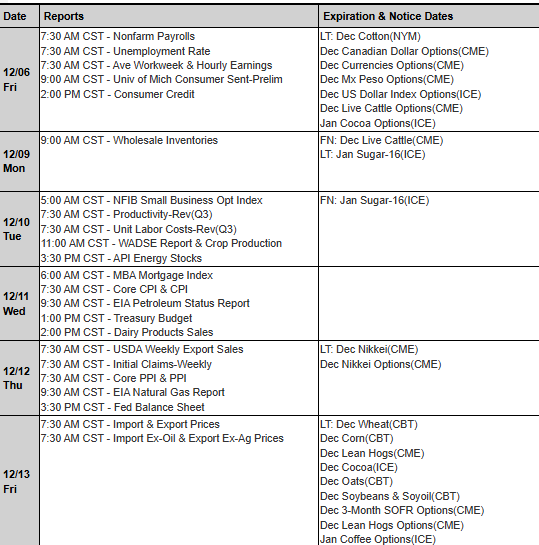

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

294 corporate earnings reports and a number of meaningful Economic data releases including Consumer Price Index (CPI) and Producer Price Index (PPI). It’s also the beginning of the Fed Blackout period and the Monthly USDA World Agriculture Supply and Demand (WASDE)report will also be next week!

Prominent Earnings Next Week:

- Mon. Oracle , post close

- Tue. Gamestop

- Wed. Adobe

- Thu. Broadcom, Costco

- Fri. quiet

FED SPEECHES:

- This is the Fed Black out period in advance of the Dec 18th, Yearend, Fed Meeting. According to the CME FedWatch Tool as of today, Dec 6th , There is an 87.1 % likelihood of a .25 basis cut from the current Fed Funds rate of 4.50-4.75 range, during the upcoming meeting, Therefore a 12.9 % probability of remaining steady with no change.

Economic Data week:

- Mon. Wholesale Inventories, Consumer Inflation Index

- Tues. NFIB Business Optimism Index , Redbook, WASDE

- Wed. CPI

- Thur. PPI, Jobless claims

- Fri. Export Prices

|

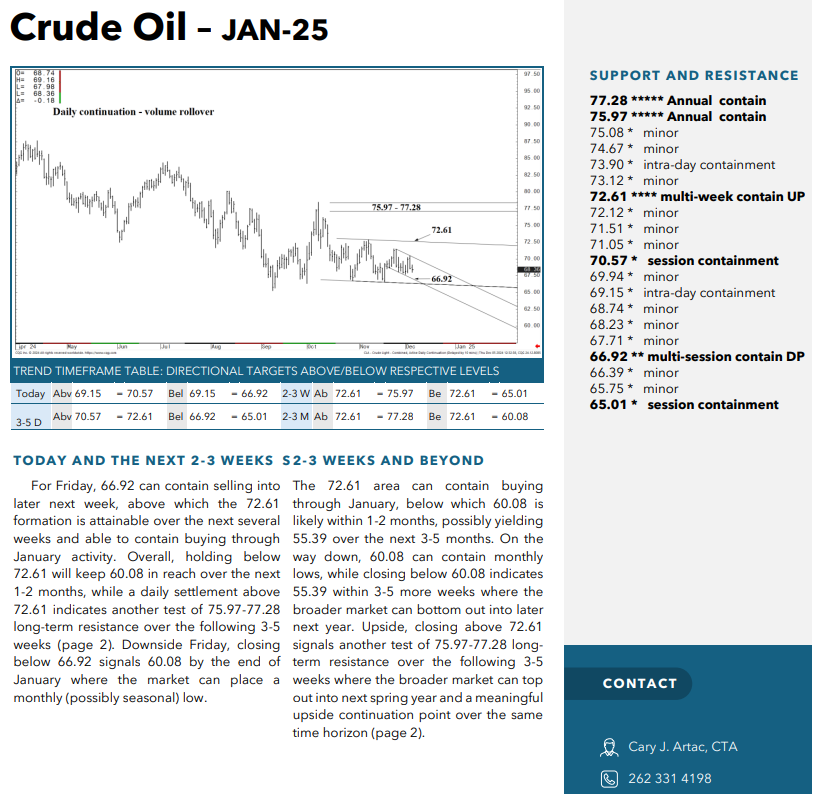

Futures 102: Crude Oil In Depth Analysis

Get Personalized Trading Reports Like the One Above Directly to your Inbox!

- Get qualified support and resistance levels for precise risk management on different commodity markets.

- Get pivot points that highlight shifts in the futures market momentum.

- Get technical forecasts to keep you on the right side of a specific commodity trading market.

- One on One “Daily Digest” with a dedicated series 3 professional.

-

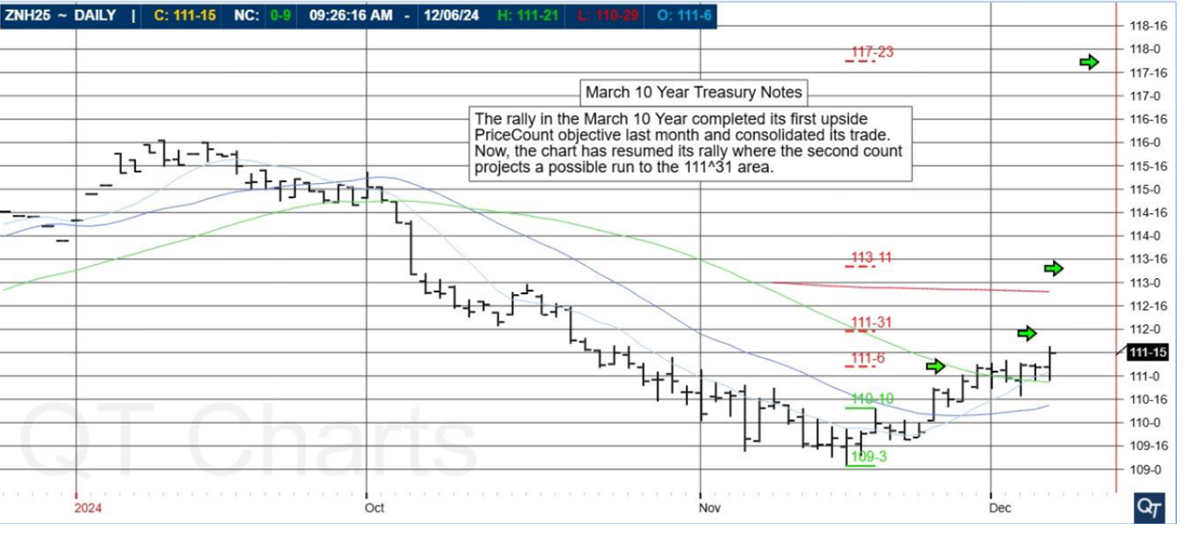

- Hot Market of the Week

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

March 10 Year Treasury Notes

The rally in the March 10 Year completed its first upside PriceCount objective last month and consolidated its trade. Now, the chart has resumed its rally where the second count projects a possible run to the 111^31 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

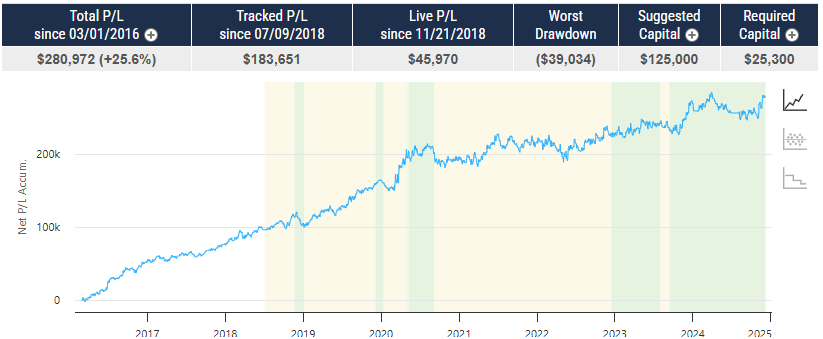

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

MidCap Yellow

PRODUCT

Mid Cap SP400

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$50,000

COST

USD 110 / monthly

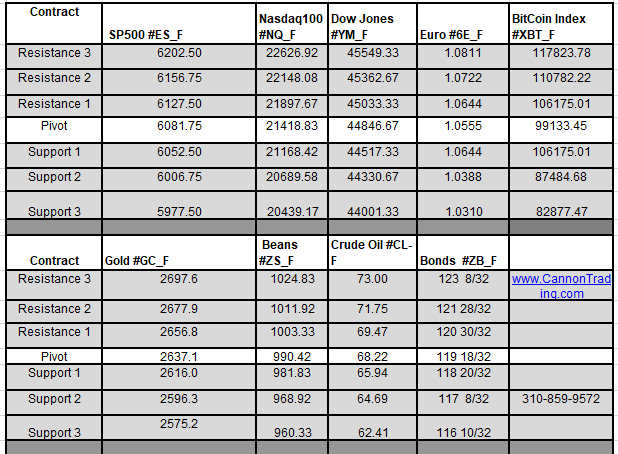

Daily Levels for December 9th, 2024

Weekly Levels for the week of

December 9th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.