Cannon Futures Weekly Letter Issue # 1210

In this issue:

- Important Notices – Heavy Fed Speaking, Active Data, Few Earnings

- Futures 101 – Daily research and Insight

- Hot Market of the Week – July/December Corn Spread

- Broker’s Trading System of the Week – NQ Day Trading System

- Trading Levels for Next Week

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

The Week Ahead

Non-Farm Payrolls, Many Fed Speakers within a very active Data week.

Earnings? Not so much only 129 company’s reporting the largest by market cap will be Nike after the Tuesday close, PayChex come in second place pre-open Tuesday.

Fed Speak:

- Mon. Bowman

- Tues. Bostic, Cook, Barkin

- Wed. Hammack, Musalem, Bowman, Barkin

- Thu. Bostic

- Fri. Williams

Big Economic Data week:

- Mon. Chicago PMI, Dallas Fed Munufaturing Index,

- Tues. JOLTS,RedBook,S&P Final PMI, ISM PMI

- Wed. ADP, Chicago PMI, Pending Home Sales

- Thur. Continuing Jobless Claims, Factory Orders, Fed Balance Sheet

- Fri. Non Farm Payrolls

How to Rollover on the E-Futures Platform video below

-

Futures 101: Daily Research

- Specific price points for shorter term, medium term and longer term

- Detailed chart analysis

- Audio brief summary as well as more detailed PDF summary

- View insight into Gold, Mini SP, Crude Oil, Corn, feeder Cattle, Live Cattle, Wheat, Hogs and more!

To sign up and get two weeks FULL access, start by requesting the free trial below.

Once you sign up, you will be set up for FULL access within one business day and be able to access and see information like the sample in the screen shot below.

-

- Hot Market of the Week – December Gold

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

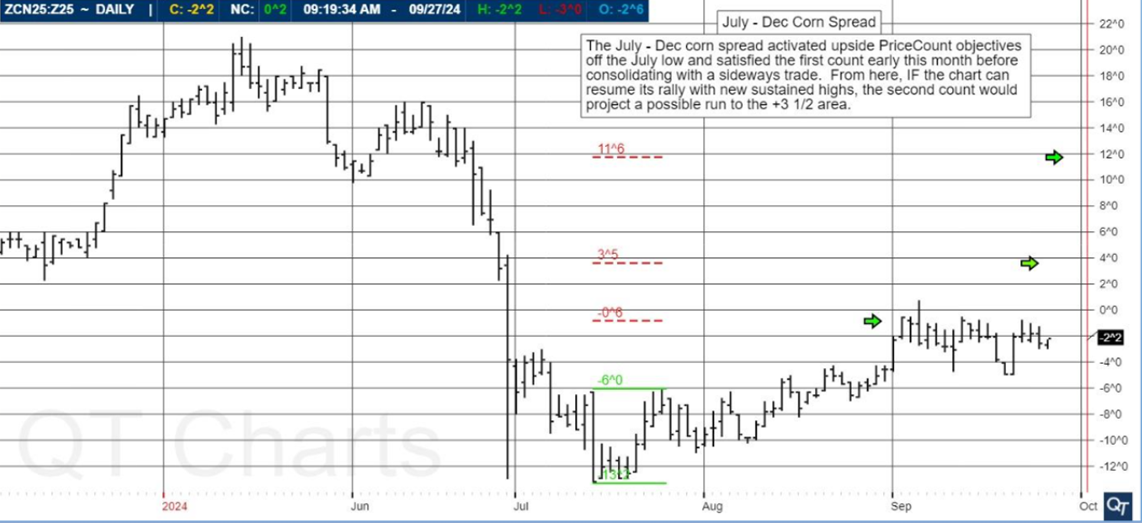

July / December Corn Spread

The July – Dec corn spread activated upside PriceCount objectives off the July low and satisfied the first count early this month before consolidating with a sideways trade. From here, IF the chart can resume its rally with new sustained highs, the second count would project a possible run to the +3 1/2 area.

PriceCounts – Not about where we’ve been, but where we might be going next!

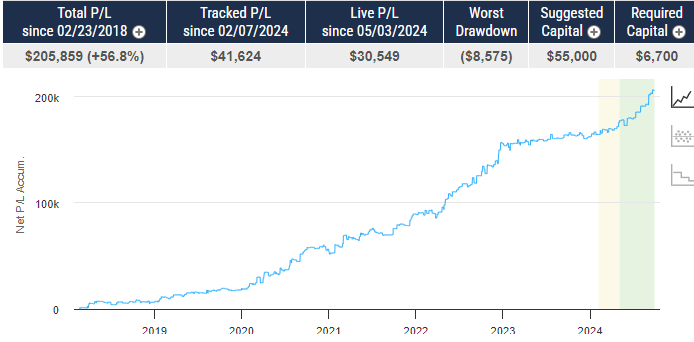

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

Sound of Freedom

PRODUCT

NQ – mini NASDAQ 100

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$25,000

COST

USD 115 / monthly

Recommended Cannon Trading Starting Capital

$25,000.00

COST

USD 150 / monthly

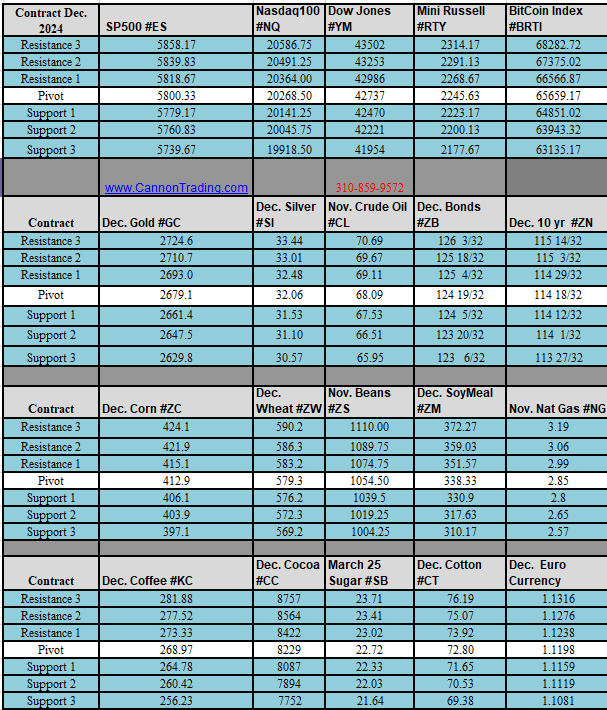

Daily Levels for September 30th, 2024

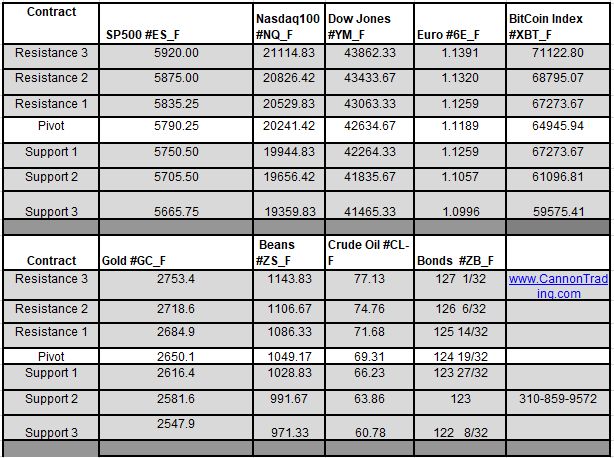

Trading Reports for Next Week

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.