Cannon Futures Weekly Letter Issue # 1216

In this issue:

- Important Notices – Veteran’s Day, CPI, PPI

- Futures 102 – Trading Contest – REAL CASH Prizes

- Hot Market of the Week – July-Dec. Corn Spread

- Broker’s Trading System of the Week – Nikkei 225 Swing System

- Trading Levels for Next Week

- Trading Reports for Next Week

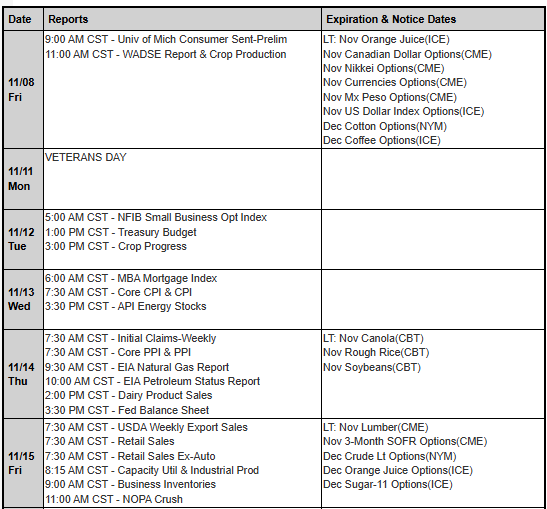

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

- Veterans Day Monday the Banks, Bond market and Federal officers are closed,

- 13 Fed Speakers Powell on Thursday!

- 821 earnings

- CPI Wed, PPI Thursday!

|

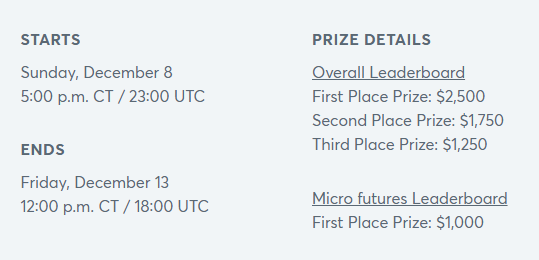

Futures 102: Trading Contest – Trade Against the Pro!

|

|

-

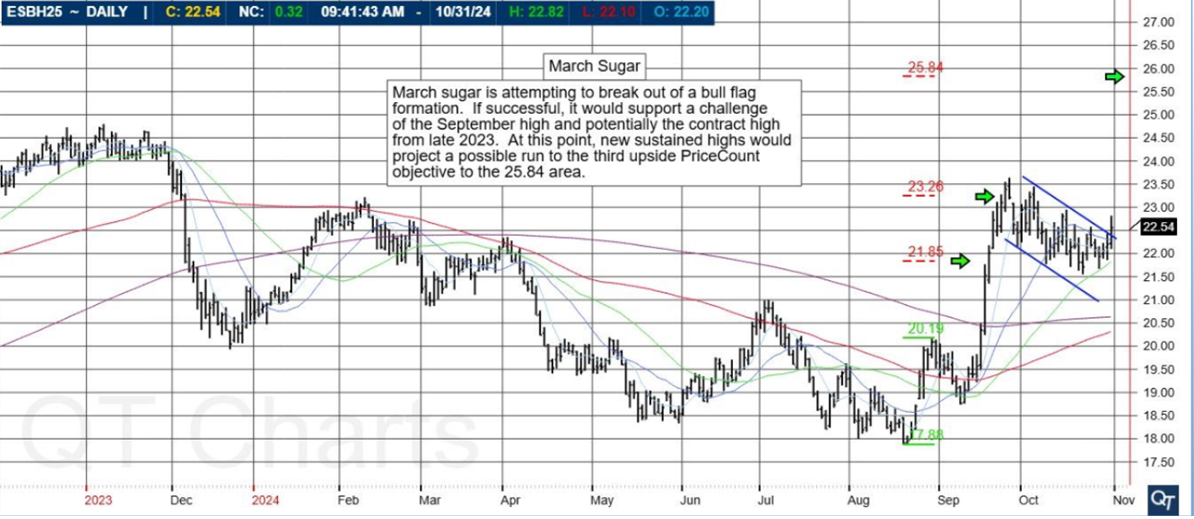

- Hot Market of the Week – July -Dec Corn Spread

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

July -Dec Corn Spread

The July – Dec corn spread satisfied its second upside PriceCount objective early last month and corrected. Now, the chart is poised to resume its rally where new sustained highs would project a possible run to the 11.75 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

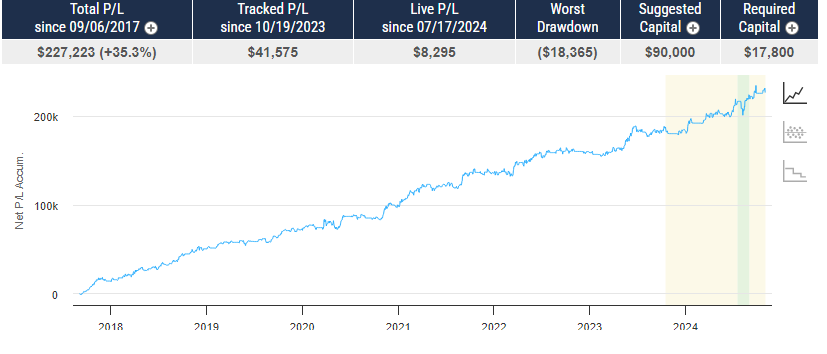

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

DaGGoR Rider M1C NQ

PRODUCT

NQ – Mini NASDAQ

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$40,000

COST

USD 150 / monthly

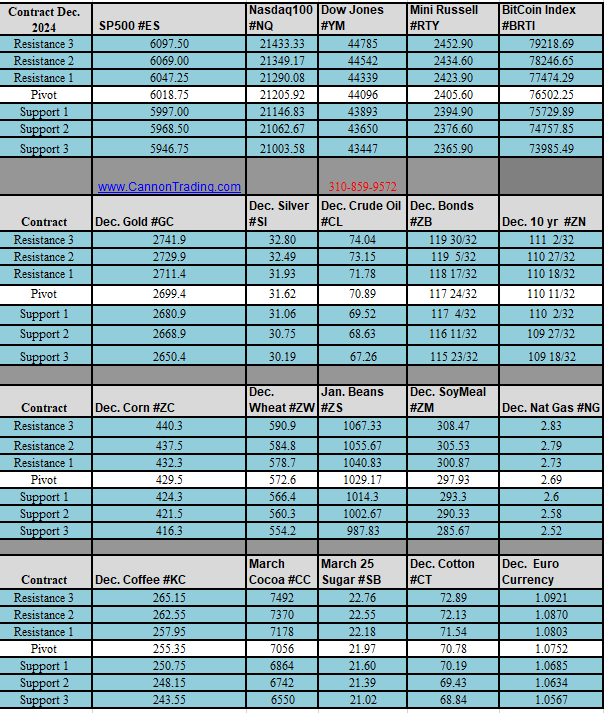

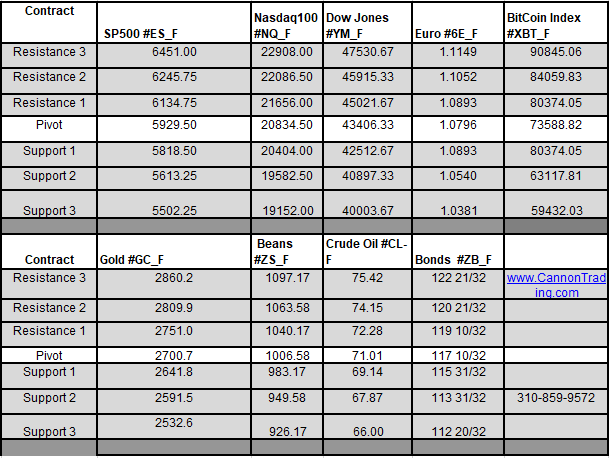

Daily Levels for November 11th, 2024

Weekly Levels for the week of November 11th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.