10-Year Treasury Note Futures

Current 10-Year Treasury Note Futures | Futures Prices

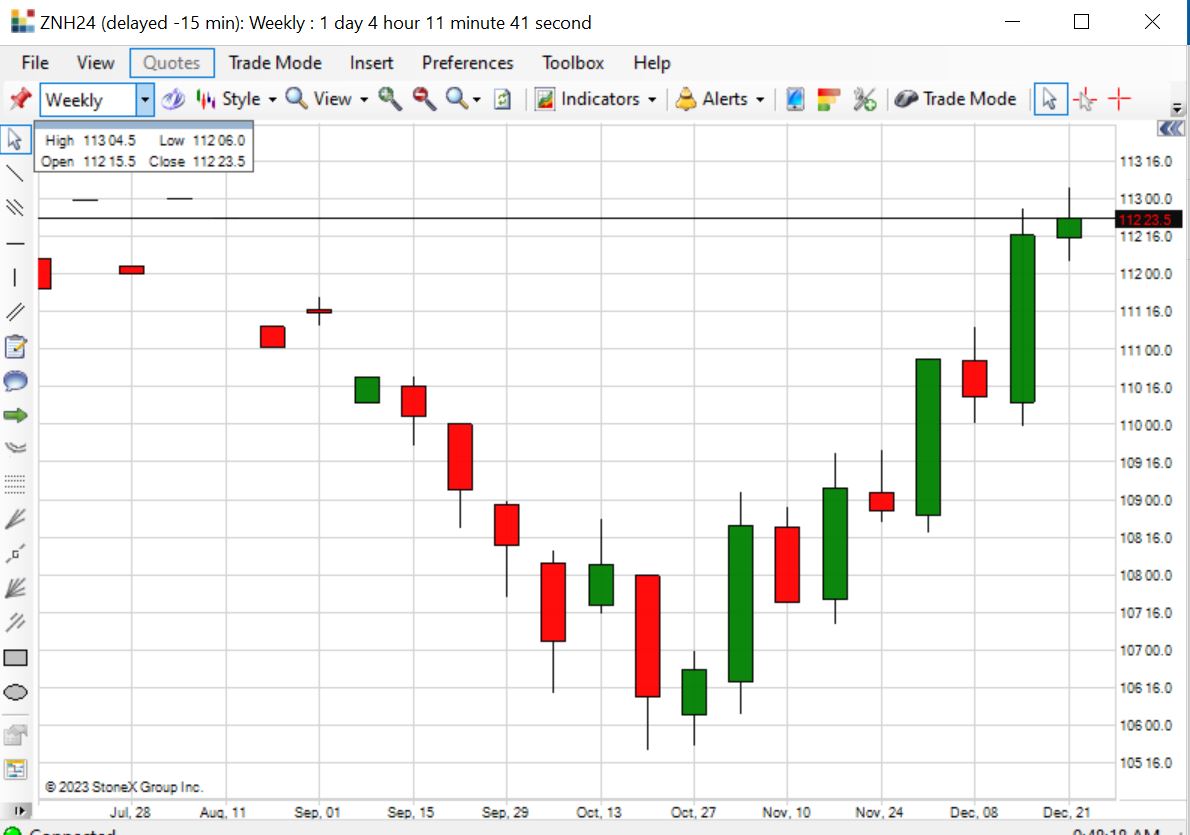

10-Year Treasury Note Futures Prices — Historical Chart

Chart of 10-Year Treasury Note Futures futures updated December 29th, 2023. Click the chart to enlarge. Press ESC to close.

Disclaimer: This material is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

![]()

10-Year Treasury Note Futures Contract Specifications

| Contract Specification | 10-Year Treasury Note Futures |

| Product Symbol | ZN |

| Contract Size | The unit of trading shall be U.S. Treasury Bonds having a face value at maturity of one hundred thousand dollars ($100,000) or multiples thereof |

| Price Quotation | Points ($1,000) and halves of 1/32 of a point. For example, 126-16 represents 126 16/32 and 126-165 represents 126 16.5/32. Par is on the basis of 100 points. |

| Venue | CME Globex, Open Outcry (New York) |

| CME Globex Hours (EST) | SUN - FRI: 5:30 p.m. - 4:00 p.m. |

| Open Outcry Hours (EST) | MON - FRI: 7:20 a.m. - 2:00 p.m. |

| Minimum Fluctuation | Par shall be on the basis of 100 points, with each point equal to $1,000 per contract. The minimum price fluctuation shall be one-half of one thirty-second of one point (equal to $15,625 per contract), except for intermonth spreads for which the minimum price fluctuation shall be one-quarter of one thirty-second of one point (equal to $7.8125 per contract). Contracts shall not be made on any other price basis. |

| Position Limits and Position Accountability | In accordance with Rule 559., no person shall own or control positions in excess of 60,000 contracts in an expiring contract during the contract’s last 10 trading days (Rule 19102.F.). No hedge exemptions will be permitted with respect to this position limit. Position accountability, as defined in Rule 560., will apply to trading of Long-Term U.S. Treasury Bond futures. |

| Termination of Trading | No trades in an expiring contract shall be made during the last 7 business days of the contract’s named month of expiration. Any contract remaining open after the last day of trading must be either: (a) settled by physical delivery no later than the last business day of the contract’s named month of expiration (Rule 19103.); or (b) liquidated by means of a bona fide Exchange of Futures for Related Position (Rule 538.) no later than 12:00 noon on the fifth business day preceding the last business day of the contract’s named month of expiration. |

| Listed Contracts | The first five consecutive contracts in the March, June, September, and December quarterly cycle. |

| Physical Delivery | Each individual contract lot that is delivered must be composed of one and only one contract grade Treasury note issue. The amount at which the short Clearing Member making delivery shall invoice the long Clearing Member taking delivery of said notes (Rule 19105.A.) shall be determined as: Invoice Amount = ($1000 x P x c) + Accrued Interest where P is the contract daily settlement price on the day that the short Clearing Member gives the Clearing House notice of intention to deliver (Rule 19104.A.). P shall be expressed in points and fractions of points with par on the basis of 100 points (Rule 19102.C.); and c is a conversion factor equal to the price at which a note with the same time to maturity as said note and with the same coupon rate as said note, and with par on the basis of one (1) point, will yield 6I per annum according to conversion factor tables prepared and published by the Exchange. For each individual contract lot that is delivered, the product expression ($1000 x P x c) shall be rounded to the nearest cent, with half-cents rounded up to the nearest cent. Example: Assume that P is 100 and 25.5/32nds. Assume that c is 0.9633. The product expression ($1000 x P x c) is found to be $97,097.6296875. The rounded amount that enters into determination of the Invoice Amount is $97,097.63. In the determination of the Invoice Amount for each individual contract lot being delivered, Accrued Interest shall be charged to the long Clearing Member taking delivery by the short Clearing Member making delivery, in accordance with 31 CFR Part 306--General Regulations Governing U.S. Securities, Subpart E--Interest. See also Rule 19102.B. |

| Expiring Futures Contracts Delivery |

Deliveries against expiring contracts shall be by book-entry transfer between accounts of Clearing Members at qualified banks (Rule 19109.) in accordance with 31 CFR Part 306-- General Regulations Governing U.S. Securities, Subpart O--Book-Entry Procedure, and 31 CFR Part 357--Regulations Governing Book-Entry of U.S. Treasury Bonds, Notes and Bills held in Legacy Treasury Direct®. Deliveries against an expiring contract can be made no earlier than the first business day of the contract’s named month of expiration, and no later than the last business day of the contract’s named month of expiration (Rule 19103). All deliveries must be assigned by the Clearing House. |

| Delivery Period | Delivery of contract grade U.S. Treasury notes may be made by a short Clearing member upon any business day of the contract delivery month that the short Clearing Member may select. The contract delivery month shall be defined so as to commence on, and to include, the first business day of the contract’s named month of expiration, and to extend to, and to include, the last business day of the contract’s named month of expiration. |

| Grade and Quality Specifications | The contract grade for delivery on futures made under these Rules shall be U.S. Treasury fixed principal bonds which have fixed semi-annual coupon payments, and which have a remaining term to maturity of at least 25 years. For the purpose of determining a U.S. Treasury security’s eligibility for contract grade, its remaining term to maturity shall be calculated from the first day of the contract’s named month of expiration, and shall be rounded down to the nearest three-month increment (e.g., 12 years 5 months 18 days shall be taken to be 12 years 3 months). New issues of U.S. Treasury securities that satisfy the standards in this Rule shall be added to the contract grade as they are issued. Notwithstanding the foregoing, the Exchange shall have the right to exclude any new issue from the contract grade or to further limit outstanding issues from the contract grade. |

| Rulebook Chapter | 19 |

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CBOT. |

10-Year Treasury Note Futures have helped investors protect capital for years, backed by the full faith and credit of the U.S. Government. These types of futures have gained popularity in the commodities market over the years because they can be used to hedge interest rate price risk for financial institutions, business and many large entities that are exposed to interest rate price risk. For this reason, many investors utilize these types of futures, including options on futures to both hedge and speculate.

Cannon Trading is happy to help our clients and those new to futures to learn more about this contract as well as the many other interest rate futures products including but not limited to, the Eurodollar , 30 yr Bond, German Bunds, 5 yr. Notes, JGB, and many other domestic and international Interest Rate futures contracts. We understand there are a lot of different futures contracts available on the market, which can make it challenging to navigate and we are here to help you move up the learning curve with ease.

Our team can help investors and clients of all experience levels utilize powerful tools to analyze the market. While there is significant risk involved in futures trading you should only use Risk Capital, that is to say, money that, if lost will not negatively impact your lifestyle or the lifestyle of your dependents.Our professional, registered Brokers will help you navigate through the tools,platforms and products available for you individually, Jointly, an IRA account, a corporate entity, investment trust or many other legally acceptable formations.

Cannon Trading's team has been a staple in the futures trading market since we opened our doors in 1988.

Fast forward 10 years, we were the first online brokerage service offering online trading in 1998. Our team of experienced brokers can assist clients with their needs. Whether they want to analyze the market with our many platforms or participate in a self directed capacity, we can help.

What Are 10-Year Treasury Notes?

A 10-Year Treasury Note is a type of bond provided to investors by the United States Government. This bond serves as a loan directly to the United States Government.

The bond owner buys the United States Government debenture at a discount and ten years later, when the bond matures, the U.S. Government returns your principal plus accrued interest.

Here are some fast facts traders should know before investing in this type of future:

More About 10-Year Treasury Notes

10-Year Treasury Notes or 10-Year T-Notes are one of the futures markets with the most liquidity. Open interest in the front month alone is greater than 4 million contracts which represents over 500 Billion dollars of notional value just in the front or spot month. For this reason, 10-Year Treasury Notes have very high liquidity. While this type of contract is highly liquid, it is one of the most popular contracts on the market for a reason; based on the full faith and credit of the US Government.

Many people prefer to invest in the 10-Year Treasury Note Futures when the economy makes a downward trend. Additionally, bad news or poor foreign relations can create undue volatility in other global assets. Since the 10-Year Treasury Note is Backed by the U.S. Government, it is an excellent option for traders looking for refuge during other global assets’ bad times.

Benefits of 10-Year Treasury Notes

10-Year Treasury Notes have a lot of benefits, especially if the equity market has a lot of instability. For this reason, many investors consider the 10 year note during bad times, which helps increase overall volume and open interest.

Here are just a few ways people can benefit from 10-Year Treasury Notes:

Things To Consider About 10-Year Treasury Notes

10-Year Treasury Notes have a lot of benefits, making them an attractive option for traders. The high volume of this option makes it easy to access for brokers and traders of all specializations.

While this option is beneficial to traders, there are a few things people should consider before they make their first investment:

Why Do We Have 10-Year Treasury Note Futures?

The Chicago Board of Trade created 10-Year Treasury Note Futures. The Chicago Board of Trade created these futures to allow investors to address interest rates. When they created this future in 1977, traders had no way to hedge against volatile interest rates, which caused instability in global economy’s.

The Chicago Board of Trade created 10-Year Treasury Note along with commercial paper and 30 yr bond Futures out of a greater need to develop hedging vehicles to better control price risk.

When the Chicago Board of Trade created them, they wanted solutions that:

Cannon Trading can help traders start on the right track with their 10-Year Treasury Notes or any other global futures contract. We understand that the market can seem confusing to new traders, so our team of experienced brokers are here to help make navigating the the markets with greater ease.

Getting Started With Cannon Trading

Our experienced team of brokers is one of the first in the industry. We opened our doors in 1988, which has led us to network with various traders across the nation and the world.

Since we opened, we have received several customer service awards and have consistently maintained good standing with the NFA and CFTC, our regulators.

How Cannon Trading Can Help 10-Year Treasury Note Futures Traders

At Cannon Trading, we have the tools traders need to make informed decisions before investing in the futures market.

We provide access to cutting-edge software and programs that put our traders at the forefront of the industry. We have significant knowledge of the 10-Year Treasury Note Futures market among many others, and we want to help our clients take full advantage of the growing industry.

Cannon Trading's experienced brokers can help clients learn more about futures, offering insight into the overall structure of the market, as well.

We work with traders, investors and entities from many different backgrounds, including:

Whether you're a beginning trader or an experienced one, our brokers can help you navigate the market. We have direct experience with the market so that we can help our clients best navigate the market.

We also provide them with the tools they need to make the most of the volatile futures market.

Contact Cannon Trading

Our professional commodities brokers will work with you to understand your specific trading style and requirements and provide you with the essential advice and information you need to thrive in this highly regulated market.

Cannon Trading's Broker-assisted Trading solution provides traders new to the field with the essential advice and tools they need to accelerate their understanding of which ever markets you are interested in.

Contact us today to learn more about commodities trading, as well as information on options on commodities and futures.

Disclaimer

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve a substantial risk of loss and are not suitable for all investors.

Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you regarding your circumstances, knowledge, and financial resources.

You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

![]()