Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday April 1, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

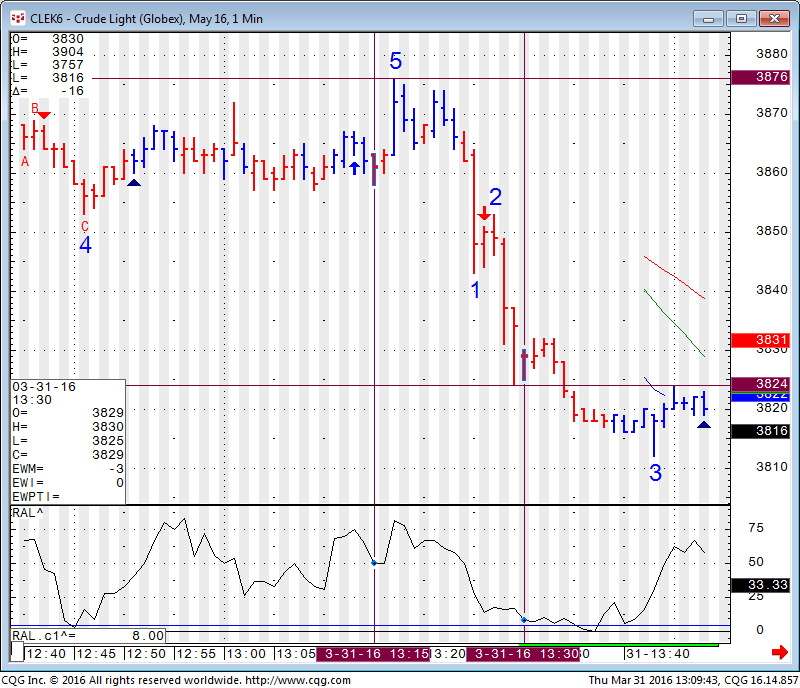

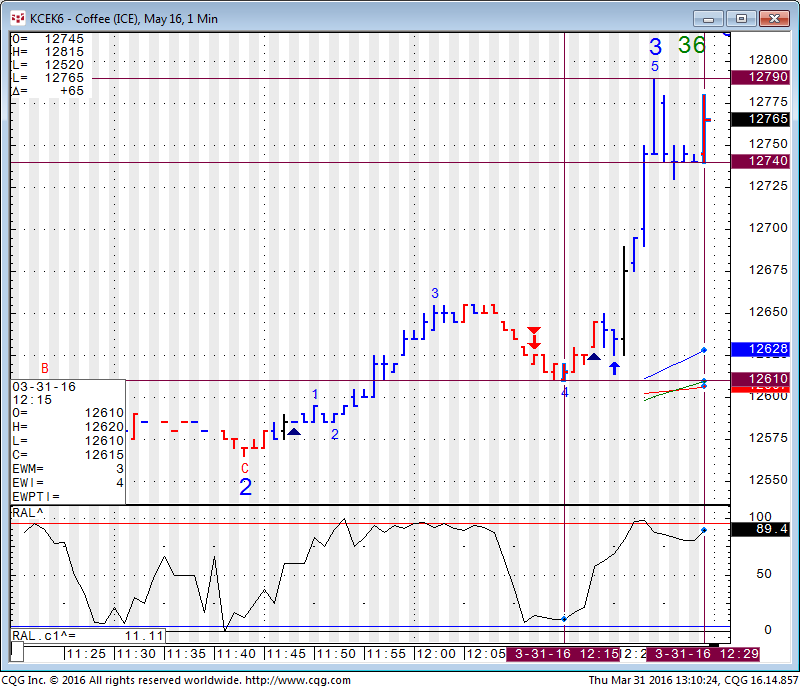

Per my blog from yesterday about the last trading day of the month…I am including 3 charts, all are 1 minute charts for coffee, US bonds and crude oil futures….Take a look on what happened in the last 7-10 minutes….

Also tomorrow is monthly unemployment, please see quick paragraph below from our friends at TradeTheNews.com

|

Friday, April 1st

US March Non-Farm Payroll Report

|

|

Friday 08:30 EST /13:30GMT

(US) March Change in Non-farm Payrolls

|

|

What the News Desk Says

March Nonfarm Payrolls are expected to notch another gain above 200K and the unemployment rate is expected to stay at 4.9% in Friday’s report. That would be consistent with Wednesday’s ADP Employment report which showed 200K job gains in March.

Last month’s payrolls report was headlined by a better than expected 242K net gain, but it was undercut by some concerning erosion in hourly earnings. There is no longer any question that US job growth is solid, but more evidence of wage stagnation could cause further delays in the Fed’s new tightening cycle... more

|

Crude Oil Chart:

Coffee Chart:

US Bonds 1 minute chart:

Featured System of the Month ( including real-time performance): Axiom Index II WFO NQ Trading System

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Contract June 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2072.08 | 4527.83 | 17754 | 1128.33 | 95.71 |

| Resistance 2 | 2065.92 | 4511.67 | 17706 | 1121.57 | 95.36 |

| Resistance 1 | 2059.58 | 4494.58 | 17659 | 1115.83 | 94.99 |

| Pivot | 2053.42 | 4478.42 | 17611 | 1109.07 | 94.64 |

| Support 1 | 2047.08 | 4461.33 | 17564 | 1103.33 | 94.27 |

| Support 2 | 2040.92 | 4445.17 | 17516 | 1096.57 | 93.92 |

| Support 3 | 2034.58 | 4428.08 | 17469 | 1090.83 | 93.55 |

| Contract | June Gold | May Silver | May Crude Oil | June Bonds | June Euro |

| Resistance 3 | 1259.5 | 15.94 | 40.40 | 166 18/32 | 1.1553 |

| Resistance 2 | 1250.9 | 15.75 | 39.72 | 165 21/32 | 1.1496 |

| Resistance 1 | 1242.3 | 15.59 | 38.93 | 165 4/32 | 1.1450 |

| Pivot | 1233.7 | 15.40 | 38.25 | 164 7/32 | 1.1392 |

| Support 1 | 1225.1 | 15.24 | 37.46 | 163 22/32 | 1.1346 |

| Support 2 | 1216.5 | 15.05 | 36.78 | 162 25/32 | 1.1289 |

| Support 3 | 1207.9 | 14.89 | 35.99 | 162 8/32 | 1.1243 |

| Contract | May Corn | May Wheat | May Beans | May SoyMeal | May Nat Gas |

| Resistance 3 | 383.1 | 497.8 | 935.83 | 280.90 | 2.22 |

| Resistance 2 | 375.2 | 485.7 | 924.92 | 277.90 | 2.17 |

| Resistance 1 | 363.3 | 479.6 | 917.83 | 274.10 | 2.12 |

| Pivot | 355.4 | 467.4 | 906.92 | 271.10 | 2.07 |

| Support 1 | 343.6 | 461.3 | 899.8 | 267.3 | 2.0 |

| Support 2 | 335.7 | 449.2 | 888.92 | 264.30 | 1.97 |

| Support 3 | 323.8 | 443.1 | 881.83 | 260.50 | 1.92 |

Economic Reports

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:17pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| FriApr 1 | 2:00am | GBP | Nationwide HPI m/m | 0.5% | 0.3% | ||||

| 3:15am | EUR | Spanish Manufacturing PMI | 53.8 | 54.1 | |||||

| 3:45am | EUR | Italian Manufacturing PMI | 52.6 | 52.2 | |||||

| 3:50am | EUR | French Final Manufacturing PMI | 49.6 | 49.6 | |||||

| 3:55am | EUR | German Final Manufacturing PMI | 50.4 | 50.4 | |||||

| 4:00am | EUR | Final Manufacturing PMI | 51.4 | 51.4 | |||||

| EUR | Italian Monthly Unemployment Rate | 11.5% | 11.5% | ||||||

| 4:30am | GBP | Manufacturing PMI | 51.4 | 50.8 | |||||

| 5:00am | EUR | Unemployment Rate | 10.3% | 10.3% | |||||

| 8:30am | USD | Average Hourly Earnings m/m | 0.2% | -0.1% | |||||

| USD | Non-Farm Employment Change | 206K | 242K | ||||||

| USD | Unemployment Rate | 4.9% | 4.9% | ||||||

| 9:45am | USD | Final Manufacturing PMI | 51.5 | 51.4 | |||||

| 10:00am | USD | ISM Manufacturing PMI | 50.8 | 49.5 | |||||

| USD | Revised UoM Consumer Sentiment | 90.6 | 90.0 | ||||||

| USD | Construction Spending m/m | 0.2% | 1.5% | ||||||

| USD | ISM Manufacturing Prices | 44.5 | 38.5 | ||||||

| USD | Revised UoM Inflation Expectations | 2.7% | |||||||

| All Day | USD | Total Vehicle Sales | 17.6M | 17.5M | |||||

| 12:00pm | USD | FOMC Member Mester Speaks |