Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday April 13, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

If you must play, decide on three things at the start: the rules of the game, the stakes, and the quitting time…Chinese Proverb

After a few days with very little reports (yet still some volatility in the markets) tomorrow we will have a few big reports including CPI, Beige Book and crude inventories.

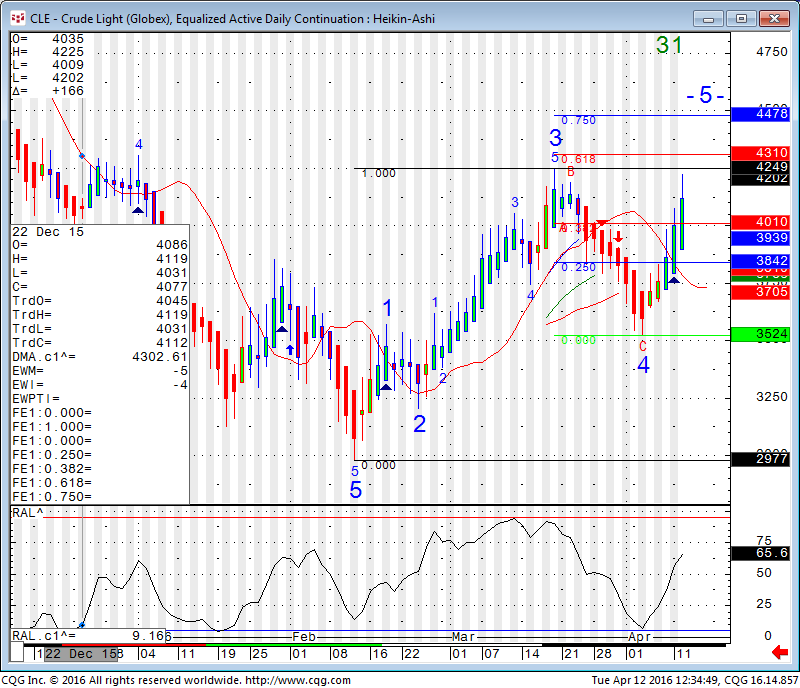

Two charts below for your review: Daily Crude Oil chart, where we are heading into a few levels of resistance:

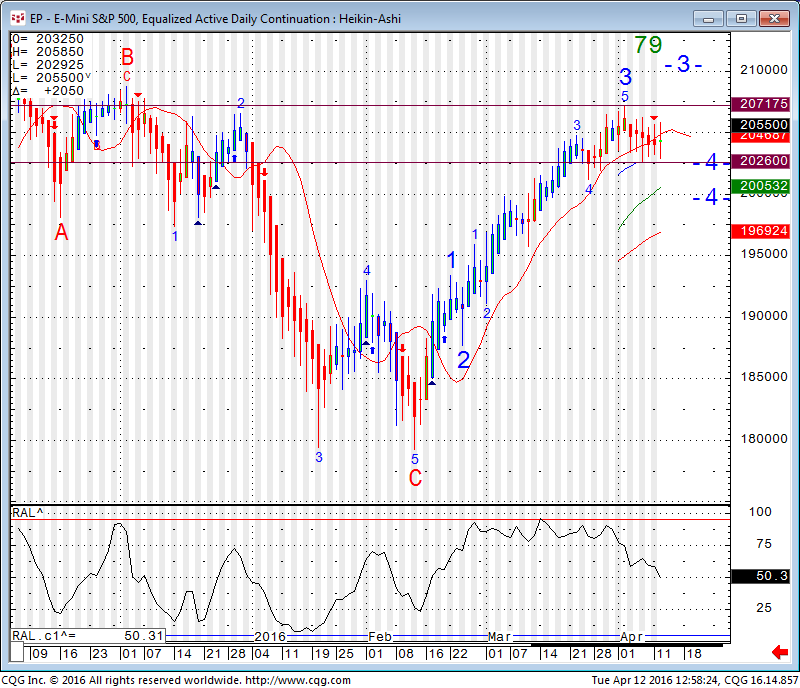

Daily mini SP chart, been in range for the last two weeks and need to either break 2071 or 2026:

Featured System of the Month ( including real-time performance): Axiom Index II WFO NQ Trading System

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Contract June 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2094.50 | 4584.00 | 17929 | 1126.87 | 95.16 |

| Resistance 2 | 2076.50 | 4540.75 | 17793 | 1115.73 | 94.77 |

| Resistance 1 | 2065.25 | 4513.00 | 17710 | 1108.97 | 94.39 |

| Pivot | 2047.25 | 4469.75 | 17574 | 1097.83 | 94.01 |

| Support 1 | 2036.00 | 4442.00 | 17491 | 1091.07 | 93.63 |

| Support 2 | 2018.00 | 4398.75 | 17355 | 1079.93 | 93.24 |

| Support 3 | 2006.75 | 4371.00 | 17272 | 1073.17 | 92.86 |

| Contract | June Gold | May Silver | May Crude Oil | June Bonds | June Euro |

| Resistance 3 | 1275.6 | 16.78 | 44.94 | 167 10/32 | 1.1594 |

| Resistance 2 | 1270.2 | 16.51 | 43.60 | 166 24/32 | 1.1540 |

| Resistance 1 | 1263.9 | 16.35 | 42.78 | 166 | 1.1475 |

| Pivot | 1258.5 | 16.08 | 41.44 | 165 14/32 | 1.1421 |

| Support 1 | 1252.2 | 15.92 | 40.62 | 164 22/32 | 1.1355 |

| Support 2 | 1246.8 | 15.65 | 39.28 | 164 4/32 | 1.1301 |

| Support 3 | 1240.5 | 15.49 | 38.46 | 163 12/32 | 1.1236 |

| Contract | May Corn | May Wheat | May Beans | May SoyMeal | May Nat Gas |

| Resistance 3 | 375.3 | 468.0 | 954.08 | 294.30 | 2.17 |

| Resistance 2 | 370.4 | 462.5 | 945.92 | 290.10 | 2.10 |

| Resistance 1 | 366.6 | 457.5 | 941.08 | 287.60 | 2.06 |

| Pivot | 361.7 | 452.0 | 932.92 | 283.40 | 1.99 |

| Support 1 | 357.8 | 447.0 | 928.1 | 280.9 | 2.0 |

| Support 2 | 352.9 | 441.5 | 919.92 | 276.70 | 1.88 |

| Support 3 | 349.1 | 436.5 | 915.08 | 274.20 | 1.84 |

Economic Reports

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 3:28pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| WedApr 13 | 2:45am | EUR | French Final CPI m/m | 0.7% | 0.7% | ||||

| 4:30am | GBP | BOE Credit Conditions Survey | |||||||

| 5:00am | EUR | Industrial Production m/m | -0.6% | 2.1% | |||||

| Tentative | GBP | 30-y Bond Auction | 2.21|2.1 | ||||||

| 8:30am | USD | Core Retail Sales m/m | 0.4% | -0.1% | |||||

| USD | PPI m/m | 0.3% | -0.2% | ||||||

| USD | Retail Sales m/m | 0.1% | -0.1% | ||||||

| USD | Core PPI m/m | 0.1% | 0.0% | ||||||

| 9:30am | GBP | CB Leading Index m/m | 0.2% | ||||||

| 10:00am | USD | Business Inventories m/m | 0.1% | 0.1% | |||||

| 10:30am | USD | Crude Oil Inventories | 1.0M | -4.9M | |||||

| 1:01pm | USD | 10-y Bond Auction | 1.90|2.5 | ||||||

| 2:00pm | USD | Beige Book | |||||||

| 7:01pm | GBP | RICS House Price Balance | 50% | 50% |