Dear Traders,

Get Real Time updates and more on our private FB group!

Have you ever wondered about:

- Order routing?

- Automated / algo trading?

- Different trading techniques and strategies?

- What added-value trading tools can help you?

Well, STOP WONDERING. You can call upon a professional, experienced, Series-3 broker who can access and share all the information above and more – utilizing our firm’s cumulative experience in futures trading: over 30 years!

LIVE WEBINAR: Cannon Trading and CME Group invite you to attend an online event on Monday, August 30, to learn more about Micro Treasury Yield futures, a streamlined approach to trading US treasury benchmark rates launching on August 30.

Join us for a conversation with Craig Bewick, Senior Director of Client Development and Sales, to discuss the contract specs in greater detail. Traded in yield, the contracts directly reference the most recently auctioned Treasury securities at key tenor points across the curve. Cash-settled and available on four key tenors, Micro Treasury Yield futures offer exposure to on-the-run Treasury yields plus the precision of a smaller contract.

Craig Bewick is senior director of client development and sales at CME Group. Mr. Bewick has spent 25 years in futures and options markets, starting at CBOT and CME working in risk management, regulatory, technology, product management, and client development. After spending over eight years with WH Trading LLC, he returned to CME Group working to educate and promote futures trading. Mr. Bewick currently writes for InFocus Options Corner.

In This Webinar You Will Learn:

• What is unique about the MICRO rate futures?

• Different ways to trade the new instruments

• Possible spread set ups between the MICRO rates and other products

SPACE is LIMITED, so reserve your space now!

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

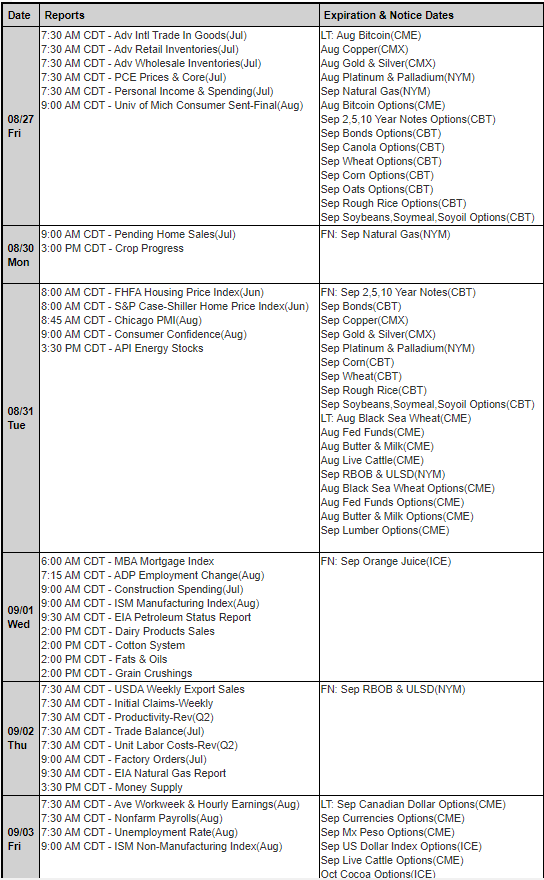

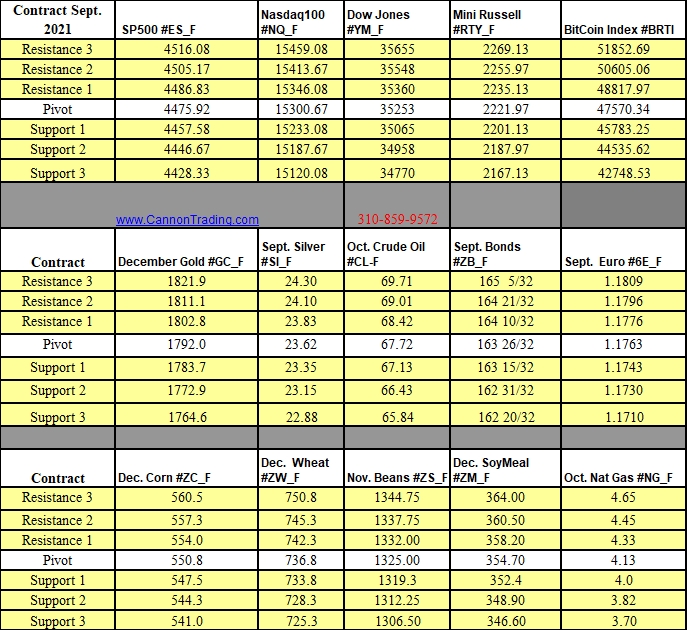

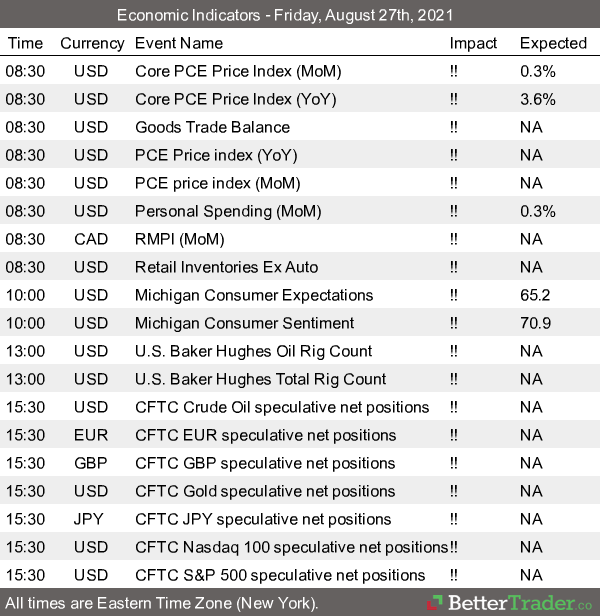

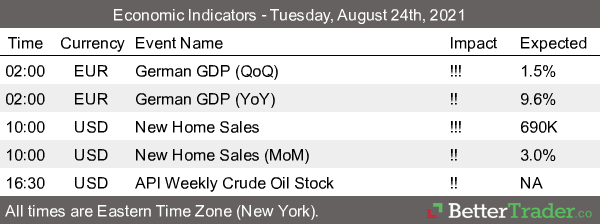

Futures Trading Levels

8-25-2021

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.