In the volatile and often unpredictable world of financial markets, risk management is not merely a strategy—it is a necessity. For both retail investors and large institutions, one of the most reliable ways to manage that risk is through futures hedging. But what exactly does it mean to hedge with futures? How has this technique evolved over the years? And why is partnering with a seasoned brokerage like Cannon Trading Company a smart move for traders of all levels?

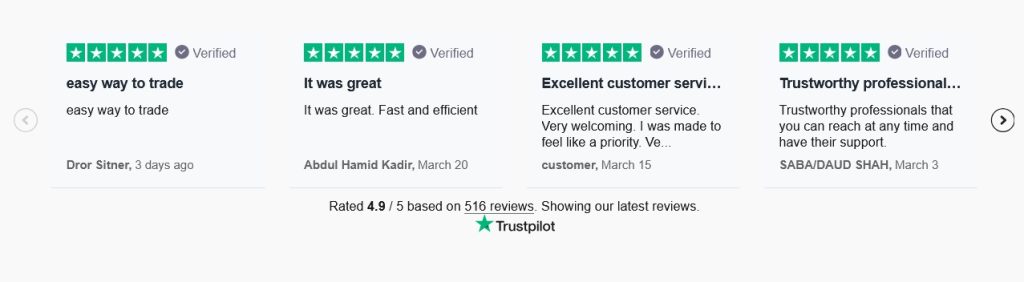

This in-depth article explores the definition, science, pros and cons, evolution, and future outlook of hedging in futures. We’ll also examine why Cannon Trading Company, with its exceptional TrustPilot ratings, regulatory reputation, and vast platform selection, stands out as a premier brokerage for futures contract trading and risk management.

What is Futures Hedging?

Futures hedging refers to the use of futures contracts to reduce or eliminate the risk of price movements in an underlying asset. These contracts obligate the buyer or seller to purchase or sell a specific quantity of an asset at a predetermined price on a specified date in the future.

Imagine a grain farmer concerned about a drop in wheat prices before harvest. By selling wheat futures contracts now, the farmer can lock in a favorable price, ensuring predictable revenue regardless of future market conditions. Conversely, a bread manufacturer worried about rising wheat prices can buy futures to secure today’s price and safeguard against inflationary shocks.

Whether it’s agricultural commodities, precious metals, energy, or financial indices like the E-mini S&P 500, hedging futures is all about protecting profits and stabilizing operations in uncertain times.

The Science Behind Hedging with Futures

At its core, futures hedging is a mathematical and statistical endeavor. Successful hedging in futures requires more than just intuition—it’s about measuring market exposure, understanding correlations, and calculating hedge ratios. Here’s how the science breaks down:

- Understanding the Hedge Ratio

The hedge ratio determines the number of futures contracts required to offset the risk of an existing position. It is often calculated using:

Hedge Ratio = Value of the position being hedged / Value of a single futures contract

This ensures the hedge is proportionate to the exposure. - Correlation and Basis Risk

The effectiveness of a hedge depends on how closely the futures contract correlates with the underlying asset. A high correlation results in lower basis risk—the risk that the price of the asset and the futures contract will not move in tandem.For instance, an investor with exposure to the S&P 500 index might use E-mini contracts to hedge their position. Since E-minis are directly tied to the index, the correlation is strong, making them an efficient hedging tool. - Delta Hedging and Greeks

In more advanced institutional trading platforms, traders use options Greeks such as delta, gamma, and vega in combination with futures to build sophisticated hedge strategies. These calculations enable dynamic hedging that adjusts with market conditions.

Pros of Hedging in Futures

- Risk Mitigation

The primary advantage of hedging futures is risk control. By locking in prices or offsetting exposure, traders and businesses can protect their margins and ensure financial stability. - Liquidity and Market Access

Futures markets are highly liquid, particularly for major contracts like oil, gold, or the E-mini S&P 500. This liquidity ensures low transaction costs and tight spreads, making them ideal for hedging large positions. - Transparency and Regulation

Futures contracts are traded on centralized exchanges, which provide transparency, standardization, and regulatory oversight. This makes futures contract trading a more secure form of hedging compared to over-the-counter derivatives. - Leverage and Capital Efficiency

Although leverage introduces risk, it also allows traders to hedge large positions with relatively small capital outlays. This efficiency makes trading futures a practical choice for managing large portfolios.

Cons of Hedging in Futures

- Opportunity Cost

One downside of hedging is that it can limit potential upside gains. If the market moves favorably, the futures hedge may reduce or negate the benefit of that movement. - Complexity

Successful futures hedging requires an understanding of markets, math, and mechanics. For newer traders, managing hedge ratios, basis risk, and margin requirements can be overwhelming without the right guidance or institutional trading platform. - Costs and Margin Requirements

While futures are generally low-cost, they do involve fees, commissions, and margin requirements. Poorly managed margin can result in margin calls or forced liquidation. - Imperfect Hedges

No hedge is perfect. Unexpected market behavior, regulatory changes, or global events can disrupt even the most carefully planned hedging in futures strategies.

Evolution of Futures Hedging Over the Years

The practice of futures contract trading for hedging goes back centuries, originating in agricultural markets. However, its sophistication and scope have expanded drastically in recent decades:

- From Commodities to Financials

What began as a tool for farmers and grain merchants has evolved into a mainstay for banks, asset managers, and even governments. Today, futures are used to hedge everything from interest rates and currencies to equity indices and carbon emissions. - Rise of the E-mini

The launch of the E-mini S&P 500 contract revolutionized futures trading by offering smaller, more accessible contracts. This enabled retail traders and small hedge funds to adopt professional-grade hedging strategies without massive capital. - Technology and Platforms

Modern institutional trading platforms offer algorithmic trading, real-time risk analysis, and AI-driven strategy optimization. Traders can now simulate various hedging futures scenarios before executing any trades. - Cross-Asset and Global Hedging

With the rise of globalization, investors hedge across borders using a wide range of futures products in different time zones and currencies. Platforms that offer seamless multi-asset trading have become essential tools for 21st-century risk management.

Futures Hedging in the 2nd Half of the 2020s: What’s Ahead?

As we enter the second half of the 2020s, futures hedging is poised for further innovation. Here are some trends shaping its future:

- AI and Predictive Analytics

Machine learning algorithms are increasingly being used to optimize hedge ratios, predict volatility, and adjust strategies in real time. These tools are becoming standard in high-end institutional trading platforms. - Tokenization and Blockchain

Smart contracts on blockchain platforms may soon enable automated futures contract trading, reducing settlement risk and increasing transparency. - ESG and Climate Hedging

As ESG (Environmental, Social, and Governance) investing grows, traders are using futures to hedge exposure to climate-related risks. Carbon futures, weather derivatives, and ESG index futures are new frontiers in hedging futures. - Retail Revolution

Platforms are making trading futures and managing hedges more accessible for retail traders, including mobile apps with educational content, intuitive dashboards, and micro futures contracts for those with smaller accounts.

Why Cannon Trading Company is a Top Partner for Futures Hedging

For traders looking to engage in futures hedging with confidence, experience, and the best tools, Cannon Trading Company stands out as a premier partner. Here’s why:

- 5-Star TrustPilot Ratings

Cannon Trading Company has earned consistent 5 out of 5-star reviews on TrustPilot, reflecting a commitment to customer service, reliability, and value. Traders trust Cannon because they deliver. - Regulatory Excellence

Cannon maintains a clean record with federal and independent futures trading regulators, such as the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). Their compliance-first approach ensures a secure trading environment. - Decades of Expertise

With over 30 years in futures contract trading, Cannon Trading has weathered every market condition and helped clients do the same. Their seasoned brokers offer custom strategies for hedging in futures and portfolio protection. - Platform Versatility

Cannon offers a wide range of top-performing platforms, from high-end institutional trading platforms to mobile apps for active retail traders. This includes access to platforms optimized for E-mini and e mini contracts, as well as tools for advanced charting, risk management, and algorithmic strategies.

Try a FREE Demo! - Personalized Support

Whether you’re new to trading futures or managing a complex institutional book, Cannon Trading provides personal guidance. Their team helps tailor futures hedging strategies that fit your risk profile, goals, and market outlook.

Hedging Futures as a Smart, Modern Strategy

Futures hedging is not just about protection—it’s about precision, foresight, and flexibility. As global markets continue to grow more interconnected and volatile, the ability to control downside while preserving upside is invaluable.

Whether you’re hedging exposure to commodities, equities, interest rates, or environmental risks, hedging in futures offers an efficient, transparent, and powerful toolset. However, like any advanced strategy, it demands the right education, platform, and brokerage.

That’s where Cannon Trading Company delivers. With decades of experience, top-tier platforms, elite customer support, and a reputation backed by 5-star reviews and industry regulators, Cannon is the brokerage partner of choice for traders serious about mastering futures contract trading.

If you’re ready to embrace the future of futures hedging, Cannon Trading Company is ready to help you get there.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading