The Week Ahead:

By John Thorpe, Senior Broker

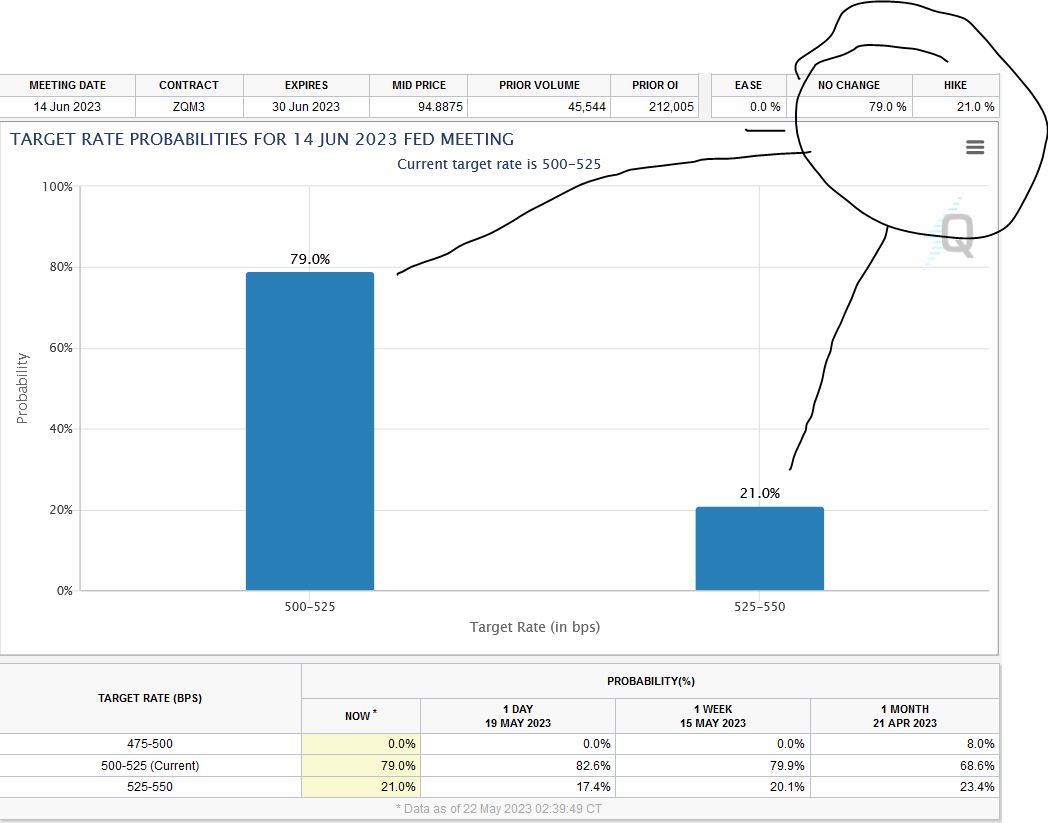

THIS WEEK FOMC Minutes will be the big mover in addition to ongoing Debt limit increase negotiations between The Executive and Legislative branches of government. Minutes of the FOMC meeting of May 2-3 will be released on Wednesday at 1:00PM CDT. In the immediate wake of the FOMC statement there was optimism that Fed policymakers were leaning toward a pause in interest rates after a swift raising of the fed funds target range by 500 basis points that began 13 months ago. However, Fed Chair Jerome Powell pushed back against that perception in his press briefing on May 3. Although, he did say last week that tight credit conditions may limit the need for further policy tightening. In the weeks since the meeting, other Fed policymakers have cautioned against being too certain that more rate hikes are not on the way.

The minutes are likely to reinforce these views, and that these views probably haven’t shifted. The economic data released in recent weeks point to a still strong labor market and continued stubborn inflation. This is the formula that has kept the Fed on a path of further tightening to address imbalances in the labor supply/demand and reduce demand for goods and services that are pushing up prices.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

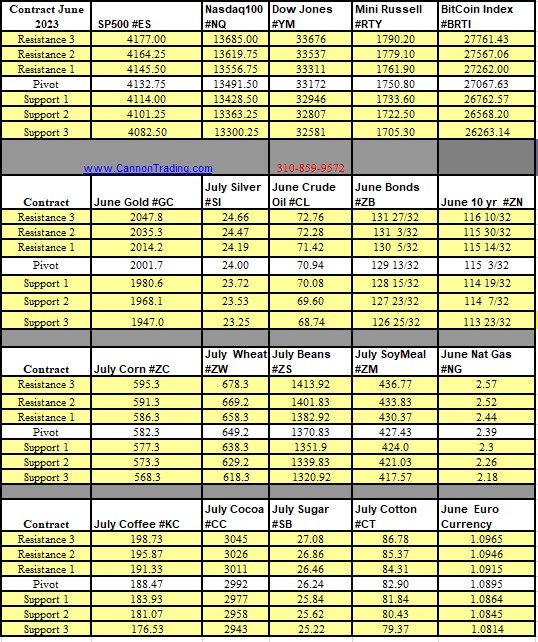

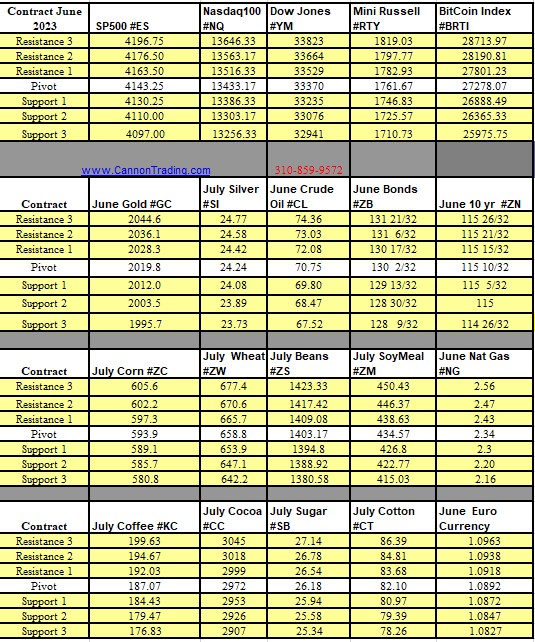

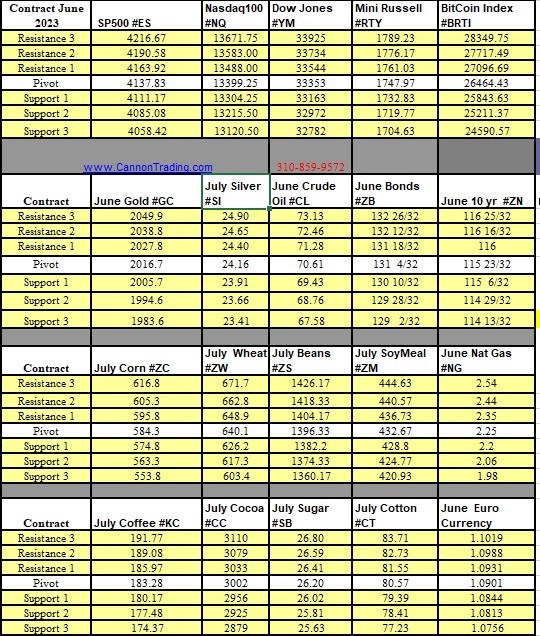

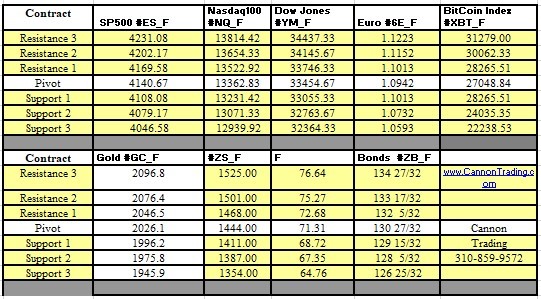

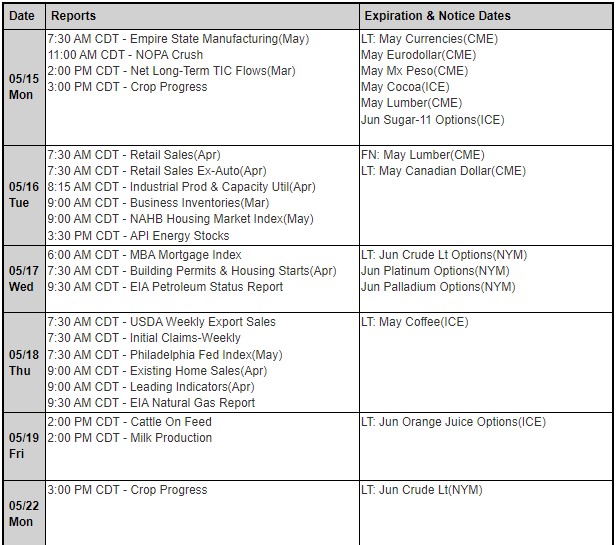

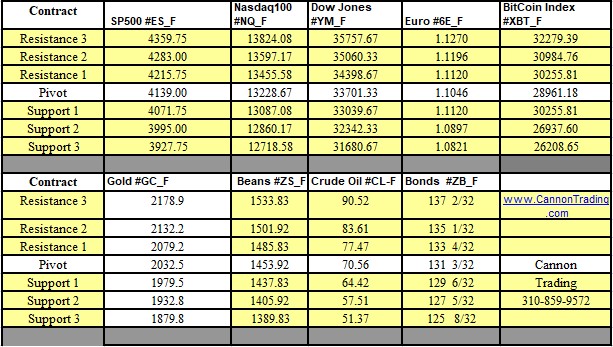

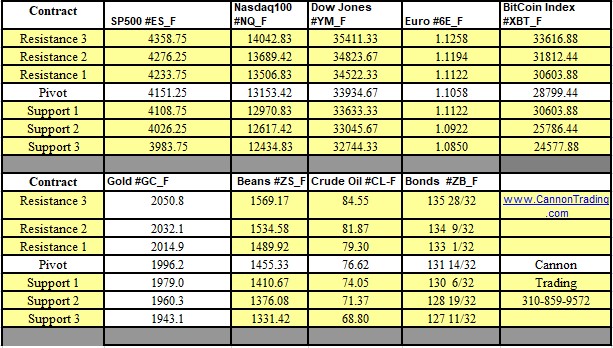

Futures Trading Levels

for 05-23-2023

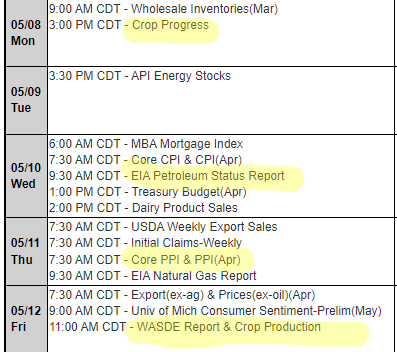

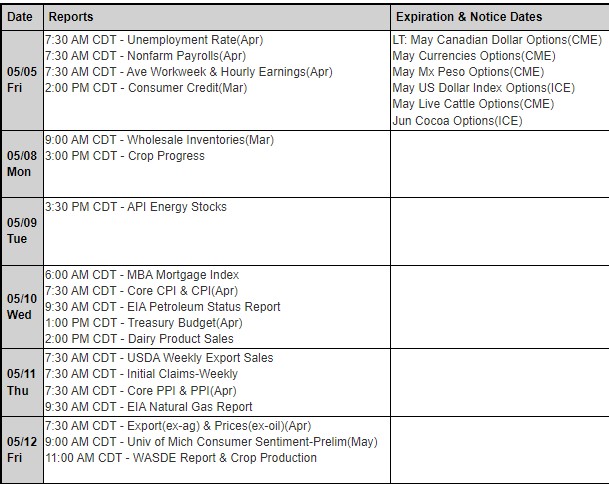

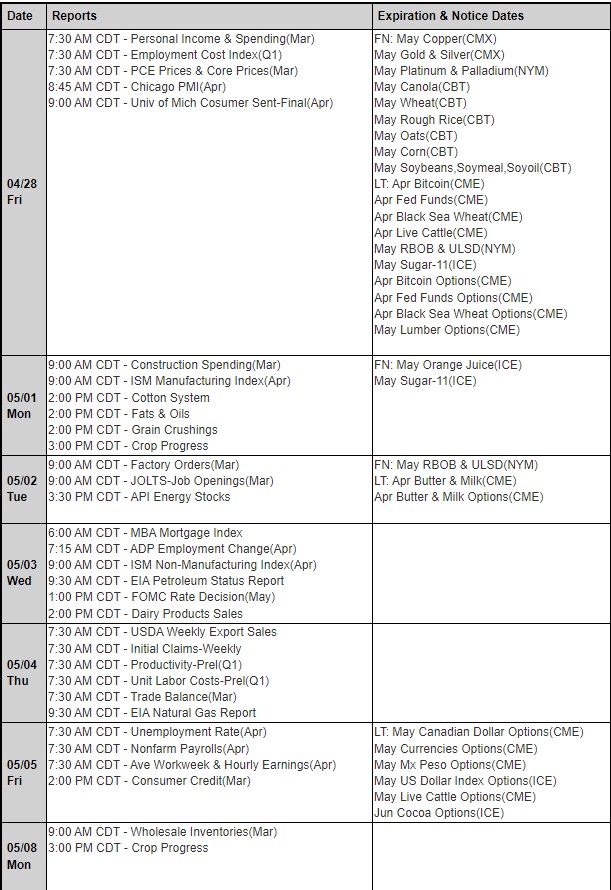

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.