Holiday Trading

By John Thorpe, Senior Broker

A National Day of Thanks!

For those who enjoy the history of any day or event I’ve included a historical highlight from history.house.gov of the national Thanksgiving holiday from George Washington’s Proclamation Nov. 26, 1789 through a House of representatives bill, signed into law in December of 1941 as a national day of thanks. https://history.house.gov/Historical-Highlights/1901-1950/The-Thanksgiving-holiday/

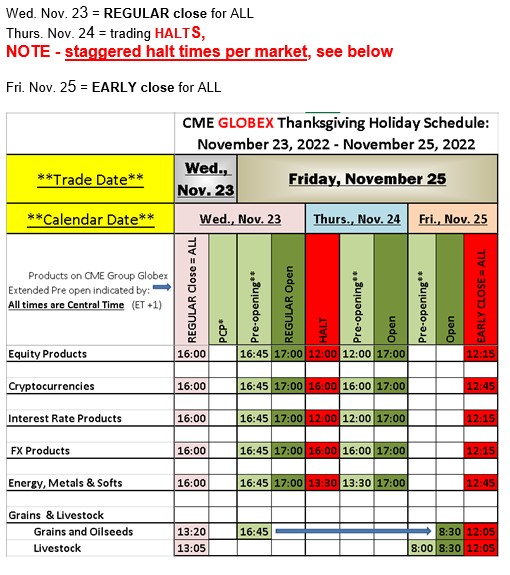

During this week, volume tends to trickle compared to no holiday weekday trading. ES volume today was about 60% of the volume last Monday.

Some Markets will be open each day under abbreviated hours, some markets like the agricultural, grain and livestock venues will be closed both Thursday and Friday.

Cannon Trading extends a warm thank you to all of our clients for a memorable and safe holiday. we will continue to post the exchange hours throughout the week. Blessings to all.

A Cannon broker will be able to assist, provide feedback and answer any questions.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

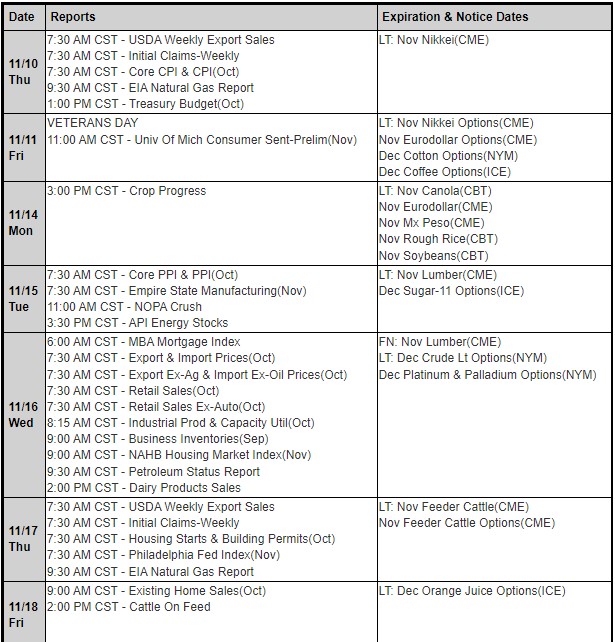

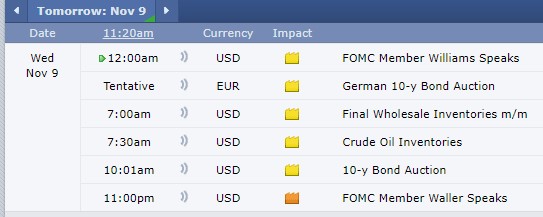

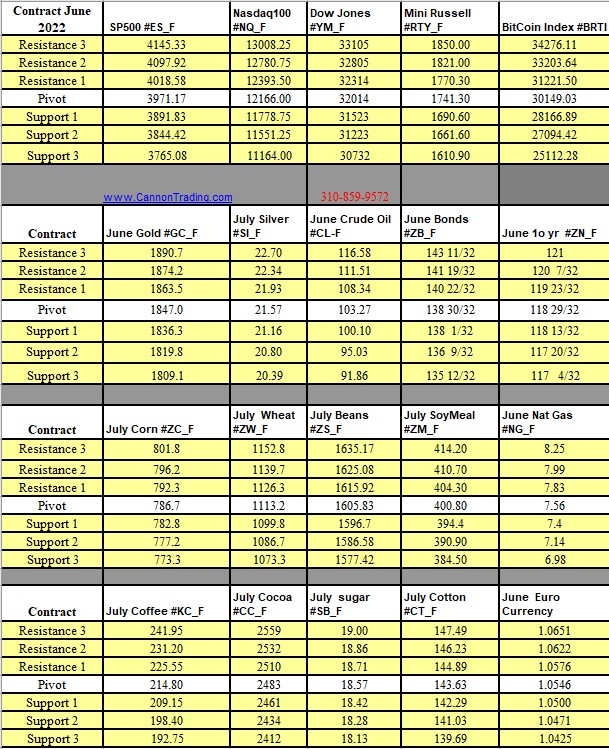

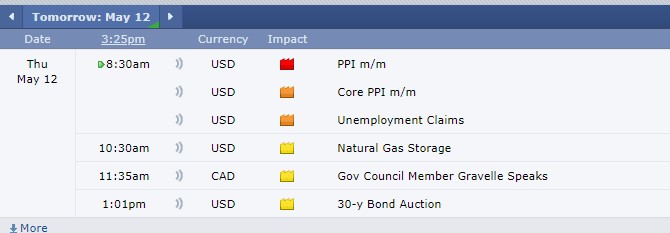

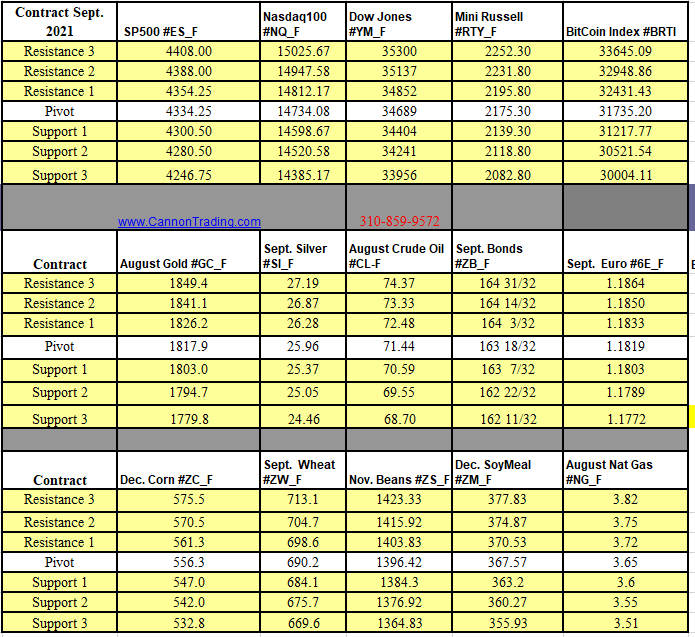

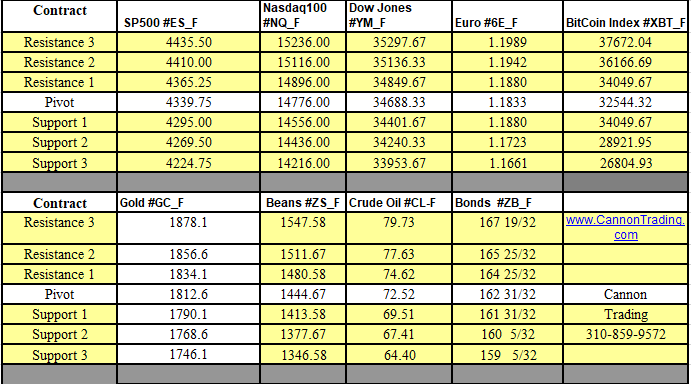

Futures Trading Levels

for 11-22-2022

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.