Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

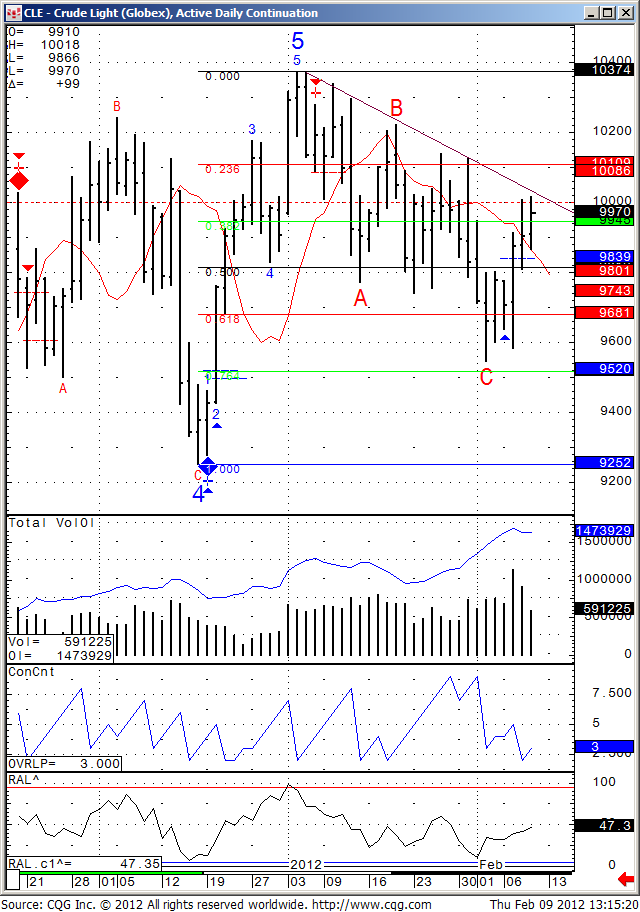

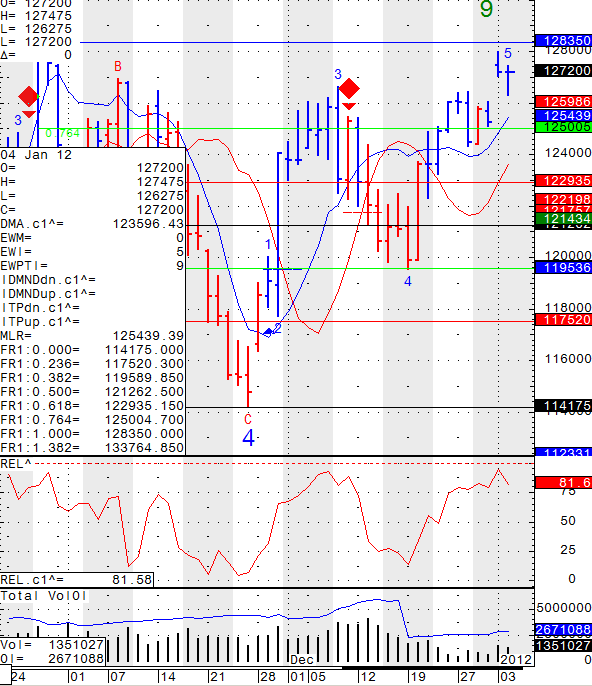

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

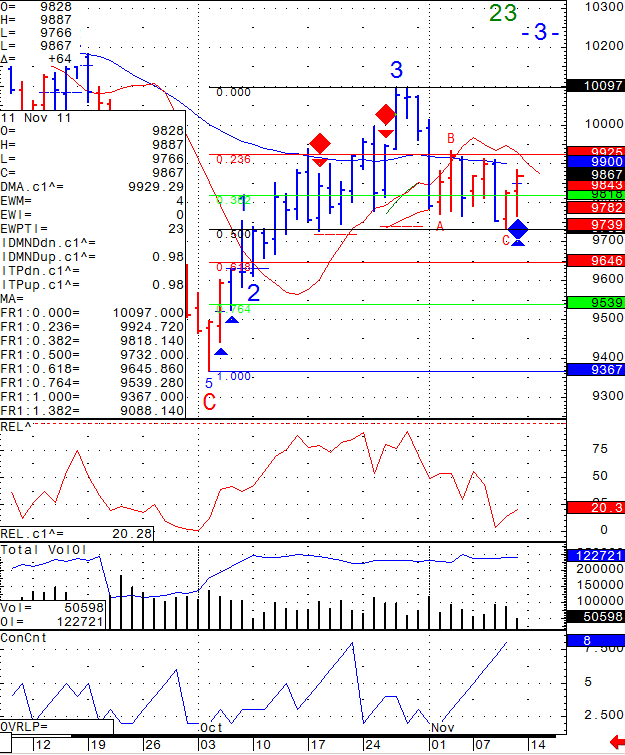

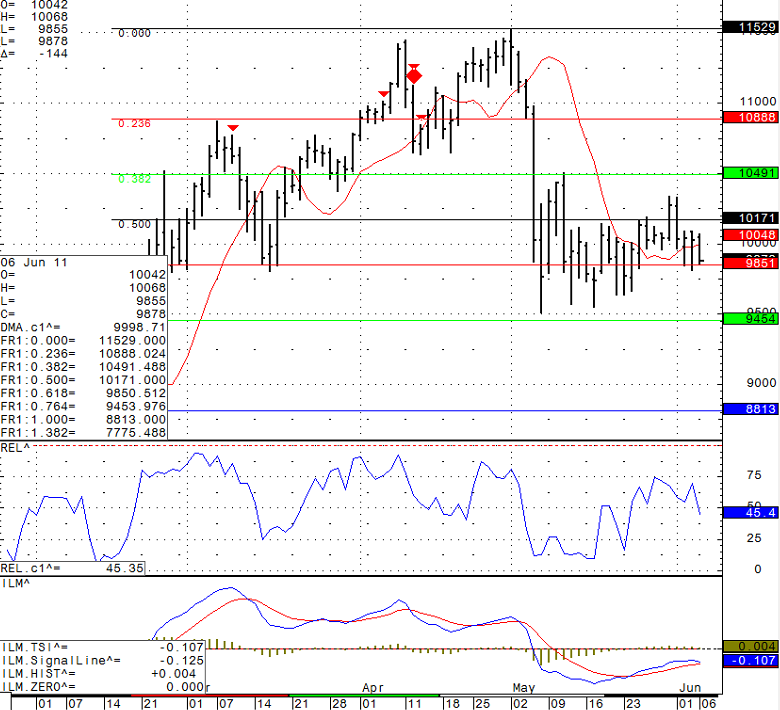

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for February 15, 2012

1. Market Commentary

Hello Traders,

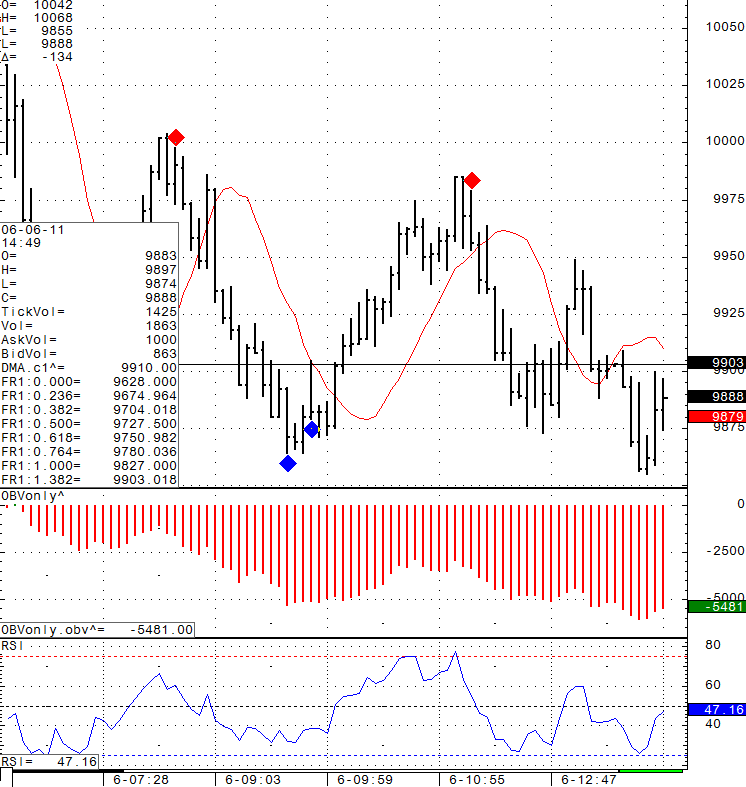

About 6-7 minutes video is now posted on how to use the trailing stop feature in our AT ( Active Trader) platform, along with small example of how I use overbought/ oversold conditions along with support and resistance to enter trades.

Any feedback is welcomed as we plan on producing additional educational videos

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

| Contract (Dec. 2011) | SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

| Resistance Level 3 | 1356.83 | 2587.17 | 12903 | 835.20 |

| Resistance Level 2 | 1351.77 | 2577.83 | 12862 | 830.10 |

| Resistance Level 1 | 1348.13 | 2572.67 | 12838 | 823.40 |

| Pivot Point | 1343.07 | 2563.33 | 12797 | 818.30 |

| Support Level 1 | 1339.43 | 2558.17 | 12773 | 811.60 |

| Support Level 2 | 1334.37 | 2548.83 | 12732 | 806.50 |

| Support Level 3 | 1330.73 | 2543.67 | 12708 | 799.80 |

Continue reading “New Video | Support and Resistance Levels”