Cannon Trading / E-Futures.com

With the Mid East situation, Crude Oil has been the leader of the commodities markets affecting movements in markets like metals, stock indices and more.

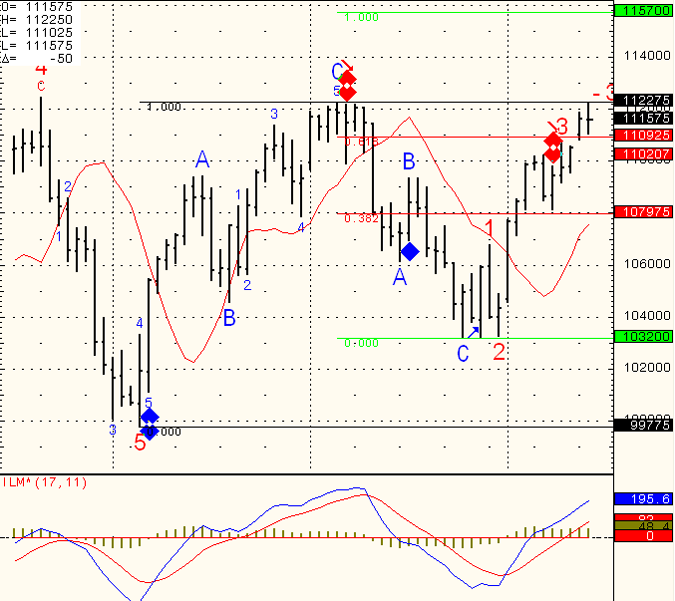

Daily chart of Crude oil for your review below along with a small picture that expresses what one can expect of tomorrow’s unemployment report better than I can…..

Either way, higher volatility, wider ranges = trader must asses their daily risk settings, their stops/ targets per trade, trading size etc.

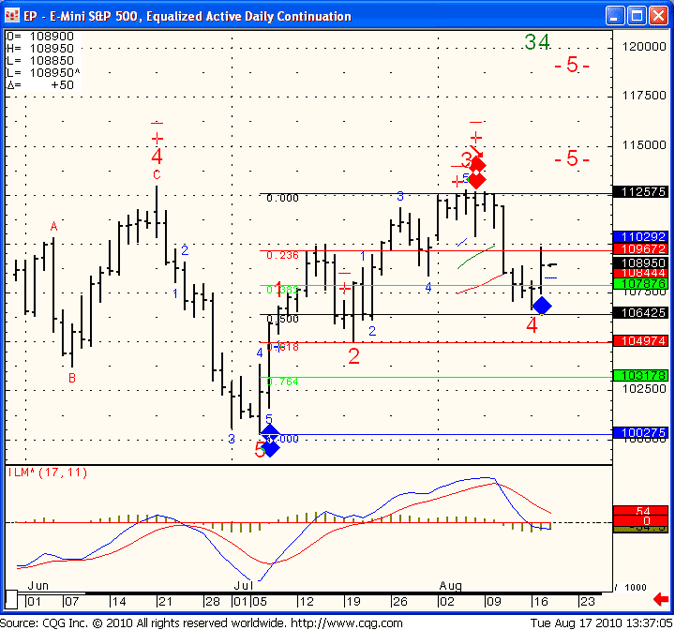

Daily E-Mini S&P 500 Futures Trading Chart

Continue reading “Futures Trading Levels, Crude Oil Leading Commodity Markets”