Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday August 6, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

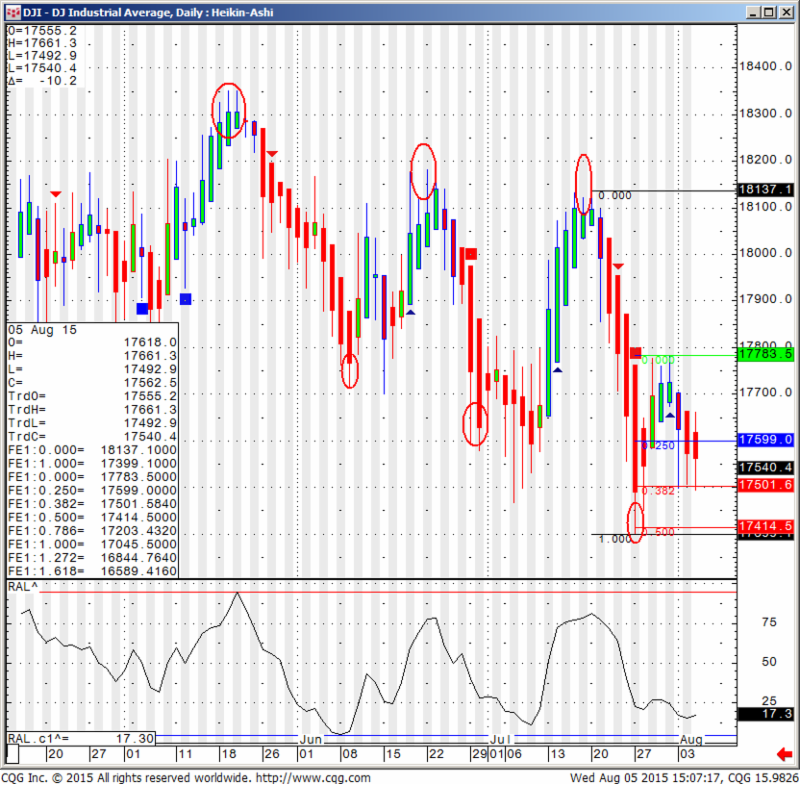

Daily chart of the Dow Jones cash index below for your review.

I marked what you can see as lower highs and lower lows.

Today’s rally may have a bit more to go to the upside but a failure to clear 17800 area may result in a resumed downside pressure.

Continue reading “Dow Jones Heikin Ashi Chart & Economic Reports 8-06-2015”