Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

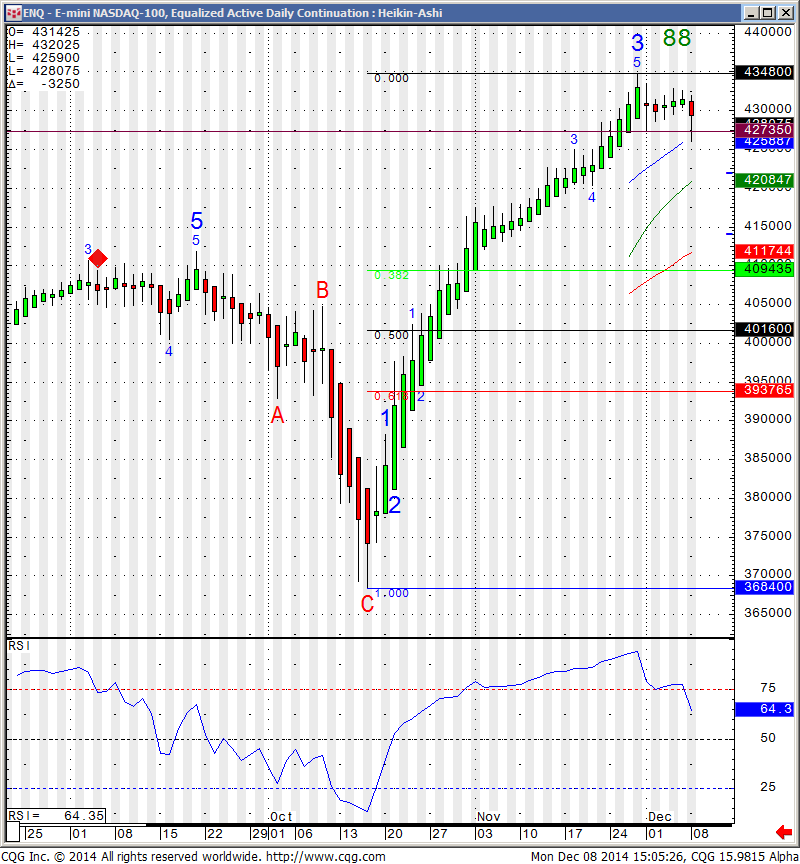

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday January 22, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

ECB decision and verbiage in regards to Euro Zone QE will move the markets early tomorrow morning ( 7:30 AM central time). Be aware and be ready.

We got a sneak preview today when some reports came out in regards to this matter.

VOLATILITY is the keyword today and the last few weeks.

Personally I think this market has been harder to trade.

Do your homework. Review the charts over different time frames.

Do you need to adjust entry techniques? Do you need to use LESS leverage? Perhaps your stops needs to be adjusted based on volatility?

i am just throwing some ideas out there to help you think, research and hopefully implement and adapt to what I consider a different market for day trading than we have seen for most of 2014.

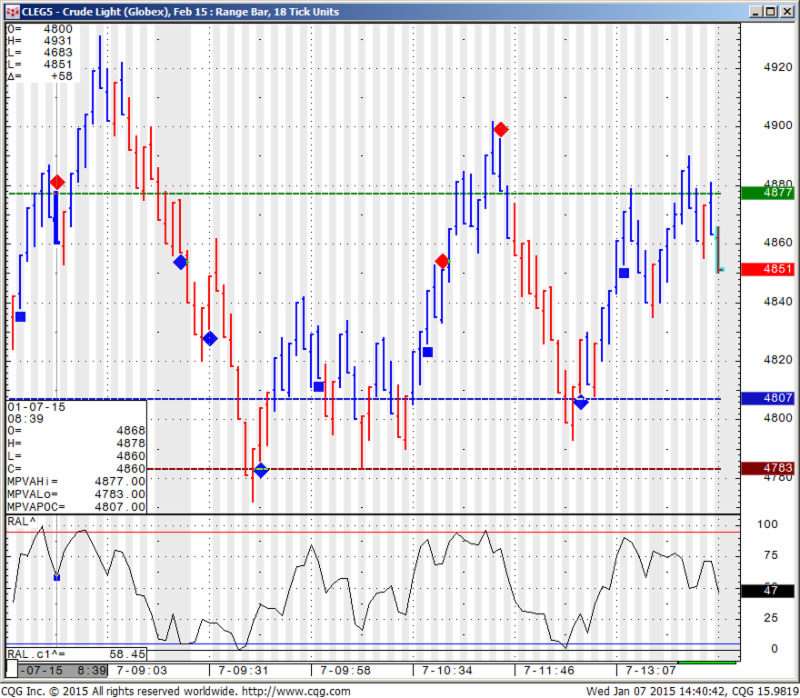

In between I am sharing with you my Crude Oil 18 tick range bar chart from today with some good and some not so good signals for your review:

Would you like to have access to the DIAMOND and TOPAZ and 5T ALGOs as shown above

and be able to apply for any market and any time frame on your own PC ? You can now have a three weeks free trial where the ALGO is enabled along with few studies for your own sierra/ ATcharts. The trial comes with a 23 page PDF booklet which explains the concepts, risks and methodology in more details.

Continue reading “Futures Levels & Economic Reports 1.22.2015”