Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday April 23, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

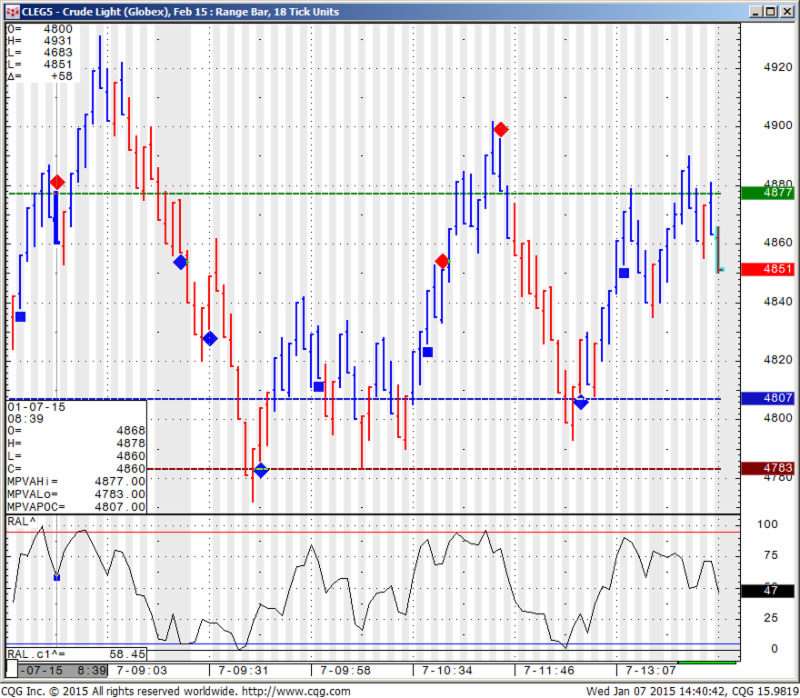

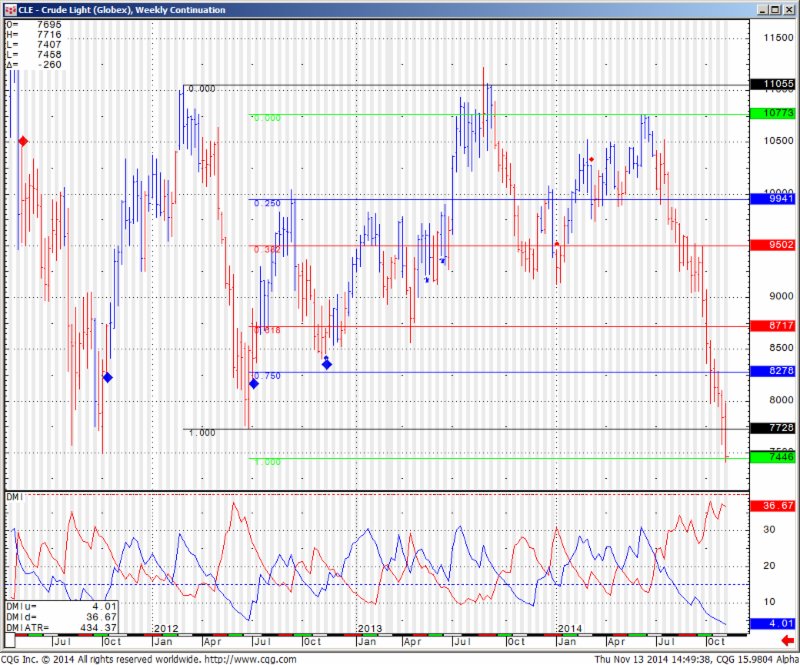

I wrote before on how certain markets experience big moves on certain reports. One of the obvious ones is the crude oil inventories, weekly report, Wednesday at 7:30 AM pacific time. There are many others and tomorrow e have a few coming.

One of the reports today was existing home sales at 7 AM pacific. The market expected/ forecast was for 5.04 mil home sales, the actual number came out at 5.19 mil sales. The result was continued sell off in bonds and a strong trend day lower.

I am sharing with you my intraday 15 minute bond chart from today along with two sell signals that took place about an hour before the report. See below if you like a free trial.

Would you like to have access to the DIAMOND and TOPAZ and 5T ALGOs as shown above and be able to apply for any market and any time frame on your own PC? You can now have a three weeks free trial where the ALGO is enabled along with few studies for your own sierra/ ATcharts OR CQG Q trader. The trial comes with a 23 page PDF booklet which explains the concepts, risks and methodology in more details.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NO INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract June 2015 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2132.58 | 4532.33 | 18226 | 1283.63 | 99.26 |

| Resistance 2 | 2118.17 | 4495.92 | 18101 | 1274.07 | 98.81 |

| Resistance 1 | 2109.08 | 4471.33 | 18024 | 1268.23 | 98.53 |

| Pivot | 2094.67 | 4434.92 | 17899 | 1258.67 | 98.07 |

| Support 1 | 2085.58 | 4410.33 | 17822 | 1252.83 | 97.79 |

| Support 2 | 2071.17 | 4373.92 | 17697 | 1243.27 | 97.34 |

| Support 3 | 2062.08 | 4349.33 | 17620 | 1237.43 | 97.06 |

| Contract | June Gold | May Silver | June Crude Oil | June Bonds | June Euro |

| Resistance 3 | 1218.1 | 16.42 | 58.54 | 165 23/32 | 1.0882 |

| Resistance 2 | 1211.3 | 16.25 | 57.86 | 164 26/32 | 1.0846 |

| Resistance 1 | 1198.7 | 16.00 | 57.08 | 163 1/32 | 1.0789 |

| Pivot | 1191.9 | 15.83 | 56.40 | 162 4/32 | 1.0753 |

| Support 1 | 1179.3 | 15.58 | 55.62 | 160 11/32 | 1.0696 |

| Support 2 | 1172.5 | 15.41 | 54.94 | 159 14/32 | 1.0660 |

| Support 3 | 1159.9 | 15.16 | 54.16 | 157 21/32 | 1.0603 |

| Contract | May Corn | July Wheat | July Beans | July SoyMeal | May Nat Gas |

| Resistance 3 | 378.2 | 499.0 | 982.83 | 321.43 | 2.70 |

| Resistance 2 | 375.8 | 499.0 | 978.42 | 319.17 | 2.66 |

| Resistance 1 | 374.2 | 499.0 | 975.08 | 317.33 | 2.63 |

| Pivot | 371.8 | 499.0 | 970.67 | 315.07 | 2.59 |

| Support 1 | 370.2 | 499.0 | 967.3 | 313.2 | 2.6 |

| Support 2 | 367.8 | 499.0 | 962.92 | 310.97 | 2.52 |

| Support 3 | 366.2 | 499.0 | 959.58 | 309.13 | 2.49 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:03pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| ThuApr 23 | 3:00am | EUR | French Flash Manufacturing PMI | 49.4 | 48.8 | ||||

| EUR | French Flash Services PMI | 52.5 | 52.4 | ||||||

| EUR | Spanish Unemployment Rate | 23.5% | 23.7% | ||||||

| 3:30am | EUR | German Flash Manufacturing PMI | 53.1 | 52.8 | |||||

| EUR | German Flash Services PMI | 55.6 | 55.4 | ||||||

| 4:00am | EUR | Flash Manufacturing PMI | 52.6 | 52.2 | |||||

| EUR | Flash Services PMI | 54.5 | 54.2 | ||||||

| 8:30am | USD | Unemployment Claims | 288K | 294K | |||||

| 9:45am | USD | Flash Manufacturing PMI | 55.6 | 55.7 | |||||

| 10:00am | USD | New Home Sales | 514K | 539K | |||||

| 10:30am | USD | Natural Gas Storage | 78B | 63B |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.