What to expect on this short trading week?

With Good Friday coming up we will only have 4 days trading week.

Fed Chair Jay Powell said Wednesday that central bank officials discussed a strategy for how to slow the shrinking of the Fed’s balance sheet,

The plan to slow down the balance-sheet runoff could come as soon as May.

The Fed’s securities holdings topped out at $9 trillion in 2022 — the year it decided to pivot and act aggressively to tamp down rising inflation. The strategy is known as quantitative tightening, or QT. QE refers to the Fed buying assets to lower longer-term interest rates, and QT means the Fed is selling assets to put upward pressure on longer-term rates. QE is used when the Fed wants to stimulate the economy and reduce interest rates on longer-term securities. The Fed tried QT once before, starting in 2017, when Janet Yellen oversaw the central bank. That shrinking of its portfolio drained bank reserves held at the central bank and led to some unexpected turbulence in 2019 after Powell had taken over.

Expectations that the Fed would cut rates by June rose to around 75% in futures markets later Wednesday, up from closer to 50% earlier this week, according to CME Group.

What about the hot PPI and CPI reports that came in last week? The latest data haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes-bumpy road toward 2%.

Many economists and some inside the Fed anticipated that the central bank’s rate increases to bring inflation down would lead to higher unemployment and a recession. But economic growth has shown surprising resilience even as wage and price increases have slowed thanks to healed supply chains and an influx of workers into the labor force.

Using the Fed’s preferred gauge, inflation excluding volatile food and energy prices has fallen to around 2.8% recently, down from 4.8% one year ago.

FED said while officials didn’t “see this in the data right now,” a significant slowdown in the labor market “could also be a reason for us to begin the process of reducing rates.

Wage growth has continued to slow, and unemployment has steadily inched up, from 3.4% last April to 3.9% in February.

The stakes are high for Fed officials, who are trying to navigate two risks. One is that they ease too soon, allowing inflation to become entrenched at a level above their 2% target. The other is that they move too slowly and the economy crumples under the weight of higher rates.

The Summary of Economic Projections expects gross domestic product growth to hit 2.1% by the end of 2024, up from December’s 1.4% forecast.

Higher housing prices and stock-market gains are boosting wealth and thus supporting consumption, especially of high-income households. The price of bitcoin has recently surged to records, a sign of exuberant risk-taking.

Homebuilders ETF: XHB. Stocks – KBH, TOL, LEN.

Plan your trade and trade your plan

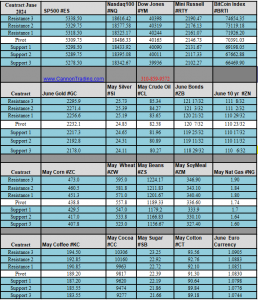

Daily Levels for March 26th, 2024

Economic Reports

All times are Eastern Time ( New York)

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.