Crude Oil Futures Trading Updates for February 2019

Crude oil futures experienced one of the strongest sell offs to finish 2018. The market sold from the mid 70’s into the mid 40’s in a matter of 7 weeks.

See daily chart below:

There were many reasons for the sell off. US China trade talks or lack off, OPEC production, US $ strength and much more but all this is old news at this point and the main focus of futures traders going forward is ”what next?” Before I try to answer that, lets take a look at some key factors that are general in nature to futures trading and crude oil futures trading:

Crude Oil is part of the energy sector along with “it’s” brothers “RBOB – Unleaded gas” and heating oil and cousin, natural gas. All traded on the NYMEX/GLOBEX exchange.

Crude Oil Futures Specs

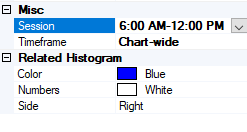

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $3410 initial, $3100 Maint. ( as of the date of this newsletter)

Point Value: full point = $1000 ( Example: 71.80 to 72.80 ). Min fluctuation is 0.1 = $10 ( Example: 71.80 to 71.81)

Settlement: Physical, deliverable commodity

Months: Monthly cycle, All Months

Weekly Options: YES

Crude Oil is one of my favorite markets for Day Trading because of the intraday volatility and movements. Be careful, these factors can work against you or in your favor.

Some of the basic fundamentals to keep in mind when you are considering a trade in the crude oil as well as other energies

- Longer term view of current market prices

- Dates and times of important reports. Namely, Tuesday afternoon report (API) and the DOE report on Wednesday mornings at 10:30 Am EST

- Weather and Seasonality

- Correlation to US Dollar prices

- Inflationary prospects

- Geopolitical Stability

- U.S. Fiscal and Monetary Stability

Keep in mind that the GLOBEX/NYMEX also offers the mini Crude oil contract which is half the size and may be a good alternative for smaller/ begginer traders.

MINI Crude Oil Futures Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $1705 initial, $1550 Maint. ( as of the date of this newsletter)

Point Value: full point = $500 ( Example: 62.80 to 63.80 ). Min fluctuation is 0.25 = $12.5 ( Example: 61.80 to 61.825)

Settlement: Cash Settled commodity one day prior to the Big Contract

Months: Monthly cycle, All Months

So just like when you are trading any commodity or futures contract, one has to ask themselves the following questions in my opinion:

- What time frame are you trading / looking at? Seconds and minutes? Hours and days or maybe even weeks and months? The answer can definitely impact the type of strategy you will use

- Do you have a view of the market? Is it going higher? Going lower? Range bound? Is there a trend?

- What is your personal preference? Risk capital? How much time do you have for following the markets?

- Are you experienced enough to take a go at it on your own or would you like to chat/ discuss, dissect the markets with a commodity broker, a series 3 licensed futures broker?

If your goal is to scalp and day trade crude oil futures, then take a look at what I consider a timeless piece I wrote a few years back on how to utilize fear and greed to day-trade crude oil futures.

This article has some chart examples and specific trading set ups using crude oil futures trading: Crude Oil Day Trading

Now back to the “million dollar question” – What is next for Crude Oil Futures in the next few weeks?

In order to answer that I will look at the daily chart above and then take a look at the weekly chart below:

Based on the fact that we had a major sell off that stopped on support levels, the fact that we are bouncing since then and the opinion I hold that crude oil longer term pressure is still down, my current view for this market is that we will see expanded range bound trading. I am looking for the market to trade between $48 and $59 ( hence the word expanded) over the next few weeks and perhaps more BEFORE it may attempt to take another stab at the down side.

“Well, what good is that you may say to yourself…..” If I am right and you are willing to speculate with risk capital, then this information can be valuable.

My preferred method would be to try and sell call options spread ( vertical call spreads) when the market rallies and sell vertical put spreads when the market sells off. Selling options is a risky strategy!! It is not for new commers and you can learn much more here.

The main theory behind selling the calls and the puts is to take advantage of the time decay of options.

As many of us know, geo political events affect the markets in general and crude oil futures in specific. No one can tell what news, wars, events will take place and that is obviously the unknown factor.

I tell my clients many times on different occasions that entering a trade is only the first part of the equation, the main and even more important part is: how to manage the trade? Where do I exit if I am correct? Where should I exit if I am wrong? Should I use multiple contracts? How much am I willing to risk on the trade?

Many ways to trade any market, many ways to lose money in any market and only very few ways to lock in gains – this one is not different. If you need help creating a trading plan, visit our broker assist services.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.