Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

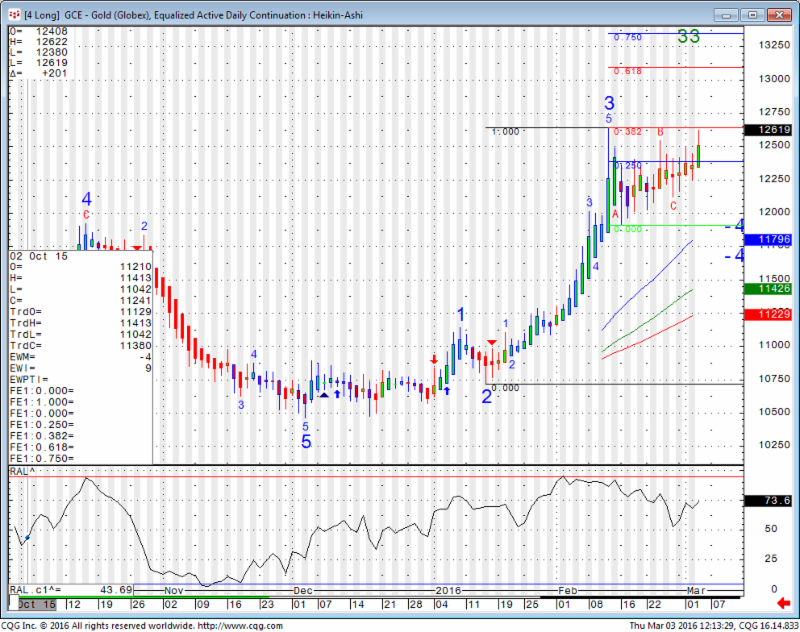

Below you will see screen shots from our E-Futures Int’l software along with my diamond ALGO which can be displayed on the platform.

The diamond ALGO tries to predict turning points in the market and comes with a few simple rules to provide trader with another tool/ approach in their trading arsenal.

Crude Oil 18 Ticks Range Bar

About Range Bar Charts:

A Range Bar chart is constructed of bars that indicate price movement as a way to help expose trends and volatility. A bar is created each time the bar range (high to low) is equal to some value that you set in preferences.

Would you like to have access to my DIAMOND ALGO as shown above and be able to apply for any market and any time frame on your own PC ? You can now have a three weeks free trial where I enable the ALGO along with few studies.

To start your trial, please visit: https://www.cannontrading.com/tools/intraday-futures-trading-signals

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does no involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.