QT Market Center – Trading Terminal for Professional Traders & Hedgers (Grain, Livestock, Energies, Metals and More!)

Thu, Apr 6, 2023 12:01 PM – 1:00 PM PDT

In this session, we’ll take a look at QT Market Center, a leading trading platform used by hedgers and professional traders world wide.

Mark Bucaro, an ex floor trader will share some of the features and tools QT offers and how you can possibly use it to help your TRADING and HEDGING.

• Pre-Opening Comments for Financials, Metals, Ags, and Softs.

• Cycle Timing Commentary for Grains

• David Hightower daily market analysis

• Market Calendar

• Web based Platform Access, Desktop (Smartphone & Tablet Access included Free) from virtually any computer anywhere there is an internet connection

• Easy to use Point and Click with Multi Screen Capability

• Profitability Cost Calculator – Input your costs and get your profitability results in seconds

• Realtime Live Streaming Agricultural & World Weather Audio Market Commentary Updates (accessible from Desktop, Tablet & Smartphone when out in the field)

• Access Current and 11+ years of Archived USDA Reports,

• Realtime Agricultural/Livestock/Ethanol-Energy News, Weather, Audio Charts, & Quotes and more all from one platform – Desktop, Tablet, Smartphone Accessible

• Daily Chart of the Day Subscription with Price Counts Price Forecasting Levels Included

• Proprietary Price Counts Price Forecasting Tool

• Chart Overlays

• Seasonal Charts

• Grain Bids Directory with approximately 16,000 bids

SPACE is LIMITED, so reserve your space now!

https://attendee.gotowebinar.com/register/8469154769041356119

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

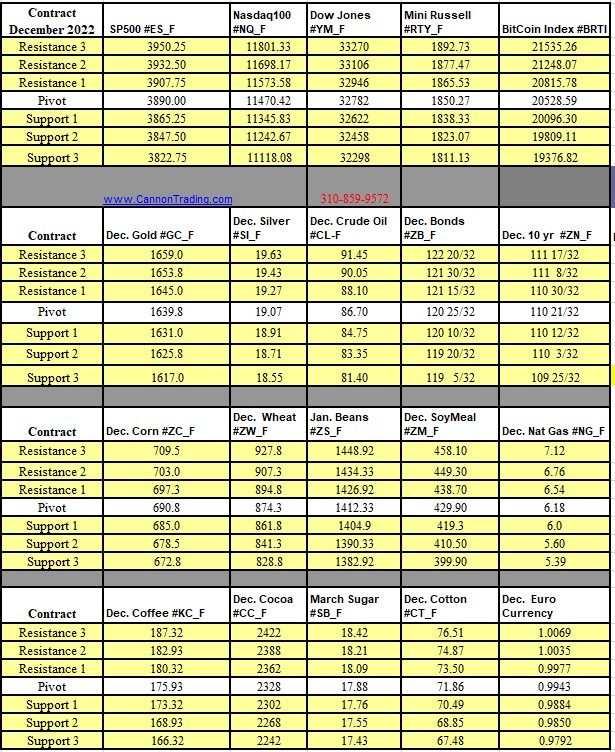

Futures Trading Levels

for 03-29-2023

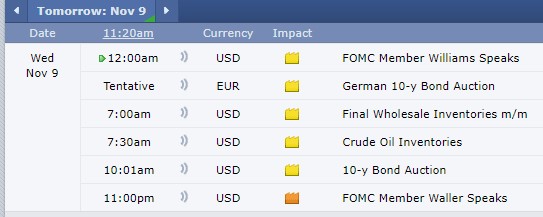

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.