The Influence of Social Media on Futures Trading

By Roger Muri, Senior Broker

Trading the news is one of the oldest ways of predicting a market direction, predating the now popular algorithm indicators that are designed to predict break-outs. For a long time, people searched the news looking for ways to get information as fast as the big players in the market. But now, there is a more rapid information feed that may indicate the trends of the futures market even faster: Social Media.

Social Media has become the fastest highway down which real news, opinions, and rumors travel, and the effects on the market are rapid and real. No example of this is more prominent right now than the Twitter account of President Donald Trump. Often, a single tweet from the President can result in immediate market fluctuations. These effects can be so startling that many have suggested that futures trading platforms should include a live social media news stream that integrates the accounts of prominent figures and news outlets from Twitter, Facebook, and even Instagram.

However, until these trading platforms create this integration, it is not a bad idea for the responsible trader to set alerts for the social media accounts of everyone from President Trump to CNN. Staying informed and getting that information as rapidly as possible has always been an important tool for successful traders, and in 2019 that is simply not possible without up-to-the-minute knowledge of prominent social media posts.

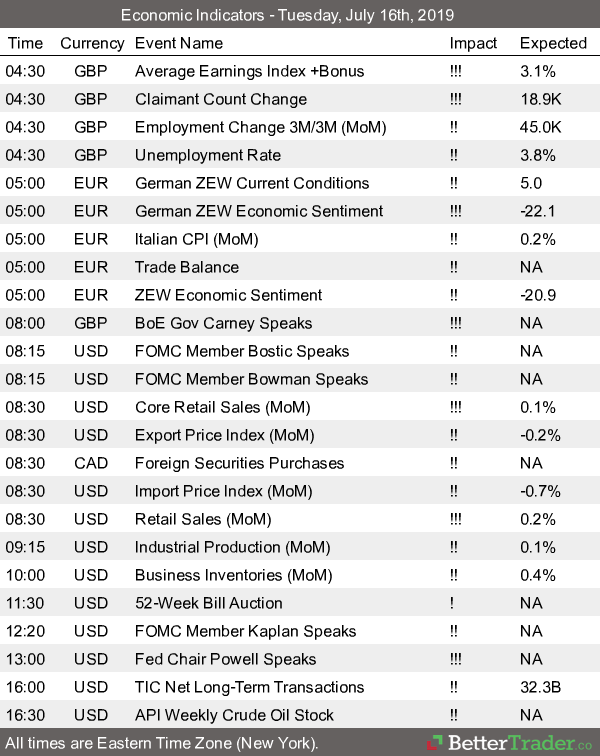

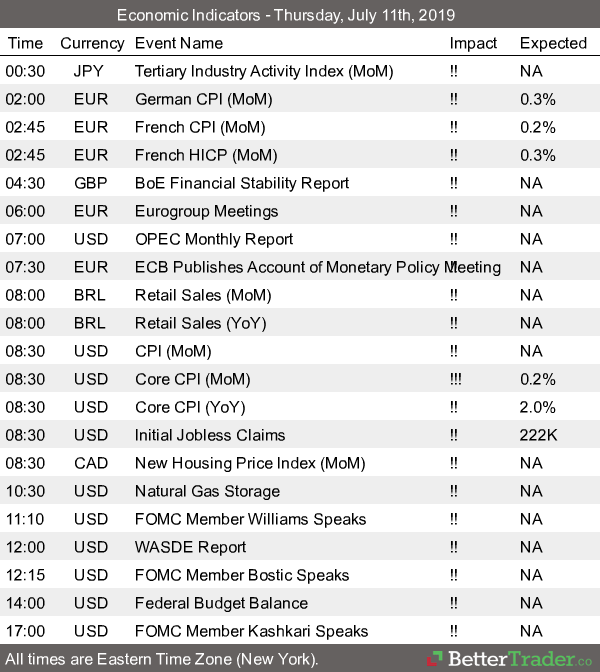

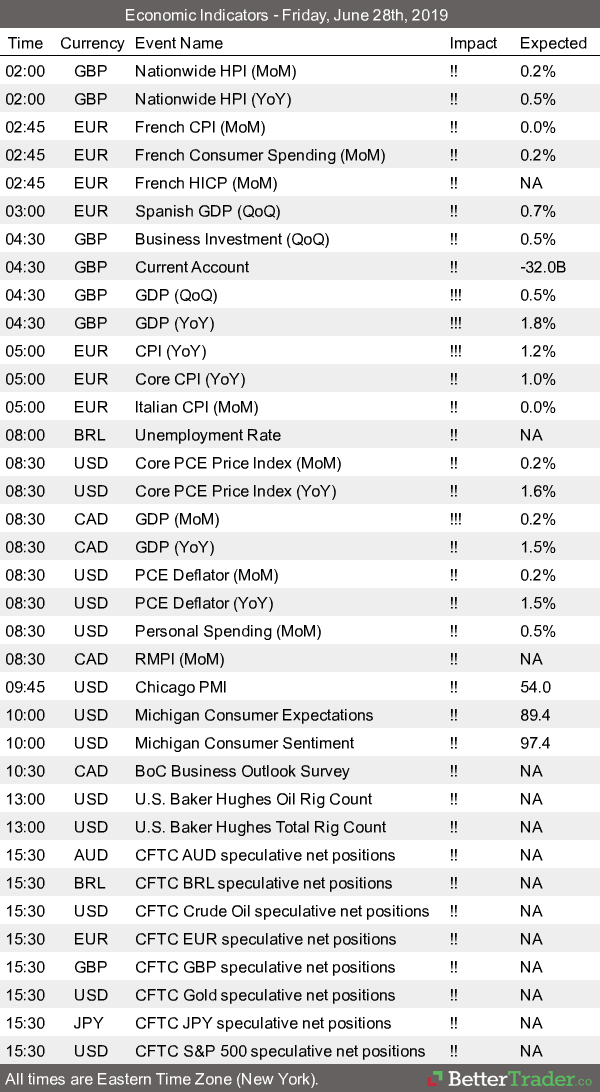

Of course, this does not mean the successful trader can throw away their current in-depth economic news resources. The current climate requires access and understanding of detailed economic reports as well as awareness of each day’s political news. These resources remain invaluable, and social media can only enhance them, not replace them. And unlike many of today’s financial news sources, adding these social media alerts to one’s trading arsenal is free, so there’s really no excuse not to.

The future of social media seems clear, politicians, news outlets, and business will continue to use it more and more to share their news and opinions. The smart trader will do their research, find the social media accounts that have the most effect on their portfolio, and follow those accounts daily. Until futures trading platforms decide to include these feeds, it is up to the trader to create their own customized feed.

The influence and availability of social media can only stand to improve the chances of success for individual traders. Social media allows information to be available to the public as quickly as it is to the big players in the market, and therefore helps to level the playing field. Smart traders will use this new technology to their advantage, increasing their chances of finding success in the futures market.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.