Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

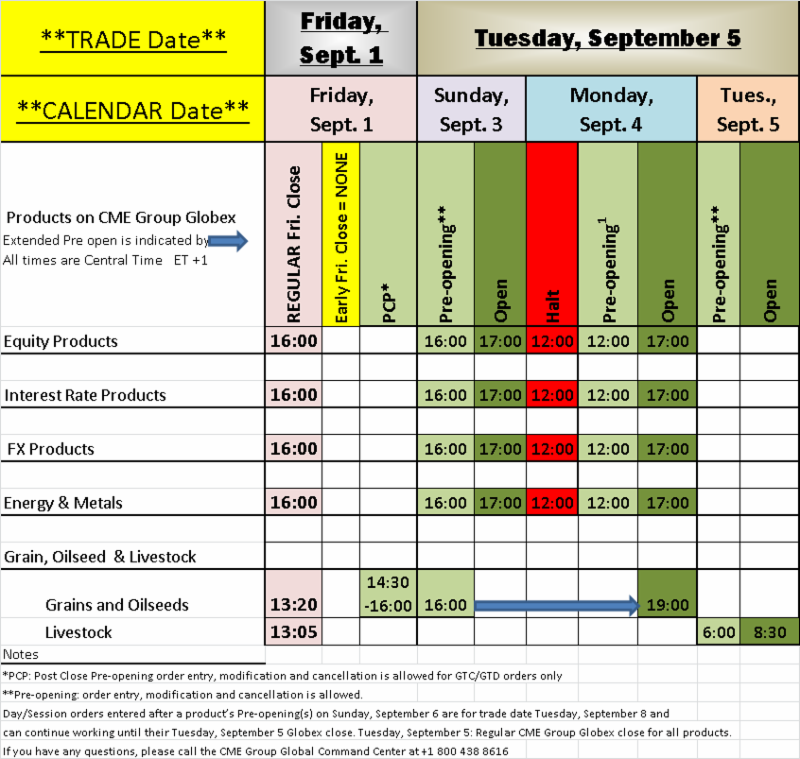

Labor day is behind us and the markets are gearing into the busy time of the year – Sept./Oct. and the end of the year.

Keep a trading journal. Know what reports are coming. Adjust your weaknesses and learn to trade with your strengths.

Prepare yourself every day before you start trading.

Take a look at this quick 8 pointer summary I wrote a while back and is very relevant in my opinion.