Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

In today’s blog, note about tomorrow’s full day of reports, changes to Russell contract size, reminder of current front months

Dear Traders,

Looking at the schedule for tomorrow – BIG day ahead.

We have OPEC, Crude Oil report, Beige book, ADP employment report, CPI and much more.

Check the calendar on section 3 of this blog. Set alarms. Know which reports affect the markets you trade so you don’t get caught in one of those moments where you yell ” What the heck just happened??”

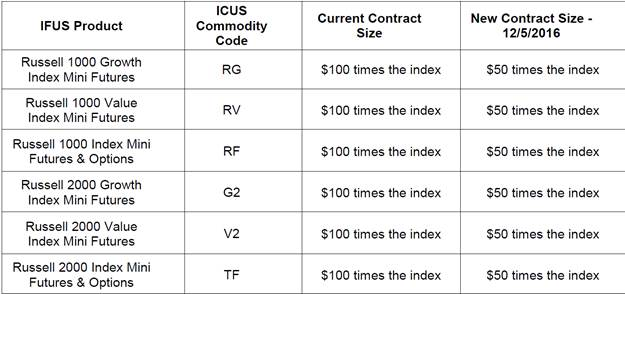

Effective on trade date Monday, December 5th, ICE Futures US will change the contract size for mini Russell 2000:

Mini Russell 2000 used to be that one point was $100 or 1 tick was $10. As of next Monday, one point will be worth $50 and each tick will be $5.

Assigned Deliveries can be a very costly process to try and reverse…..make sure you are trading the correct months:

- Front month for Gold is February.

- Silver front month is March.

- Front month for most grains is March.

- Crude oil and Natural gas are January.

If you enjoy our blog and the information we share, please vote for us as #1 under the “Blog Section” and provide us with the strength and energy to continue and providing you with the best tips and information on this blog!!

You can vote daily, both for the blog and for Cannon Brokerage services!!

Continue reading “Big day on the last trading day of the month tomorrow! 11.30.2016”