Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

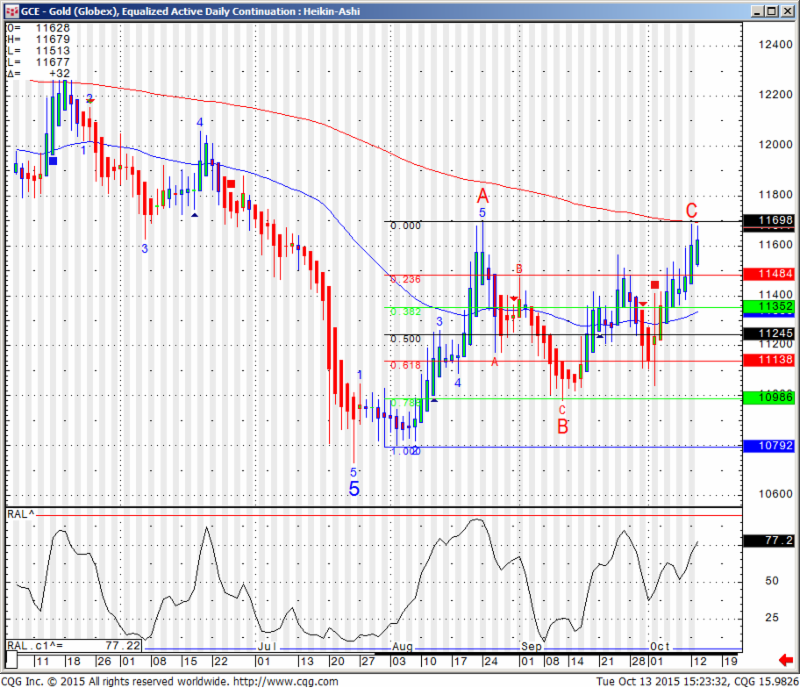

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday October 27, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

From our friends at TradeTheNews.com, weekly recap and what to look for in the week ahead.if you would like a free trial to TradeTheNews.com live audio commentary, breaking news alerts and much more,

visit us to get started.

Markets tilted even further back into risk-on sentiment this week on the prospects of more central bank stimulus and as many of the marquee names reported better than expected Q3 earnings. ECB President Draghi gave markets a boost by promising more stimulus at the December meeting on the heels of Germany reporting another month of PPI contraction. China’s central bank threw in another rate cut for good measure, further confirming market expectations that central banks will provide an even bigger stimulus cushion. A raft of housing data showed the US real estate market remains a bright spot. Despite some more turmoil in the biotech sector, the broader stock market continued to rebound as solid earnings reports came in and some key firms surprised to the upside. The major US indices exploded past their 200 day moving averages on Friday, and for the week, the DJIA gained 2.5%, the S&P rose 2.1%, and the Nasdaq surged 3%.Central Bank monetary policy came sharply back into focus this week. ECB President Draghi kicked things off with the bank’s latest policy statement. Draghi announced the council will formally re-examine the degree of accommodation necessary to offset growing downside risks to growth when they meet in December. He went on to reveal that, as part of a robust discussion, the monetary policy council talked about lowering the deposit rate as well as expanding QE, though no stimulus tool has yet emerged as the favorite. The shift in the ECB stance sent global equities and the Dollar Index on a run that was further propelled by the PBOC’s decision to cut both the deposit rate and the RRR on Friday, its 6th rate cut action this year. The PBoC cut was particularly meaningful ahead of the Chinese Communist Party Plenum next week which will set targets for the country’s next 5-year economic plan.The US Treasury curve steepened on the increased likelihood this week’s move gives even more cover to the US Fed should it choose to delay rate liftoff into 2016. Fed speak was notably absent due to the blackout period ahead of next week’s FOMC meeting.US housing data continued to show strength. The October NAHB housing market index beat expectation and hit its best level in nearly 10 years. Existing home sales for September came in at 5.55M, better than the 5.39M estimate amid continued tight supply. September housing starts were better than expected, though building permits missed estimates.

Oil prices declined more than 6% this week with WTI retreating back towards one month lows after looking poised to break out above the $50 earlier this month. The weekly API and DoE inventory surveys both reported another huge inventory build (+7.1 million and +8.0 million bbls, respectively), highlighting continued strong supply of crude in North America. The recent decline we have been seeing in the Baker Hughes rig count slowed dramatically this week as well.

Continue reading “Market Recap & Economic Reports 10.27.2015”

![]()

![]()

![]()

![]()

![]()

![]()