Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

Hope everyone enjoyed a nice holiday break with their loved ones!

What a volatile start for the month of December!!

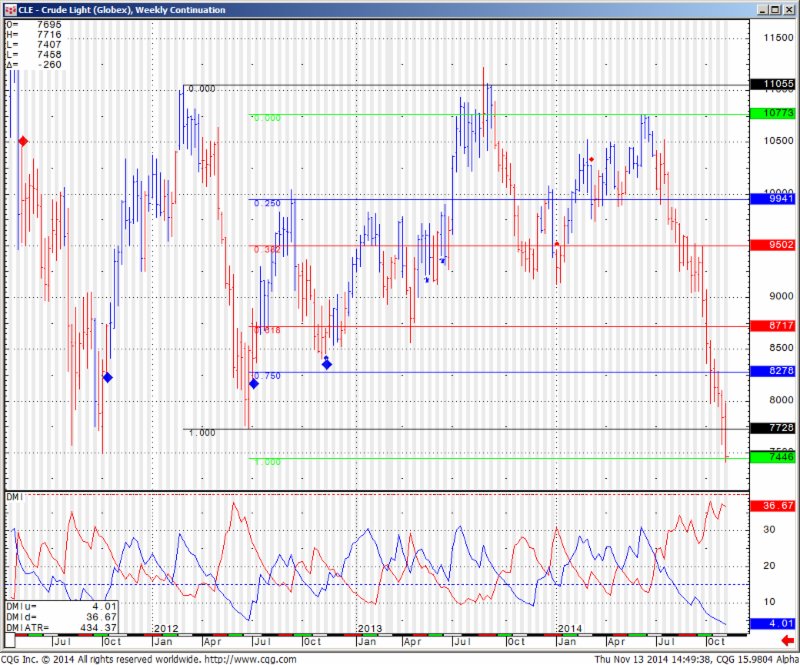

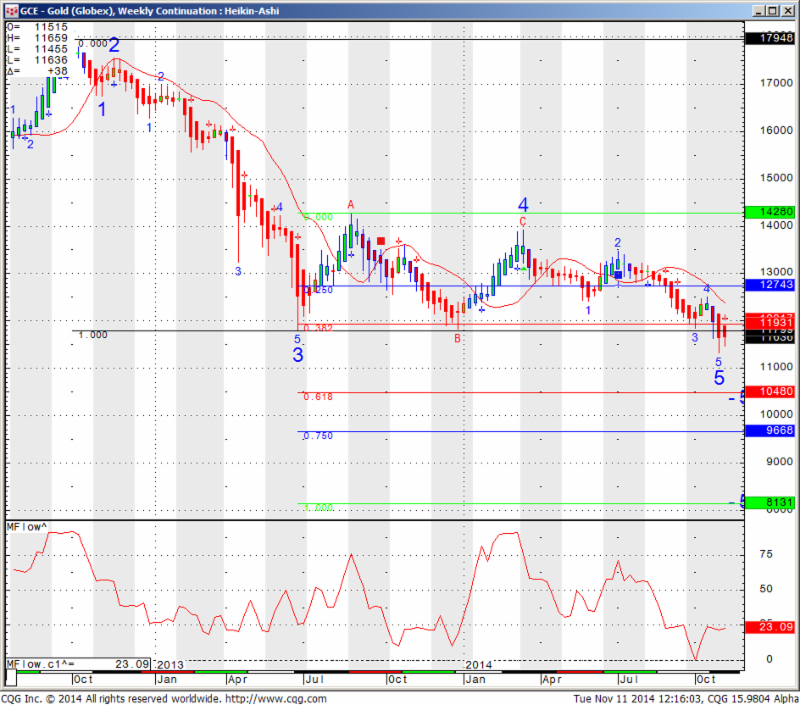

It started with over the Thanksgiving break, when OPEC met during thin holiday markets and the reaction sent vibes across many different markets with a strong sell off in energy and metals that started Thursday, Friday and Sunday night but then some time around midnight pacific time last night, big reversal on the4se sectors as crude oil bounced over $6 from the lows, silver almost $2.50 off the lows….extreme volatility.

Quick overview from TradeTheNews.com below:

TradeTheNews.com Weekly Market Update: Oil Carnage Spills Into Deflation Fears

Fri, 28 Nov 2014 13:53 PM ESTOPEC’s decision to refrain from a production ceiling cut drove most of the trading action this week. As the cartel confirmed on Thursday that it would not reduce its 30M bpd production target, oil prices plummeted to multi-year lows dragging down energy related equities, and oil-leveraged currencies like the Ruble and Norwegian Krone hit multi-year lows. The move in oil reinvigorated the broader market debate about whether the biggest impact of cheap energy will be the benefit to consumers or the threat of creating a deflationary wave. This was further substantiated by more weak CPI readings out of Europe and Japan. The other big trend of the week, the start of the holiday shopping season, got off to a solid start with preliminary Thanksgiving Day and Black Friday sales showing good year over year growth. The second read on US Q3 GDP came in better than expected, further validating the US as the leading edge of the economic recovery. For the week, the DJIA rose 0.1%, the S&P500 gained 0.2%, and the Nasdaq added 1.7%.Third-quarter US economic growth was revised higher in the preliminary GDP reading, to +3.9% from +3.5% in the advance reading, well ahead of the +3.3% expected. The economy has grown at or above a 3.5% quarterly rate for four out of the last five quarters, although many observers suggest this pace of growth is not sustainable. Spending on investment in housing and by business grew strongly over the advance reading. In other US data, the headline October durable goods was up very slightly, driven up by a spike in bookings for military aircraft, but the core business investment segment looked weak. October personal income and spending was slightly lower than expected but bounced back from September’s flat reading, returning to the steady rate of growth seen over recent months. The PCE series, the Fed’s preferred measure of inflation, was pretty much flat in October.

Oil prices fluctuated in the first half of the week as major oil producers horse traded ahead of Thursday’s OPEC meeting in Vienna. Prior to the meeting, oil ministers from Saudi Arabia and Venezuela met with non-OPEC nations Russia and Mexico to discuss falling prices. The four countries, which together account for about a third of global oil production, agreed to “monitor” prices and come together again in three months to assess the market. Interestingly, Rosneft CEO Sechin, the de facto oil tsar of Russia who was at the four-party meeting, said that even oil prices falling below $60/barrel would not force Russia to cut production. As the week wore on, it became clear that OPEC would not cut its production ceiling, and after the official announcement on Thursday crude futures plunged nearly 10%, dragging down oil-related equities. OPEC took the stance that the cartel does not want to give up market share and put the onus on the “new” players (i.e. North American shale oil) to reduce their production to stabilize the oversupplied market. For its part, OPEC indicated it may better enforce the cartel’s 30 million bpd targeted production ceiling, which could trim 300 thousand bpd of overproduction if members adhere to their quotas. Brent crude ended Friday testing the $70/barrel level and WTI finished around $66/barrel.

![Veteran's Day Tomorrow & Economic Reports 11.11.2014 3 [Report]](https://ui.constantcontact.com/rnavmap/tip/dispatcher?origImg=http://mam.econoday.com/images/mam/byreport_butt_new.gif)

![Veteran's Day Tomorrow & Economic Reports 11.11.2014 10 [Report]](https://ui.constantcontact.com/rnavmap/tip/dispatcher?origImg=http://mam.econoday.com/images/mam/byconsensus_butt.gif)

![Veteran's Day Tomorrow & Economic Reports 11.11.2014 18 [Star]](https://ui.constantcontact.com/rnavmap/tip/dispatcher?origImg=http://mam.econoday.com/images/mam/star.gif)

![Veteran's Day Tomorrow & Economic Reports 11.11.2014 21 [djStar]](https://ui.constantcontact.com/rnavmap/tip/dispatcher?origImg=http://mam.econoday.com/images/mam/djstar.gif)