Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

1. Market Commentary

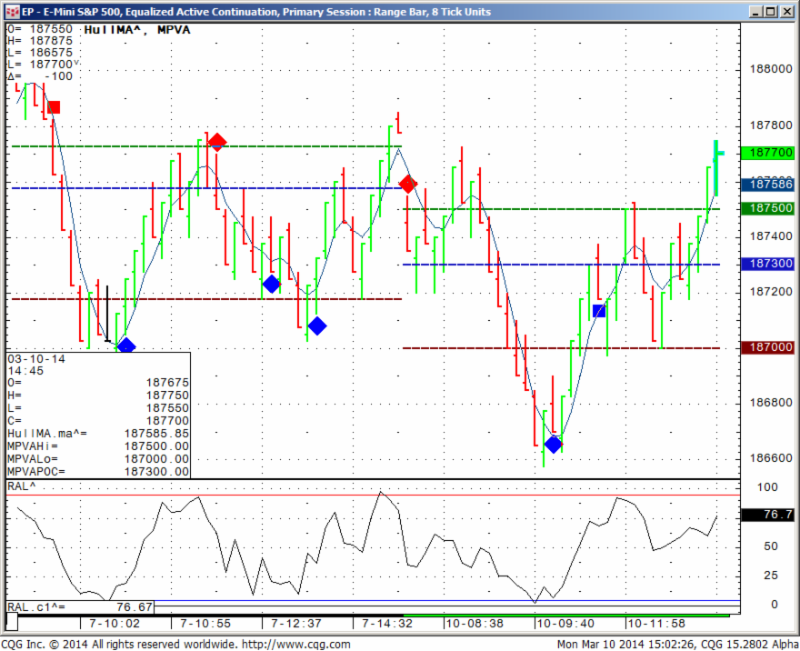

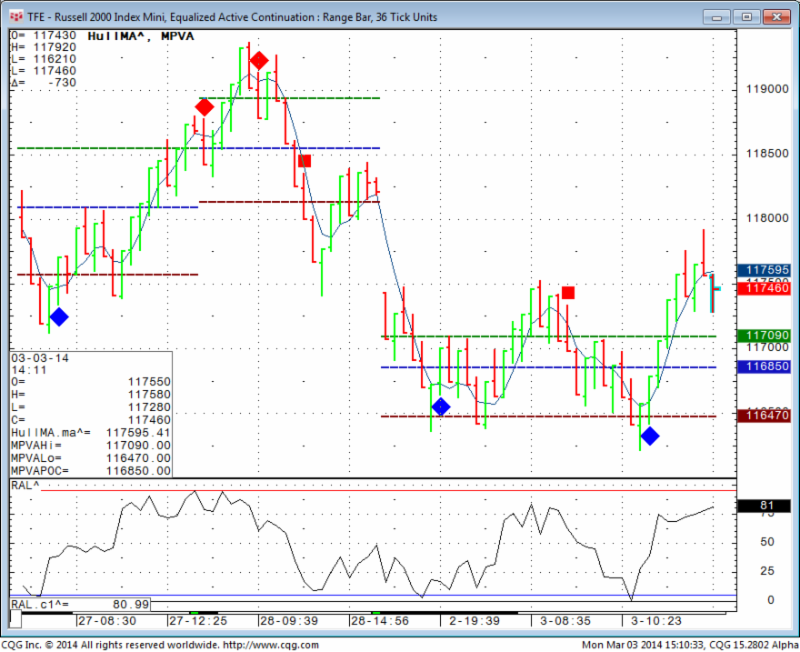

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday March 06, 2014

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Walk Before You Run

By Cannon Trading staff

The image of a successful futures trader is that of a lone wolf surveying the landscape looking for an opportunity to attack and seize quick and substantial profits. We all know about the potential for making a fortune in the futures markets. Yet, few do so. Why is that? What are some of the common pitfalls that prevent this dream from becoming a reality for most traders?

One of the most prevalent misconceptions for inexperienced traders is that they believe themselves to be smarter than the rest of the market participants. They under estimate the qualifications and abilities of the rest of the futures markets professionals. This business of trading is dominated by very dedicated, resourceful professionals who have invested lots of time and assets into their pursuit of trading profits. Competing against these seasoned professionals is not impossible but going it alone, especially initially, is usually not the most prudent course of action for new traders.

When we were children, we learned to walk before we learned to run. This is true for most of our life experiences. We played t-ball before we played baseball. We took lessons from Arthur Murray before we entered dance competitions. We watched cooking shows or read cookbooks before we attempted to deep fry our first turkey. So, why do so many novice traders think that they should enter into the world of futures trading without the support of an experienced futures broker? Why, armed with their computers and quote systems do they think that they are equipped to go it alone and be successful? It isn’t logical. It goes counter to our collective life experiences.

If your goal is to trade independently, why not do so after acquiring valuable experience and insight by working with a seasoned professional broker? Someone who is already fully engaged in the futures markets. Why not begin by using a mentor, a teacher, an advisor who can supply ideas, guidelines, disciplines, and insights that the novice trader could not otherwise be exposed to? We all learned to drive with the help of an instructor, why not approach the futures markets in a similar fashion? Your hard earned capital is at stake. Getting an education can be a very expensive process, especially in the futures business. Why not take advantage of the help offered by an experienced professional? Help like this can shorten a new trader’s learning curve and reduce the cost of his or her tuition for this education.

Continue reading “Futures Trading Levels & Economic Reports 3.06.2014”

![]()

![]()

![]()

![]()

![]()

![]()