|

|

|

|

As a high risk trading type, futures trading is not for someone who is faint-hearted. Though there are a number of different ways of investing in futures , it is important to stick to what you know. Treading into unknown waters is not something that you should do when dealing in futures.

From managing margins to ordering trades to doing market analysis and more if you want to, you can do that all by yourself – but you may betaking double the risk. Therefore, when trading in futures, it may be better to seek advice from a professional trader.

Professional trading experts at Cannon Trading can help you with your futures trading. We are also there to keep you updated with the latest on futures trading and market news. All the news and latest articles on futures trading are published on our site under the category Archive Futures Trading News, which you are currently browsing through. Read more and the latest here and keep updated.

|

|

|

|

|

|

|

|

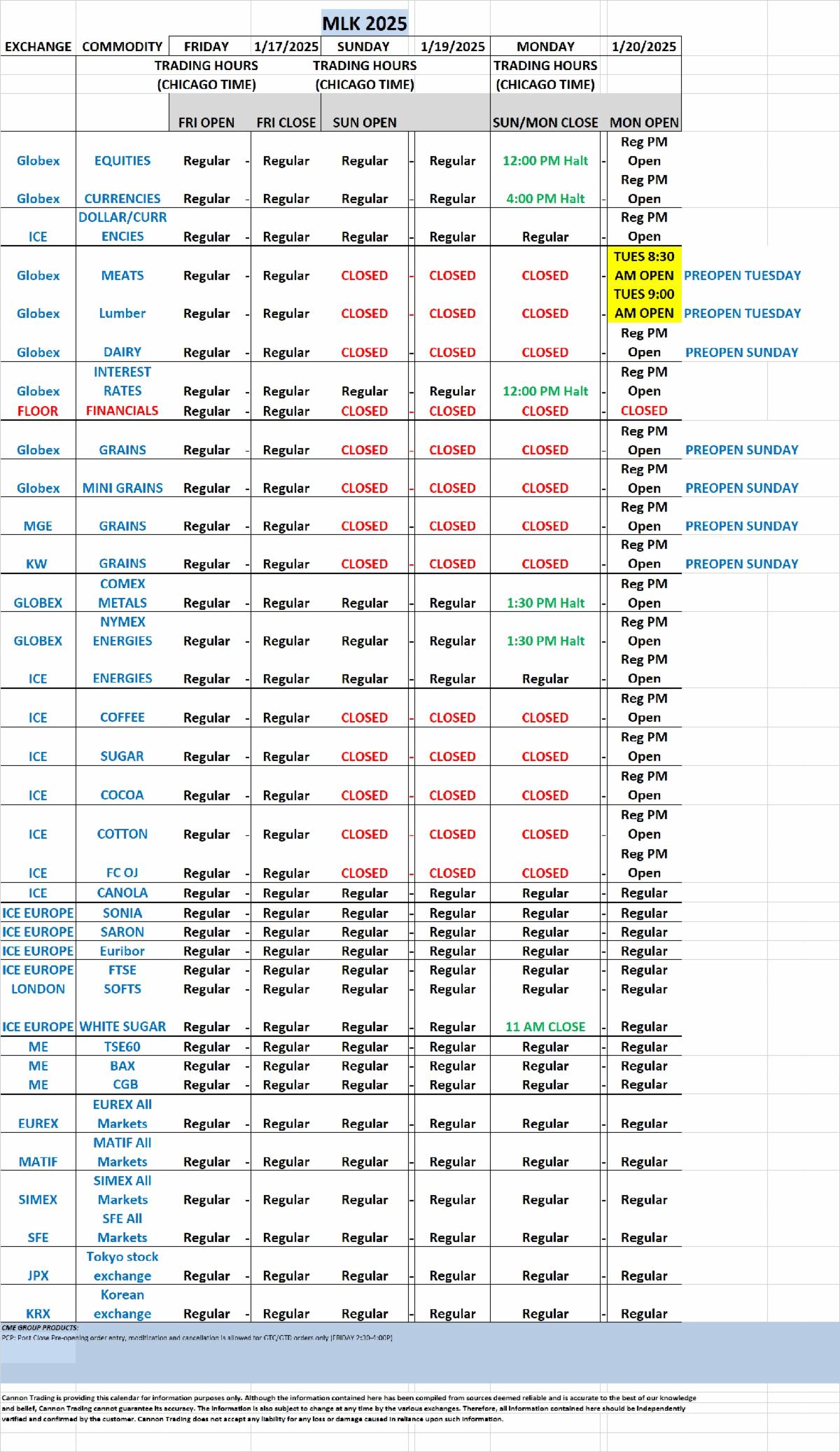

*Dates and times are subject to change

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe at +44 800 898 013 or in Asia at +65 6532 5010

*Dates and times are subject to change

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe at +44 800 898 013 or in Asia at +65 6532 5010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The futures trading landscape in the United States is at the cusp of significant evolution, driven by advances in technology, changing regulations, and shifting trader demographics. For anyone engaged in futures trading—whether seasoned professionals or novices—understanding the dynamics of this transformation is critical. Futures brokers in the USA, known for providing access to commodities, indices, and currency markets, are navigating this shift with an eye on innovation and adaptability. In this comprehensive exploration, we’ll examine the future of futures brokerages in the U.S. and highlight what traders should anticipate as 2025 approaches. Along the way, we’ll explore the role of Cannon Trading Company, a leading name among futures brokers in the US, and why it stands out in an increasingly competitive field.

Futures trading has a long-standing history of facilitating risk management and speculative opportunities. Traditionally, it was a domain dominated by institutional traders and large-scale hedgers. However, the rise of technology has democratized access to futures trading, enabling retail traders to participate alongside institutional players. Futures brokers in the USA have adapted to this trend by offering diverse platforms, competitive pricing, and robust educational resources.

Take the example of a mid-sized agricultural producer in Kansas. In 2015, they relied on manual trading to hedge their corn production against market volatility. By 2023, with the advent of algorithmic trading and artificial intelligence (AI), they transitioned to automated systems provided by top futures brokers in the US. This shift not only improved their trading efficiency but also reduced human error and enhanced profitability.

By 2025, experts predict that more than 70% of futures trading will be executed through algorithmic systems. This trend underscores the importance of choosing a broker equipped with cutting-edge technology. Cannon Trading Company, for instance, excels in this area, offering platforms like Sierra Chart and MultiCharts, which cater to both discretionary and algorithmic traders.

The futures market is one of the most heavily regulated sectors in the financial industry. The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) play pivotal roles in ensuring market integrity. As we approach 2025, several regulatory changes are expected to shape the industry:

In 2021, a small retail trader in California faced challenges navigating margin requirements for crude oil futures. They switched to Cannon Trading Company after discovering its transparent approach to compliance and margin policies. The trader’s success in managing risk through Cannon’s educational resources highlights why compliance and transparency are integral to the best brokers for futures.

Technology continues to revolutionize the futures trading ecosystem. By 2025, brokers will likely integrate even more advanced tools to enhance trading experiences, such as:

Imagine a day trader in New York using a platform equipped with AI analytics and real-time blockchain data verification. This trader identifies a bullish trend in the gold market and executes a profitable trade within seconds. Such scenarios highlight the potential of technological advancements to empower futures trading brokers and their clients.

Cannon Trading Company is well-positioned to lead this charge. Its diverse selection of trading platforms, including the highly rated E-Futures International and Optimus Flow, caters to traders of all experience levels. These platforms offer features like advanced charting, backtesting, and customizable indicators, ensuring traders have the tools they need to succeed.

The demographic profile of futures traders is shifting. Millennials and Gen Z traders, known for their tech-savviness and preference for online platforms, are entering the market in greater numbers. These traders demand:

A college graduate in Florida started trading futures in 2022 using a mobile app. Initially overwhelmed by the complexity of the market, they turned to Cannon Trading Company for guidance. With its robust educational resources and responsive customer support, the broker helped the trader build confidence and execute successful trades. By 2025, such brokers will play a pivotal role in onboarding and nurturing the next generation of futures traders.

Cannon Trading Company exemplifies the qualities of a top-tier futures broker in the US. Here’s why it’s a great choice for trading futures contracts:

As the futures trading industry evolves, traders must adapt to stay competitive. Here are some tips to prepare for the changes ahead:

By aligning with a forward-thinking broker and staying proactive, traders can thrive in the dynamic futures market of 2025 and beyond.

The future of futures brokerages in the USA is bright, marked by technological innovation, regulatory advancements, and changing trader demographics. Brokers like Cannon Trading Company exemplify the adaptability and excellence needed to succeed in this evolving landscape. Whether you’re a novice exploring futures trading or a seasoned professional seeking advanced tools, Cannon Trading offers the platforms, expertise, and support to help you achieve your trading goals.

By understanding the trends shaping the industry and aligning with a trusted partner, traders can navigate the complexities of the futures market with confidence. As 2025 approaches, the opportunities for growth and success in futures trading are more abundant than ever.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

|

|

|

|

In the fast-paced and high-stakes world of futures trading, selecting the right futures trading broker is one of the most critical decisions any trader—new or seasoned—can make. With a variety of platforms, strategies, and instruments available, a broker can make or break your trading experience. Enter Cannon Trading Company, a legacy brokerage firm founded in 1988 and widely considered one of the best brokers for futures trading.

Cannon Trading Company’s rich history, combined with its commitment to innovation, client education, and transparency, has earned the trust of thousands of traders worldwide. Recognized for its decades of experience, stellar 5 out of 5-star ratings on TrustPilot, and exemplary reputation with regulatory bodies, Cannon Trading remains a cornerstone in the industry. This comprehensive guide explores why Cannon Trading Company excels as the best broker for futures trading while showcasing its strengths, real-life trading examples, and hypothetical scenarios that demonstrate its unmatched value.

Founded in 1988, Cannon Trading Company has steadily built a reputation as a trusted and respected broker for futures trading. While some brokerages focus solely on short-term profits, Cannon has always prioritized client transparency and respect. For over 35 years, the company has been providing expert brokerage services to traders of all levels, cementing its position as one of the best brokers for futures in the United States and beyond.

This longevity in such a competitive marketplace speaks volumes about their ability to adapt, innovate, and provide unparalleled service. As a member of the National Futures Association (NFA) and registered with the Commodity Futures Trading Commission (CFTC), Cannon Trading is held to the highest regulatory standards. This oversight ensures the safety and security of client accounts and underscores their reputation as a responsible, compliant, and forward-thinking brokerage.

One of Cannon Trading’s most significant strengths is its variety of trading platforms, tailored to meet the unique needs of every trader. Whether you are an active day trader, swing trader, or someone who prefers algorithmic strategies, Cannon has a solution for you.

Platforms such as NinjaTrader, TradingView, Sierra Chart, CQG, and MultiCharts are available, providing advanced charting, analysis tools, and seamless order execution. For instance, a trader looking to execute precise futures trades with minimal latency might choose CQG, while someone seeking extensive backtesting capabilities could use Sierra Chart.

Consider this hypothetical example:

Scenario: Sarah, a part-time futures trader, wants a user-friendly platform to trade E-mini S&P 500 futures during volatile market hours. She chooses NinjaTrader for its intuitive design and powerful analytics. Using the NinjaTrader platform via Cannon Trading, Sarah is able to execute her trades in seconds, minimizing slippage and maximizing her profit potential.

At Cannon Trading, clients are more than just account numbers. Whether you are a beginner or a seasoned trader, Cannon Trading’s experienced team offers one-on-one consultations, helping you navigate the complexities of futures trading. Their personalized approach ensures traders receive tailored advice and platform recommendations that align with their goals.

For example, when John, a novice trader, struggled with order execution during his early trades, a Cannon Trading representative walked him through a detailed platform demo. After implementing their advice, John confidently placed his trades without delays or errors, improving his trading outcomes.

Cannon Trading Company offers competitive commission rates without hidden fees, providing traders with cost-effective solutions for their futures trading needs. Unlike some brokers, Cannon ensures traders know exactly what they are paying for—a critical factor for maintaining profitability in futures markets.

Case Study: Michael, an experienced trader, switched to Cannon Trading after realizing his previous broker had excessive hidden fees for market data and platform usage. With Cannon, Michael received transparent pricing, allowing him to better calculate his profit margins on each trade. Over six months, he reported saving over $3,000 in unnecessary fees.

The best brokers for futures are often defined by the personal content of their clients. Cannon Trading Company has consistently delivered results, enabling traders to achieve their financial goals.

Paul, a veteran crude oil futures trader, faced significant volatility during the 2020 oil price crash. With Cannon Trading’s support, Paul employed protective stop orders and diversified into mini crude oil contracts. Their team’s guidance helped him limit his downside risk while positioning himself for a rebound — a testament to Cannon Trading’s emphasis on risk management.

Jennifer, a complete beginner in futures trading, was initially overwhelmed by complex charts and terminology. Cannon’s team provided her with educational materials, webinars, and one-on-one coaching sessions. Jennifer started with simulated trading on the CQG Trader platform before transitioning to live trading. Within a year, Jennifer had developed a reliable strategy trading agricultural futures and confidently traded her account.

To further illustrate Cannon Trading’s strengths, let’s explore hypothetical scenarios that showcase how traders of all experience levels can benefit from their services.

Tom, a professional day trader, relies on low latency and real-time data to scalp profits from E-mini Nasdaq futures. By choosing CQG Integrated Client through Cannon Trading, Tom gains access to lightning-fast execution and market-leading data feeds. As a result, Tom’s trades are executed faster than those of his competitors, enabling him to navigate tiny price movements during volatile sessions.

Lisa, a conservative trader nearing retirement, wants to hedge her stock portfolio against market downturns. After consulting with a Cannon Trading expert, Lisa decides to trade micro E-mini S&P 500 futures. The smaller contract size reduces her exposure while still providing effective portfolio diversification. With proper guidance, Lisa manages risk while protecting her investments.

Cannon Trading Company’s reputation as one of the best brokers for futures stems from its unwavering commitment to trader respect and responsibility. Let’s summarize the key reasons why Cannon stands out:

With over 35 years in the futures markets, Cannon Trading has weathered economic cycles, market crashes, and technological revolutions. Their experience equips them to guide traders through both calm and turbulent markets.

The company’s wide selection of platforms, including NinjaTrader, Sierra Chart, and CQG, ensures every trader has the tools they need to succeed.

Personalized support, platform demos, and ongoing education make Cannon Trading accessible for traders of all experience levels.

As an NFA member and CFTC-registered firm, Cannon adheres to the highest regulatory standards. Their transparent fee structures and ethical practices ensure client trust.

Cannon Trading’s 5 out of 5-star ratings on TrustPilot reflect their commitment to excellence. Positive client feedback highlights their reliability, integrity, and consistent service.

In the competitive landscape of futures trading brokers, Cannon Trading Company shines as an industry leader. With its extensive history, wide selection of trading platforms, and a client-first approach, Cannon meets the needs of beginners, active traders, and institutional clients alike. The company’s ability to combine advanced technology, personalized service, and competitive pricing makes it the best broker for futures trading.

For traders looking to execute precise, efficient trades while managing risk and costs, Cannon Trading Company provides the ideal environment. Their exemplary reputation with regulatory bodies, high ratings on TrustPilot, and decades of experience set them apart as the premier choice for trading futures.

Whether you are just starting or you’re a seasoned professional, Cannon Trading Company’s commitment to empowering traders at every level ensures that your trading journey is supported and informed.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.