Our Weekly Futures Trading Newsletter is Ready for Your Review at:

*********************************************************************

https://www.cannontrading.com/community/newsletter/

********************************************************************* Continue reading “Futures Trading Levels and Weekly Newsletter for January 13, 2011”

- Bitcoin Futures (113)

- Charts & Indicators (299)

- Commodity Brokers (589)

- Commodity Trading (845)

- Corn Futures (64)

- Crude Oil (229)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (162)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (177)

- Future Trading News (3,153)

- Future Trading Platform (326)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,265)

- futures trading education (446)

- Gold Futures (109)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (133)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (144)

- Trading Guide (425)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (221)

Category: Future Trading News

As a high risk trading type, futures trading is not for someone who is faint-hearted. Though there are a number of different ways of investing in futures , it is important to stick to what you know. Treading into unknown waters is not something that you should do when dealing in futures.

From managing margins to ordering trades to doing market analysis and more if you want to, you can do that all by yourself – but you may betaking double the risk. Therefore, when trading in futures, it may be better to seek advice from a professional trader.

Professional trading experts at Cannon Trading can help you with your futures trading. We are also there to keep you updated with the latest on futures trading and market news. All the news and latest articles on futures trading are published on our site under the category Archive Futures Trading News, which you are currently browsing through. Read more and the latest here and keep updated.

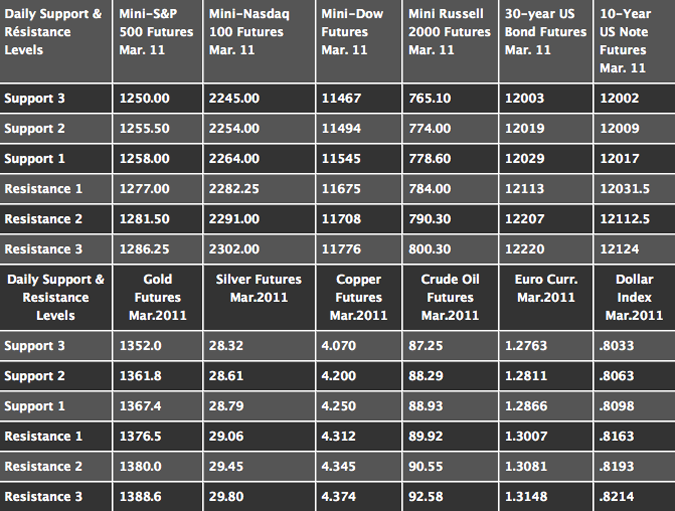

Futures Trading Levels and Economic Reports for January 12, 2011

Market is still locked in a range….so far in 2011, the March SP500 been trading between 1255 and 1277….My feeling is that by Thursday we should break out one way or the other as the market awaits some economic reports and earnings are being released.

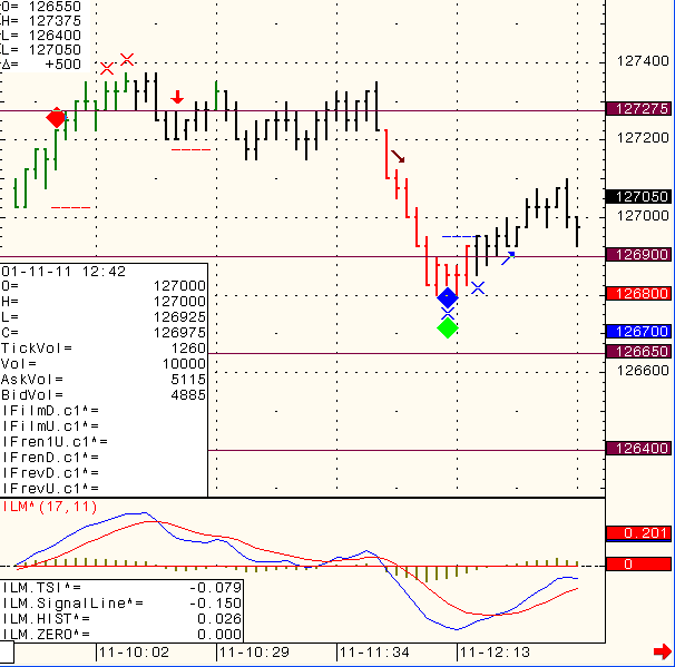

In between, you are welcome to check out our “Live Charts” service which I run daily.

Subscribers get a daily invitation to view my charts ( sample from todays session below). I share my charts, notes, set ups, trade philosophy and more for the mini SP, crude oil and Euro currency markets. For 2 week free trial (no repeat trials), please visit:

https://www.cannontrading.com/tools/intraday-futures-trading-signals

There is a substantial risk of loss in trading commodity futures, options and off-exchange foreign currency products.

Past performance is not indicative of future results. Continue reading “Futures Trading Levels and Economic Reports for January 12, 2011”

Futures Trading Levels and Economic Reports for January 11, 2010

Interesting DATE tomorrow…1-11-11

Other than that I don’t have much to share, market is still waiting for either another leg up or correction to the downside.

I am looking at 1255 to 1273 as the band and think that an hourly close above or below can trigger the next move.

Plan your trade, trade your plan!

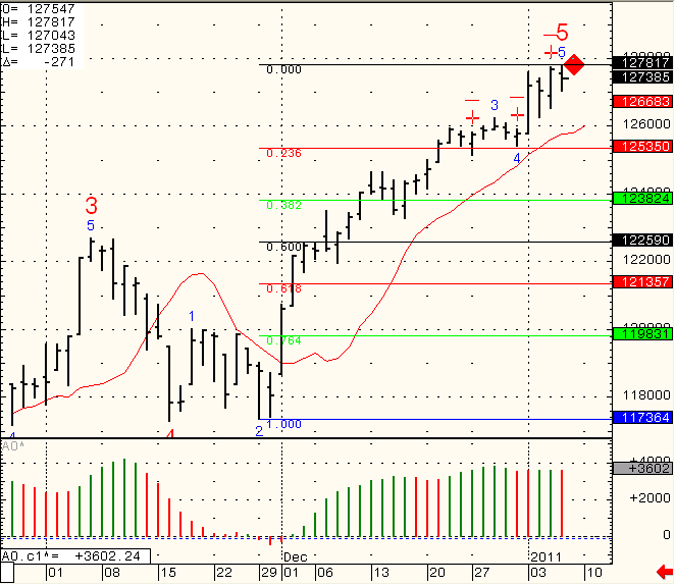

Mini SP hourly chart for your review below:

Continue reading “Futures Trading Levels and Economic Reports for January 11, 2010”

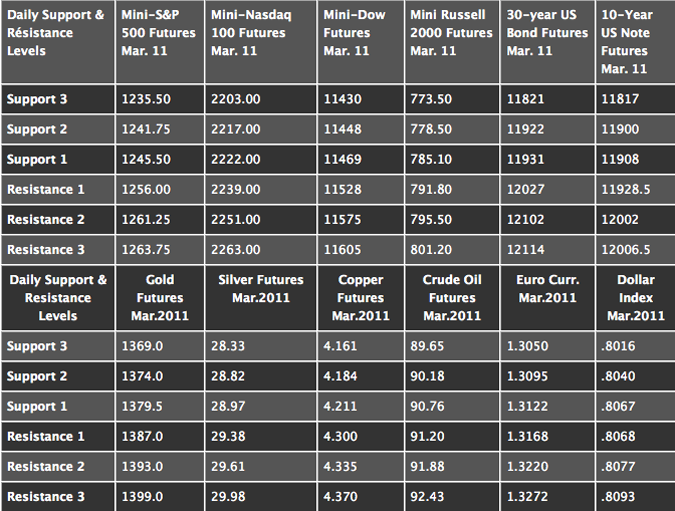

Daily Support and Resistance Levels for January 10, 2011

Updated: 10-Jan-11 08:38 ET

This Week’s Calendar Continue reading “Daily Support and Resistance Levels for January 10, 2011”

Futures Trading Levels and Tips for January 10, 2011

Trading is SO MUCH MENTAL once you have a concept you believe in, have confidence in. After that there is a lot of psychological work….

Some examples:

-

Ability to take losses and know not every trade will be a winner and not every day will be a winning day

-

Ability to stay patient and NOT feel that if you are NOT trading, you are NOT doing your job….

-

The confidence to stay in winning trades and the discipline to get out of losing trades

-

Allowing trades some time to work

-

Not getting down on yourself for “could have should have etc”

-

Being a hard worker and keeping a journal after certain trading days. Being a hard worker in putting time and effort learning new approaches, set ups before deciding if its worthy or not. I WILL SAVE THIS LITTLE LIST AND ADD TO IT AS DAYS PROGRESS. Continue reading “Futures Trading Levels and Tips for January 10, 2011”

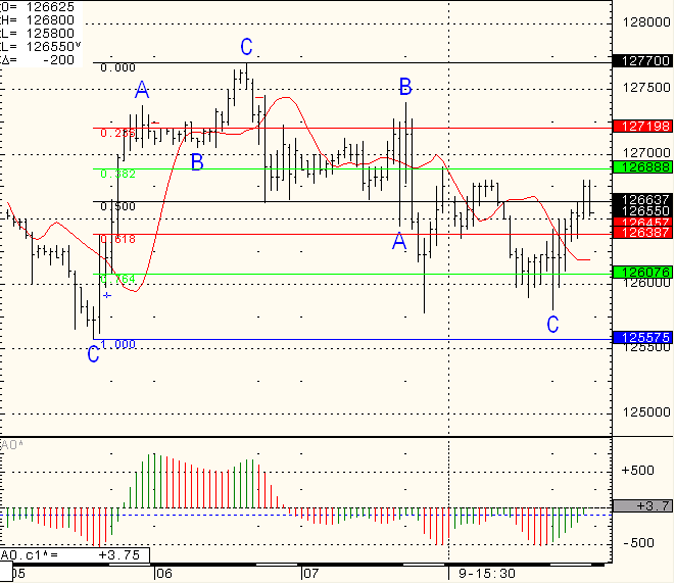

Futures Trading Levels and Economic Reports for January 7, 2010

Daily chart of the SP cash index below….I got a potential sell set up if CASH goes below 1270.

We have monthly unemployment tomorrow before the CASH market opens, so it will be interesting to see how the market reacts.

Either way, make sure you have a trading plan and that you are comfortable with the risk – reward associated with your trading plan so you can have the confidence to execute it.

Continue reading “Futures Trading Levels and Economic Reports for January 7, 2010”

Continue reading “Futures Trading Levels and Economic Reports for January 7, 2010”

Futures Trading Levels and Economic Reports for December 20, 2010

Market is acting a bit funny….reason i am saying that is that we are trading at relatively HIGH prices, over 52 weeks highs, yet the volatility is at a very low level….

What i have noticed over the years is the wave pattern of volatility….from extremely high volatility to extremely low volatility and goes again….so now the question is when is the next wave of higher volatility starts?

Have a great weekend, successful trading week ahead ( only 4 trading days next week, with Thursday packed with economic numbers).

I will be out of the office until Jan. 3rd but you will receive levels and reports published by colleague here at cannon.

happy Holidays and great trading in 2011! Continue reading “Futures Trading Levels and Economic Reports for December 20, 2010”

Futures Trading Levels and Weekly Newsletter for December 16th 2010

Market feels bit heavy right now but then again it felt heavy more than a few times over past few weeks only to find some more legs and go higher….so either way you plan on trading this market, make it exactly that….have a plan and then trade your plan.

Our Weekly Newsletter is Ready for Your Review:

**************************************************************

https://www.cannontrading.com/community/newsletter/

************************************************************** Continue reading “Futures Trading Levels and Weekly Newsletter for December 16th 2010”

Futures Trading Levels and Economic Reports Schedule for December 14th 2010

We are now trading MARCH contracts for all e-minis, stock indices, financials and CURRENCIES.

FOMC tomorrow and before that more than a few economic numbers.

FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow.

if you are a newcomer, take a more conservative approach and make sure you understand that the news can really move the market.

My observations suggest choppy, low volume up until announcement, followed by some some sharp volatile moves right during and after the announcement. However, with tomorrow early morning reports, we may see more volatility duirng first couple of hours as well. Continue reading “Futures Trading Levels and Economic Reports Schedule for December 14th 2010”

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010