Bullet Points, Highlights, Announcements

By John Thorpe, Senior Broker

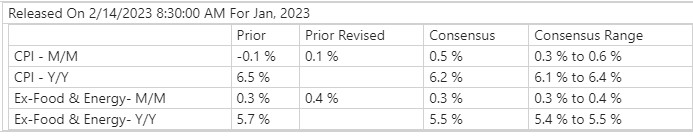

Inflation concerns weigh heavily not only on the markets we trade, discussions with our family, friends and neighbors often include the topic of inflation. It’s an inescapable reality in 2023. This weeks anticipated market movers are inflation gauges or data points the FED uses to guide future policy directives.

Tomorrow we have a number of gauges for the markets to absorb and they are all before 10 a.m. EST. Case -Shiller home price index, Chicago PMI, Consumer Confidence and the Richmond Fed Manu Index. All between 9 and 10 a.m..

Wednesday Fed Governor Kashkari at 9 a.m. followed by PMI Manu Final @ 9:45 ISM and construction spending @ 10 a.m.

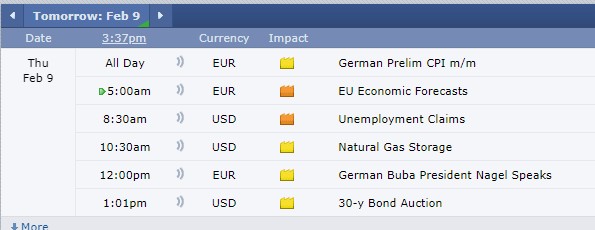

Thursday Motor Vehicle Sales (look for a slowdown compared to a hot January) and Jobless Claims at 8:30 EST and Productivity and costs. It’s also a heavy week for US Treasury bill note and bond settlements and auctions.

Friday ISM @ 10 EST and a number of fed Governor speeches beginning @ 110:45 EST through the end of the trading week. No Non Farm Payrolls this week!

Historically, the Senate Banking and the House Financial Services committees hold hearings with the FED Chair Twice a year and February is the month these open mike events are held. Not this year. Although when they do schedule the hearings it may be a little more challenging for FED Chair Powell to rely on Post Black out period discussions since this is normally when the Chairman is invited to the congressional hearings-immediately after FED Rate announcements.

The employment situation for February AKA Non Farm Payrolls won’t be released until Friday, March 10. The February survey reference period ended Saturday, February 18. It takes three weeks to prepare the report. What is normally a first Friday of the month release, will therefore be on the second Friday.

https://www.bls.gov/schedule/2023/03_sched.htm

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

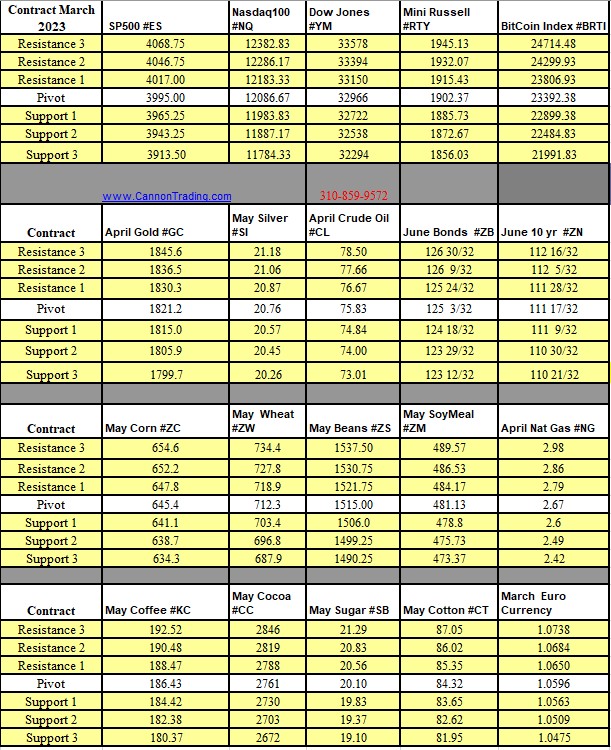

Futures Trading Levels

02-28-2023

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.