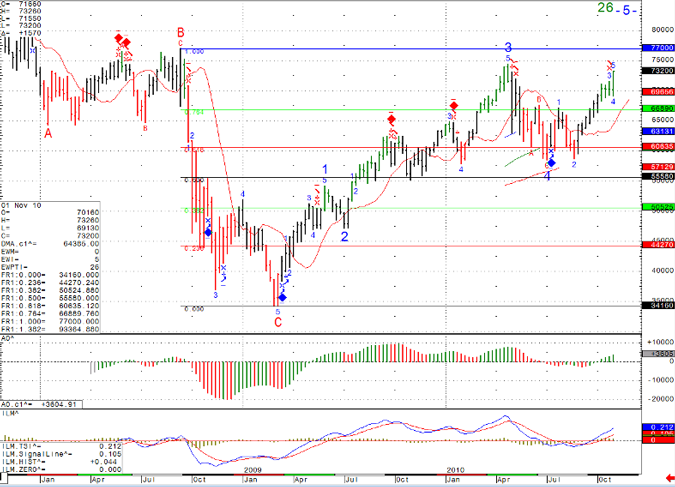

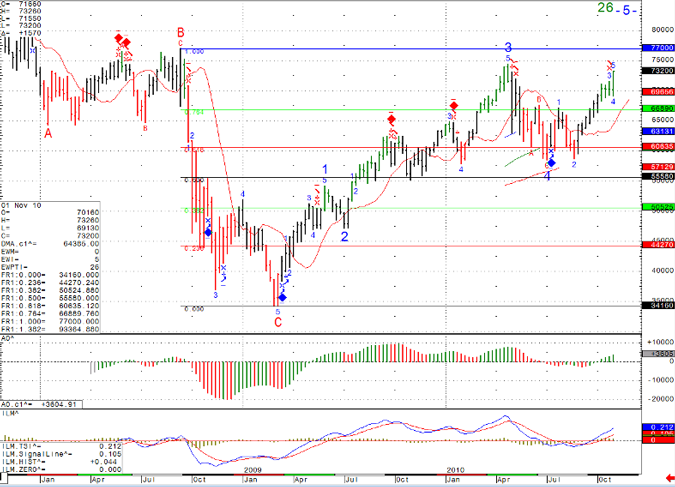

Some potential levels to watch on the way up and/or on pullbacks in the mini Russell WEEKLY chart below:

Continue reading “Futures Trading Levels and Economic Reports for November 5th 2010”

A futures trading platform is a single or a group of softwares that it used for enabling Online Futures Trading. The plus point about trading futures is that it enables you as the trading party to leverage both big and small moves. With our future trading platforms you can benefit in a number of ways. Firstly, they provide you with speedy access at any given point of time.

Secondly, they aid you in figuring out which trading method you should use so as to make the best out of the trade. The outcome is that you are able to manage your money, time as well as risk better. Offering futures trading platforms like Ninja Trader, OEC Trader, Shogun Trade Executer. CQG QTrader and more, Cannon Trading can aid you when it comes to commodity and futures trading. Under this particular archive we have detailed the futures trading platforms that we offer.

What we want from you as our trusted users and readers is to read through all the links provided so as to get some idea about how these futures trading platforms function. Although we are always there to advise, being equipped with information is crucial for every person interested in trading.

Some potential levels to watch on the way up and/or on pullbacks in the mini Russell WEEKLY chart below:

Continue reading “Futures Trading Levels and Economic Reports for November 5th 2010”

FOMC came and gone. market had its normal volatile two sided action but finished on the highs.

I have said this before, many times you can see the “true market reaction” the day after FOMC.

Tomorrow and Friday (monthly un-employment figures) should be interesting and perhaps volatile trading days. Continue reading “FOMC Sparks True Futures Market Reaction, November 4th 2010”

Two day FOMC starts tomorrow along with preliminary election news. Should provide for some interesting action in the second part of the trading week.

In between I still don’t see a longer term or a medium term swing trading set up I like, hence I currently focus on intraday set ups which I share in my daily “live charts/ webinar” service.

Daily Futures Day Trading Webinar:

**************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

**************************************************

Our Weekly Newsletter is Ready for Your Review at:

****************************************************************

https://www.cannontrading.com/community/newsletter/

**************************************************************** Continue reading “Futures Trading Levels and Weekly Newsletter for October 28th 2010”

Stocks finished pretty much unchanged today, which brings me to another point….

There ARE OTHER MARKETS one can day-trade….Most day-traders focus on the Mini SP 500 and it’s relatives:

Mini Nasdaq, Mini Dow, Mini Russell etc. because of volume, familiarity, trading hours etc.

However, markets like bonds, Euro Currency, Crude oil, beans, corn to name a few do offer day trading opportunities and risks. Different market have different personalities which may fit different traders. Different markets also have different trading hours when volatility is present, different volatility at different times and other

characteristics which traders may want to explore. During the day-trading charts service I hold daily, I feature the mini SP 500 chart along with Euro currency and Crude oil and possible trade set ups.

As always I recommend using demo account when exploring trading in market you normally don’t trade, as well as performing some research regarding tick size, price behavior and more.

FREE Trial for the Day-Trading Charts Service:

*************************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

************************************************************* Continue reading “Futures Trading Levels and Day Trading Webinar Trial, October 27th 2010”

Have a great weekend!! take time to clear your “trading brain” and allow it to recharge.

Screen shot from today’s session during our “live charts” service where one can see real-time trade set ups like below

(blue diamonds = possible buy, red diamonds = possible sell)

Charts included in this service are: Mini SP 500, Euro Currency and Crude oil.

For a Free Day Trading Webinar Trial Please Visit:

**************************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

**************************************************************

Continue reading “Free Day Trading Webinar Trial, October 18th 2010”