Cannon Futures Weekly Newsletter Issue # 1148

Join our private Facebook group for additional insight into trading and the futures markets!

Have a safe Memorial Day Weekend. Trading Schedule HERE

In this issue:

- Important Notices – Win 1 OZ Gold Bar!

- Trading Resource of the Week – Order Flow, Advanced T&S Trading Webinar

- Hot Market of the Week – June Dollar Index

- Broker’s Trading System of the Week – Browse Hundreds of “Hands Free” Systems

- Trading Levels for Next Week

- Trading Reports for Next Week

-

Important Notices –

Are you ready to go for gold?

Then here is your golden opportunity. CME Group will be launching the Go for Gold Precious Metals Trading Challenge coming this June.

You’ll have the opportunity to practice trading highly liquid Precious Metals products while competing against other traders for the chance to win the grand prize of a 1 oz. bar of gold*.

During the challenge, you’ll explore our suite of precious metals contracts and test-drive strategies in a simulated environment. We’ll send you exclusive, daily education materials on precious metals contracts in order for you to feel prepared to trade and confidently compete against your peers.

*Participants will only be eligible to receive a 1 oz. gold bar if permitted in accordance with the applicable laws of their jurisdiction.

START DATE: June 4, 2023

END DATE: June 9, 2023

Trading Resource of the Week –

A Cannon broker will be able to assist, provide feedback and answer any questions.

- Hot Market of the Week – June US$ Index

-

Hundreds of “Hands Free” Automated Systems to Choose from!

-

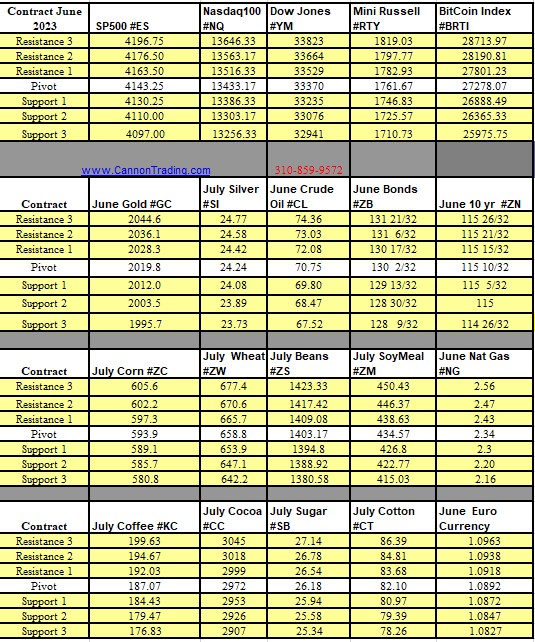

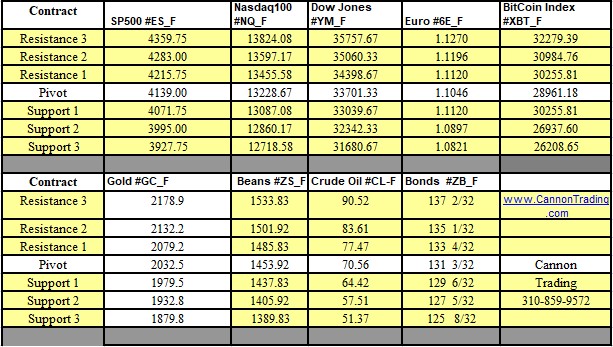

Trading Levels for Next Week

Weekly Levels

-

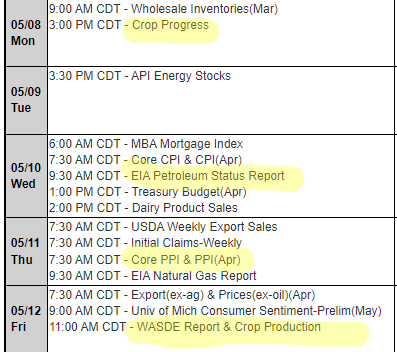

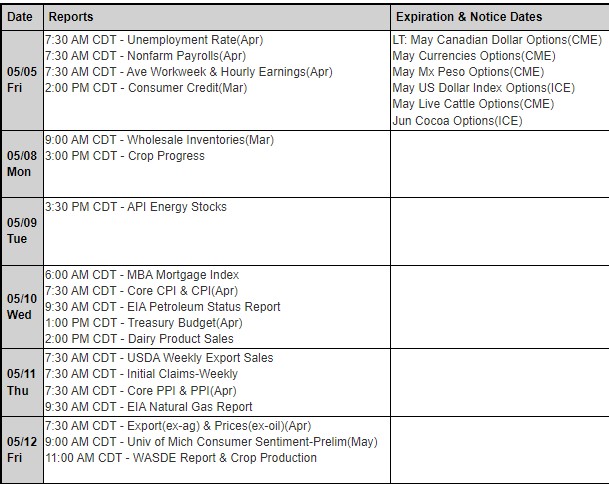

Trading Reports for Next Week

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.