Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

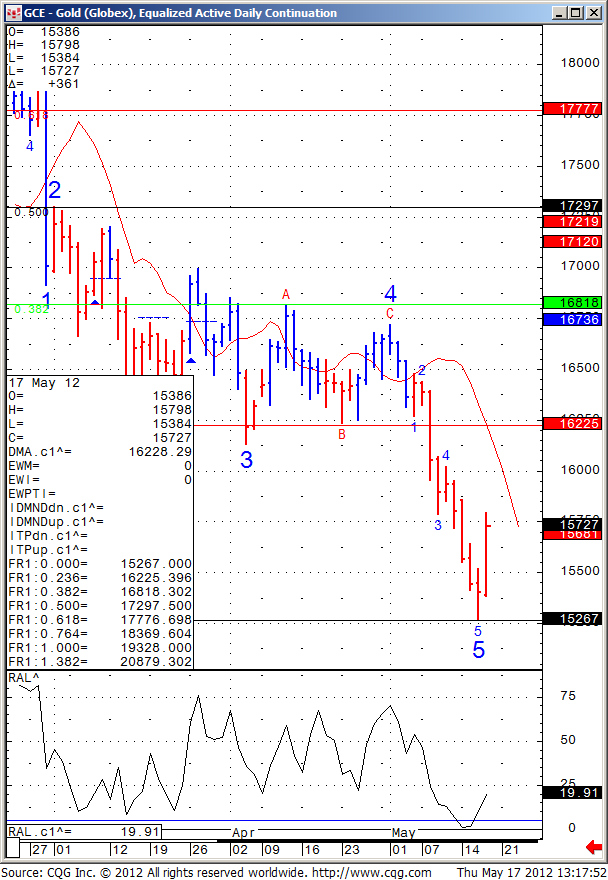

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday April 24, 2013

Hello Traders,

For 2013 I would like to wish all of you discipline and patience in your trading!

Today we witnessed the possibility of erratic moves in the futures market.

From what I am reading, false rumors generated by hackers hit the news with: Explosions in the White House, Obama is hurt….

That resulted in the SP futures dropping 18 full points in matter of minutes. An intraday chart of mini SP 500 for your review below. Note the huge price drop and volume between 12:06 and 12:12 central time.

That brings me to a point that I like to share, using “auto brackets when entering a trade”. This is my personal preference but when I enter day-trades, I like my software to immediately generate a stop and a limit**. I have the ability to modify these stops/ targets but at least I have orders in the system. This can help in situations like today, when different reports come out etc.

Most of our trading platforms have that ability of auto brackets and you can test drive two of my favorite platforms for free:

If you like the information we share? We would appreciate your positive reviews on our new yelp!!

Continue reading “Futures Trading Levels and Economic Reports for April 24, 2013”