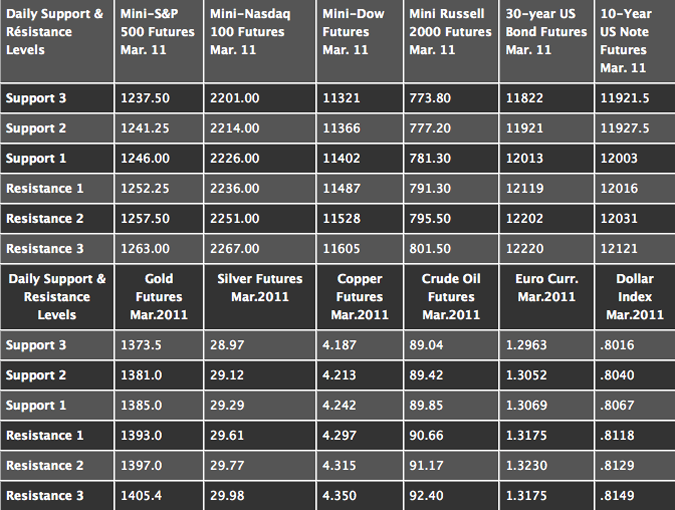

Updated: 22-Dec-10 08:30 ET Continue reading “Daily Support and Resistance Levels for December 22, 2010”

No matter how much time and attention you pay to the details of future trading and futures exchange, sometimes it can get difficult to understand what these things are. Otherwise also known as futures markets, a futures exchange is where people trade future contracts.

This contract is to buy certain specific quantities of a certain commodity and/or a financial instrument. Another thing about the futures exchange is that the contracts traded on it are always standardized. And, there are a number of elements that define the standardization of the contract. There is a list of futures exchanges or futures markets that you must read about before entering the futures exchange.

We at Cannon Trading are there to help you understand and assist in matters related to futures markets. Apart from our expert traders and brokers who can be reached at any time, our online knowledge base helps you get all the information possible on the latest about futures markets in different parts of the world. So, in order to be better informed, read through all the blogs in this category archive.

Market is acting a bit funny….reason i am saying that is that we are trading at relatively HIGH prices, over 52 weeks highs, yet the volatility is at a very low level….

What i have noticed over the years is the wave pattern of volatility….from extremely high volatility to extremely low volatility and goes again….so now the question is when is the next wave of higher volatility starts?

Have a great weekend, successful trading week ahead ( only 4 trading days next week, with Thursday packed with economic numbers).

I will be out of the office until Jan. 3rd but you will receive levels and reports published by colleague here at cannon.

happy Holidays and great trading in 2011! Continue reading “Futures Trading Levels and Economic Reports for December 20, 2010”

We are heading into the last two weeks of 2010 with only 4 days of trading next week and generally lower volume during this period of the year. Keep that in mind when trading.

Some days you will see very slow, choppy trading while other days you may see some volatile and exaggerated moves because of the lower volume.

Keep a trading journal, write notes on how this time of the year is affecting the markets and trading and refer back to these notes when needed. Continue reading “Futures Trading Levels and Economic Reports for December 17, 2010”

Market feels bit heavy right now but then again it felt heavy more than a few times over past few weeks only to find some more legs and go higher….so either way you plan on trading this market, make it exactly that….have a plan and then trade your plan.

Our Weekly Newsletter is Ready for Your Review:

**************************************************************

https://www.cannontrading.com/community/newsletter/

************************************************************** Continue reading “Futures Trading Levels and Weekly Newsletter for December 16th 2010”

FOMC is behind us and the market is heading into the final little stretch of the year, going into that last two weeks of 2010 along with the holiday season and what may be lower volume period.

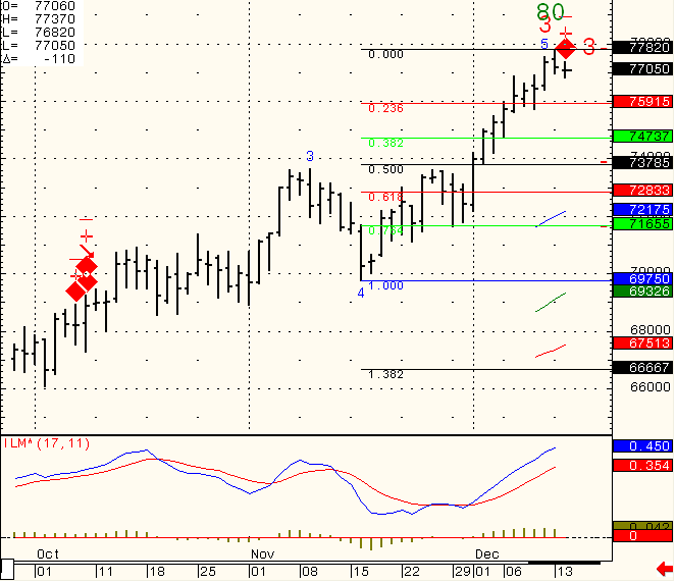

In between, I see a possibility for a pull back on the Mini Russell 2000 if prices can break below 767.00 basis the march contract. Daily chart for your review below:

Continue reading “Futures Trading Levels and Economic Reports for December 15, 2010”

Continue reading “Futures Trading Levels and Economic Reports for December 15, 2010”

We are now trading MARCH contracts for all e-minis, stock indices, financials and CURRENCIES.

I think next week we should see some volatility with economic reports due along with FOMC. Please see next reports below.

I think the following quote is so appropriate in our business….

“One cannot do anything about yesterday”

Wishing you a great weekend. Continue reading “Futures Trading Levels and Economic Reports for December 13th 2010”

December to March Rollover Notice

We are now trading MARCH contracts for all e-minis and stock indices.

Weekly chart of the CASH SP index for your review below:

Today we witnesses a high volatility day that followed a very “sleepy” trading day on Monday.

You should keep trading notes with information such as this and other that will assist you as your trading experience grows.

Below is an hourly chart of the mini SP 500 for your review.

Continue reading “Futures Trading Levels and Economic Reports for December 8th 2010”

Continue reading “Futures Trading Levels and Economic Reports for December 8th 2010”

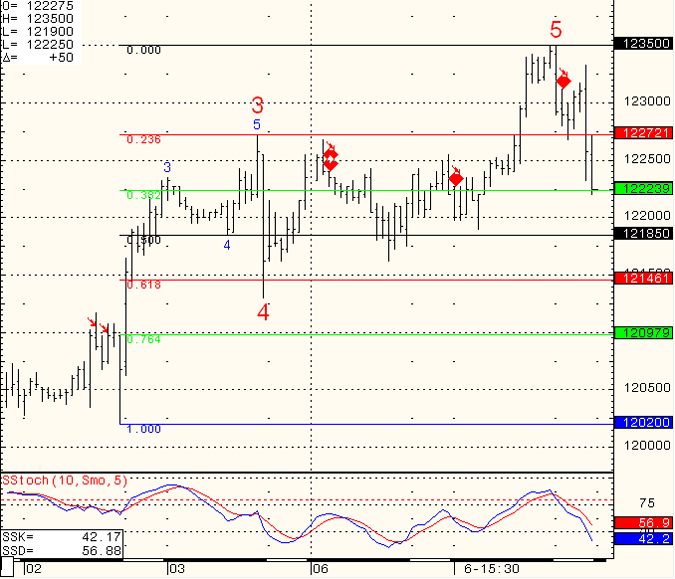

Today was a “slow trading day” when it came to stock indices, which leads me to a good point I would like to make. Most of our day traders, trade the e-mini stock index futures, mostly the mini SP because of its heavy daily volume and exposure.

However, I think that day-traders should be able to follow at least another market, maybe even two additional markets and look for different set up in these markets as well.

Good example from today is the Euro currency. While the mini SP was pretty dead….the Euro had nice range, good volatility and good volume which presents both risks and opportunities for day-traders.

Obviously, before you start trading a new market you should educate yourself on tick size, trading hours, “personality”, when is there more volume in that specific contract etc.

If you do so, I think you will achieve a couple of things, first is diversification. While some days trades in certain market may not work, trades in a different market may provide balance.

Also, if on certain days, certain markets are “sleepy” ( which most day-traders do NOT like), another market may have more action….

As always, do your homework, practice in simulation mode first and make sure you understand the “new contract” you may be trading along with the risks involved.

Below is a screen shot of the Euro Currency from todays webinar session :

( free trial at – https://www.cannontrading.com/tools/intraday-futures-trading-signals )

Continue reading “Futures Trading Levels and Economic Reports for December 7th 2010”

Continue reading “Futures Trading Levels and Economic Reports for December 7th 2010”