Stocks finished pretty much unchanged today, which brings me to another point….

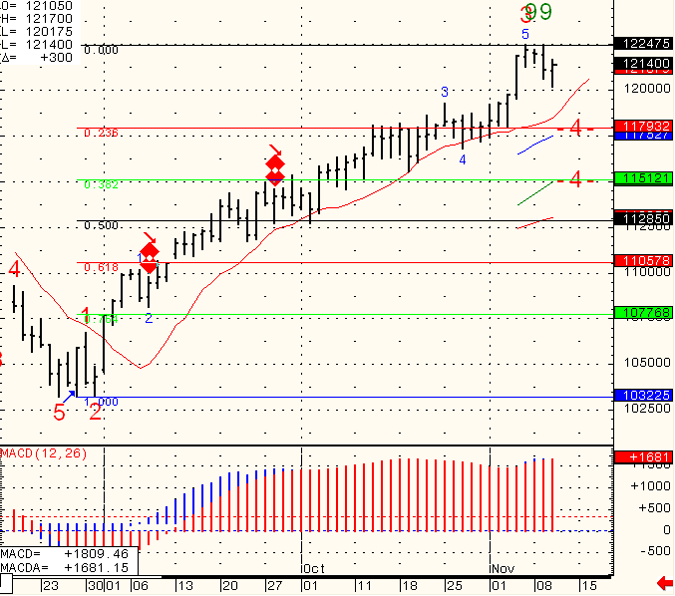

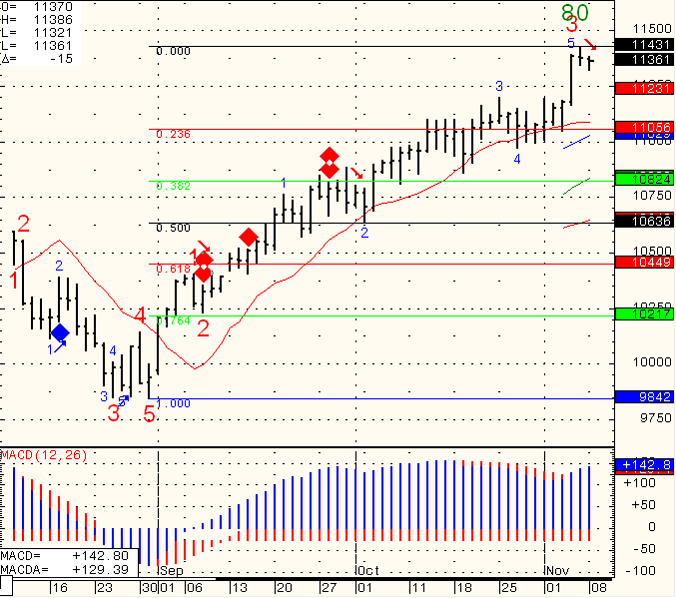

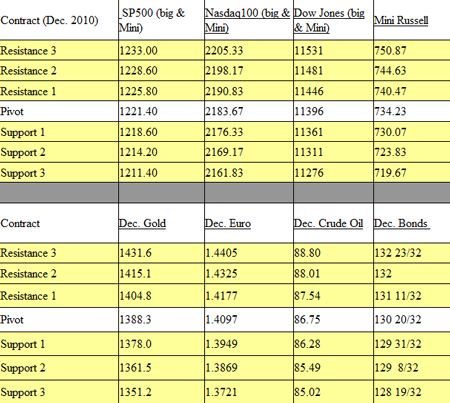

There ARE OTHER MARKETS one can day-trade….Most day-traders focus on the Mini SP 500 and it’s relatives:

Mini Nasdaq, Mini Dow, Mini Russell etc. because of volume, familiarity, trading hours etc.

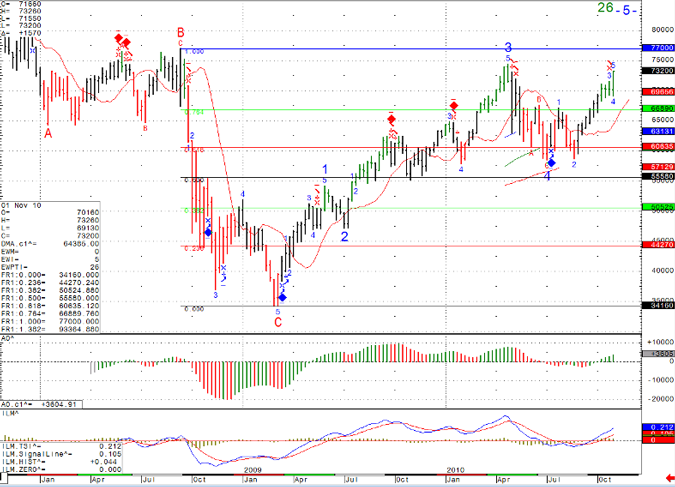

However, markets like bonds, Euro Currency, Crude oil, beans, corn to name a few do offer day trading opportunities and risks. Different market have different personalities which may fit different traders. Different markets also have different trading hours when volatility is present, different volatility at different times and other

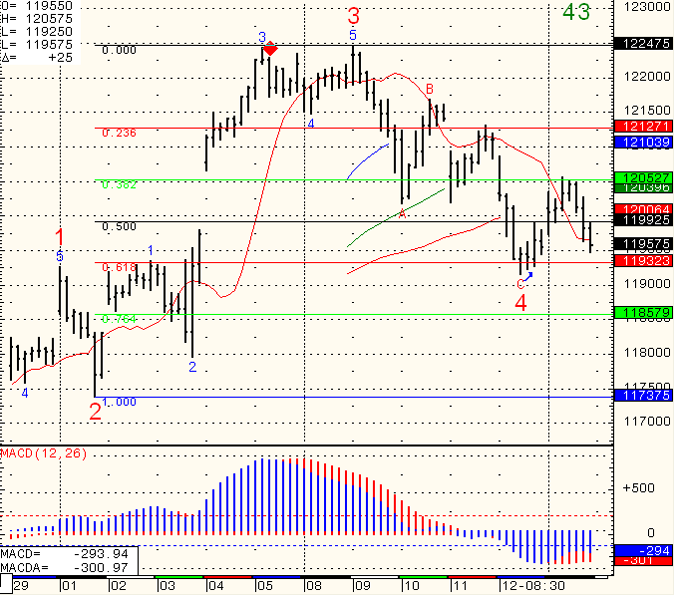

characteristics which traders may want to explore. During the day-trading charts service I hold daily, I feature the mini SP 500 chart along with Euro currency and Crude oil and possible trade set ups.

As always I recommend using demo account when exploring trading in market you normally don’t trade, as well as performing some research regarding tick size, price behavior and more.

FREE Trial for the Day-Trading Charts Service:

*************************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

************************************************************* Continue reading “Futures Trading Levels and Day Trading Webinar Trial, October 27th 2010”

Continue reading “Futures Trading Levels and Economic Reports for November 16th, 2010”

Continue reading “Futures Trading Levels and Economic Reports for November 16th, 2010”