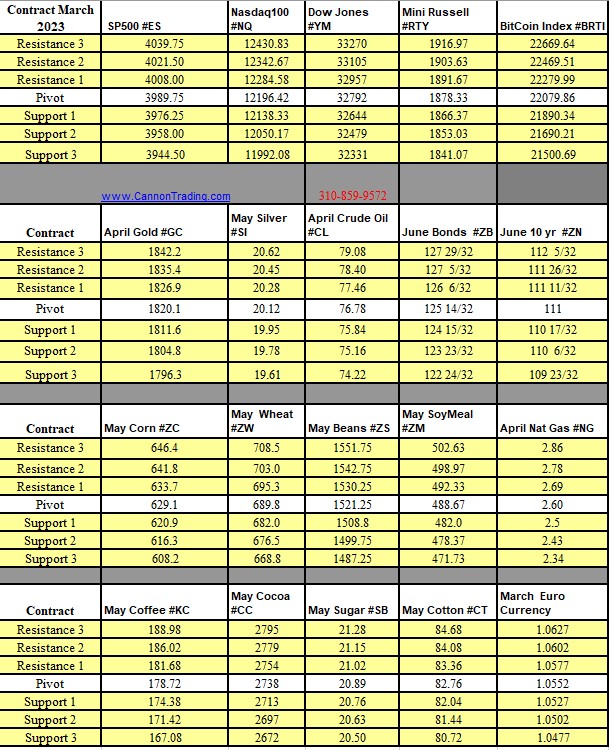

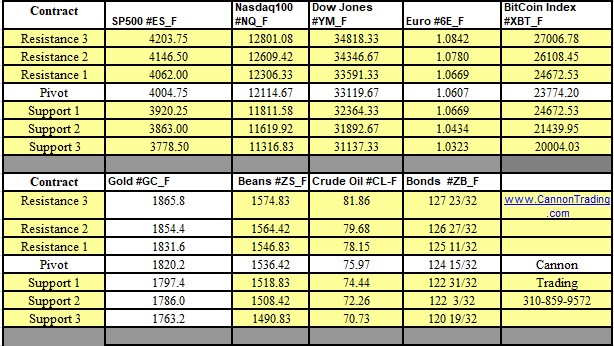

Trade June indices as well as June currencies!

The Week Ahead,(hint CPI release tomorrow, Fed Blackout period, ECB Rate decision to name a few)

By John Thorpe, Senior broker

Or rather the weekend update for March 13th.. No government bailouts!

I bring this to everyone’s attention so you can, for yourself, rather than listen to our available media outlets what the Fed has decided to do and how they plan on addressing any future bank issues. I have also included the FDIC links where Failed Banks will be listed. For now we have two , let’s hope it stays that way..

Mixed signals from a number The US Treasury Department and The Fed over the weekend. (Janet Yellen said no help for the depositors of SVB on Saturday) Fed Reversed.

Here are a few links regarding the eye popping news of Bank Failures.

First from the Fed

Here are the rules for the failed banks

Bank Term Funding Program (federalreserve.gov)

The FDIC is where you can get the most recent updated list and what actions they take. Personally when the appoint a new CEO do your research on these people.

https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

https://www.fdic.gov/news/press-releases/2023/pr23019.html

https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/signature-ny.html

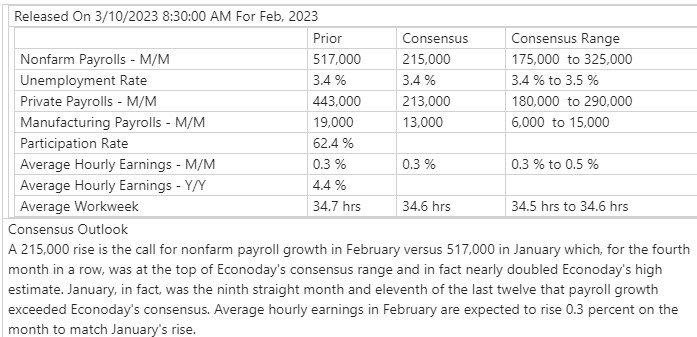

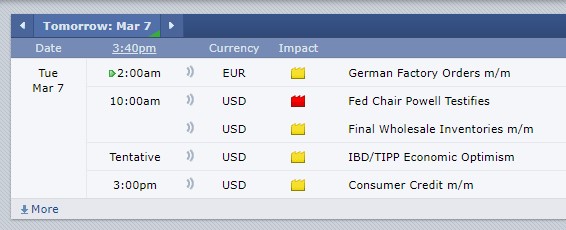

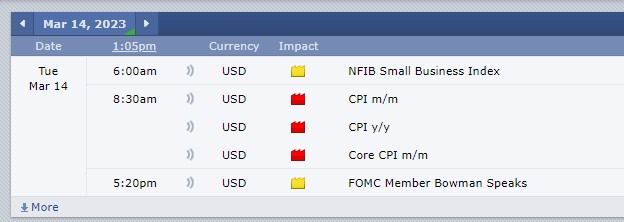

Now for CPI! It’s tomorrow!

if CPI core services excluding housing is not also improving, the FOMC will have another reason to hike rates by 50 basis points at the March meeting. If some of the lagged effects of past rate hikes are visible release @ 7:30 CDT Tuesday.

FINAL Demand PPI on Wednesday at , you got it, the same time will move the market although it shouldn’t be Brutal.

Thursday Jobless claims! Same bat time same bat station. Also the ECB Rate decision at 8:15 CDT 45 mins after the jobless claims and housing starts, we finish on ST. Paddy’s day! With a Leading indicators number that may be overshadowed by the previous economic releases. Be Careful out there, Plan your trade and trade your plan!

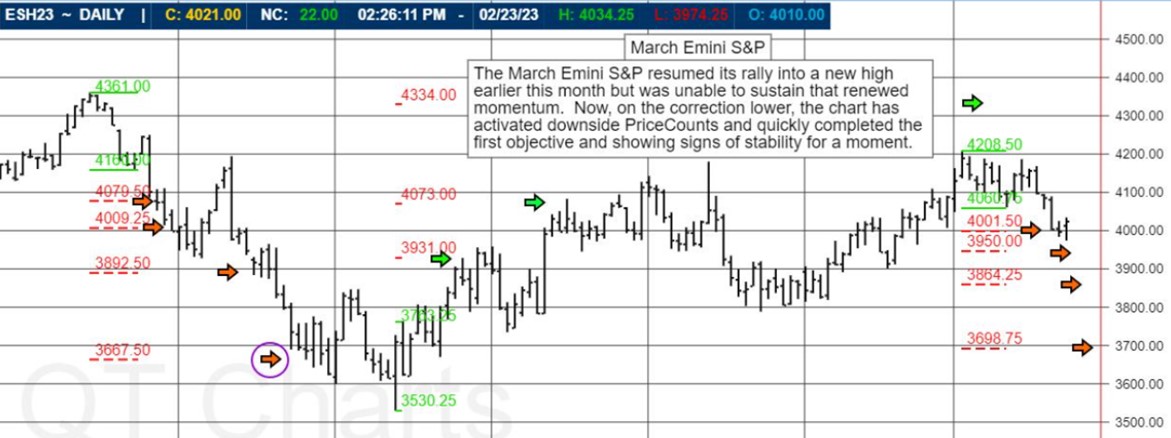

The March Mini SP resumed its rally into a new high earlier this month but was unable to sustain that renewed momentum now in the correction lower the chart is activated downside PriceCounts and quickly completed the first objective and showing signs of stability for a moment

Hot market above is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

PriceCounts – Not about where we’ve been , but where we might be going next!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

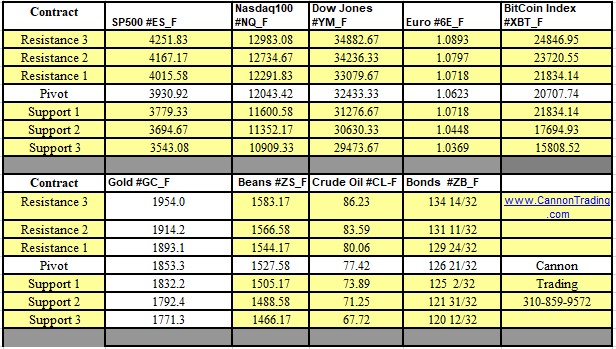

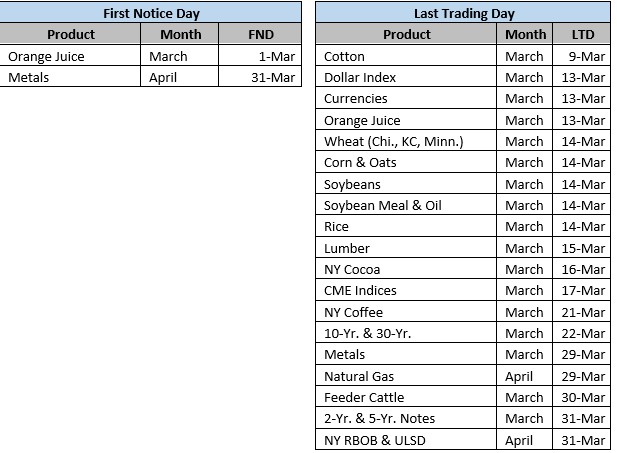

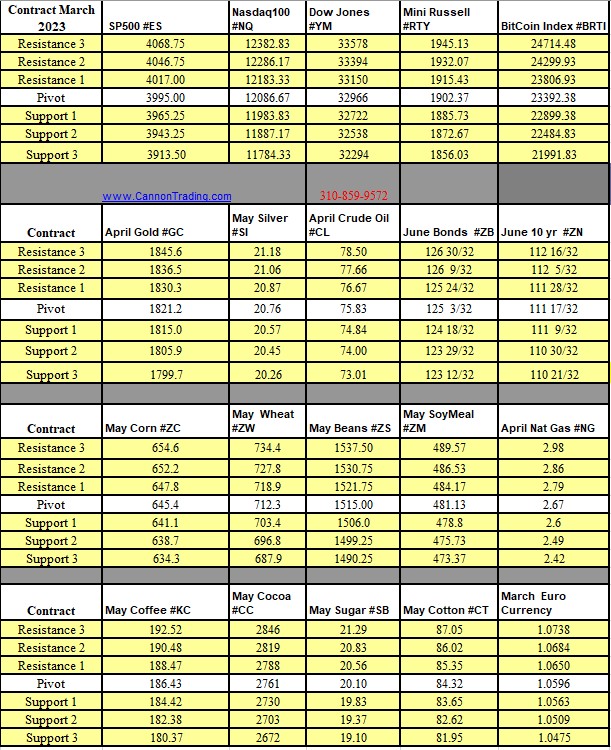

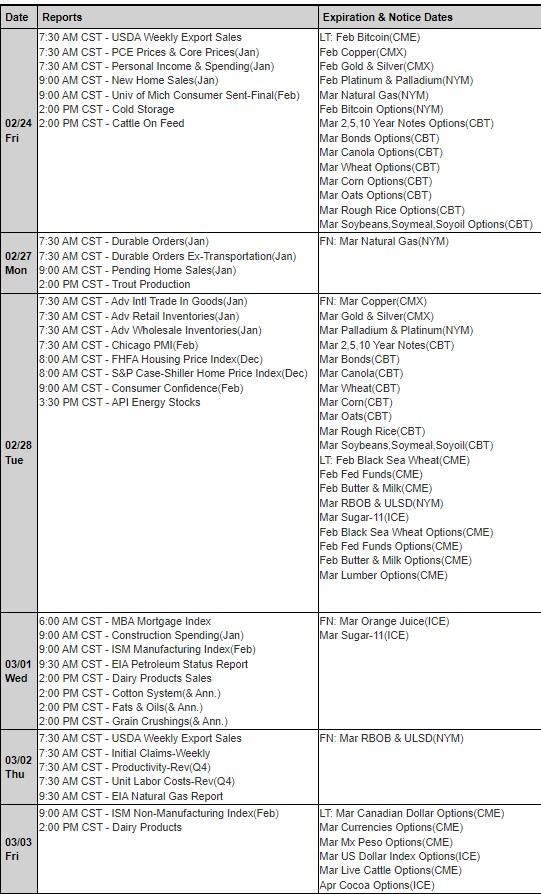

Futures Trading Levels

03-14-2023

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.