Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

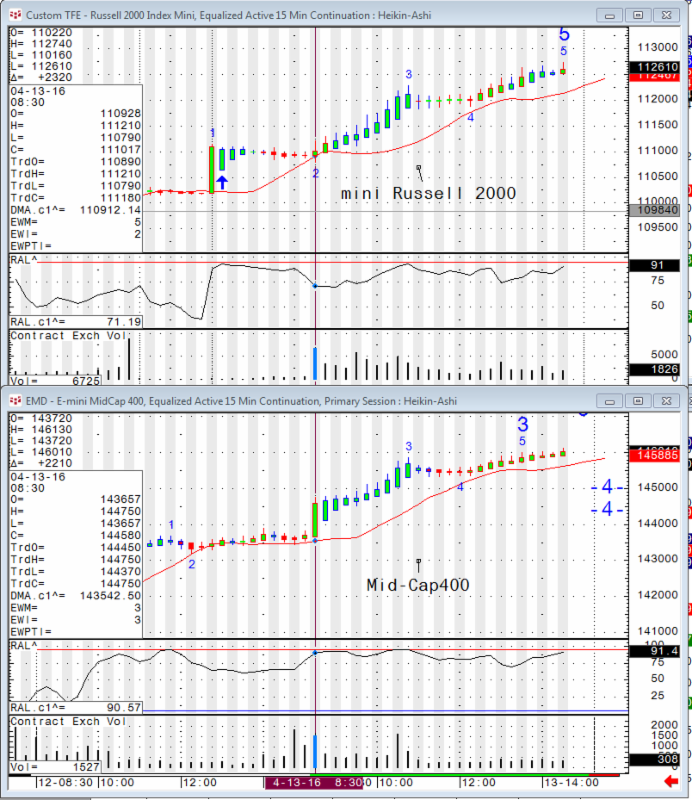

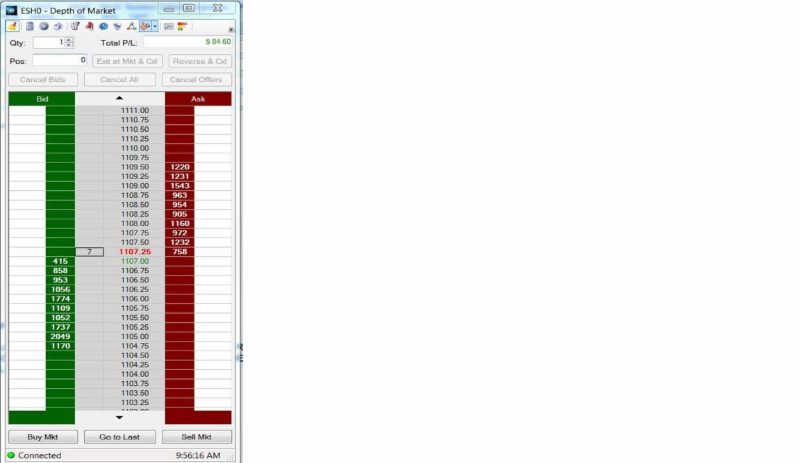

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

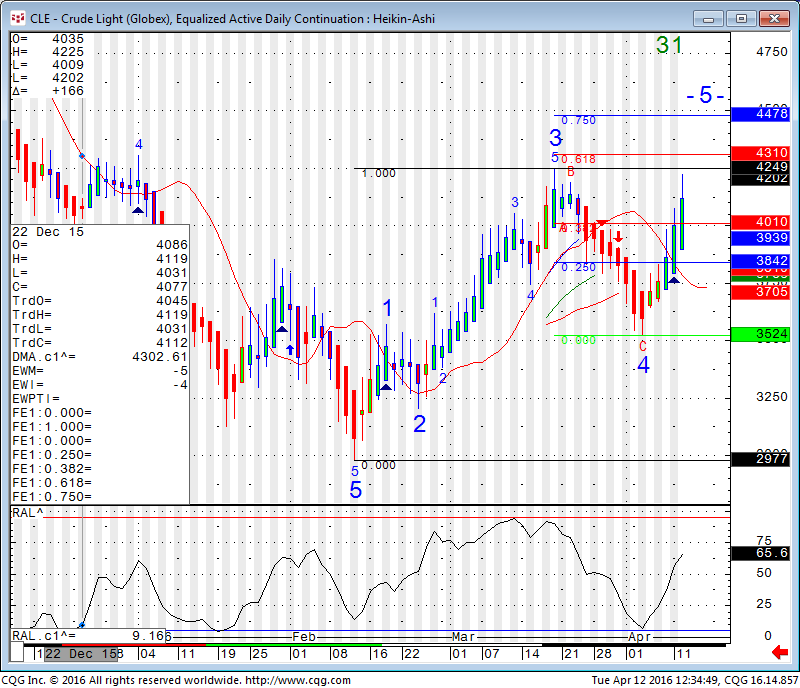

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday April 15, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Voted #1 futures trading blog!

Greetings!

I wrote the following crude oil analysis for equities.com, which you can read in full at:

https://www.equities.com/news/crude-oil-futures-heading-towards-45-and-decision-point

Featured System of the Month ( including real-time performance): Axiom Index II WFO NQ Trading System