Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

1. Market Commentary

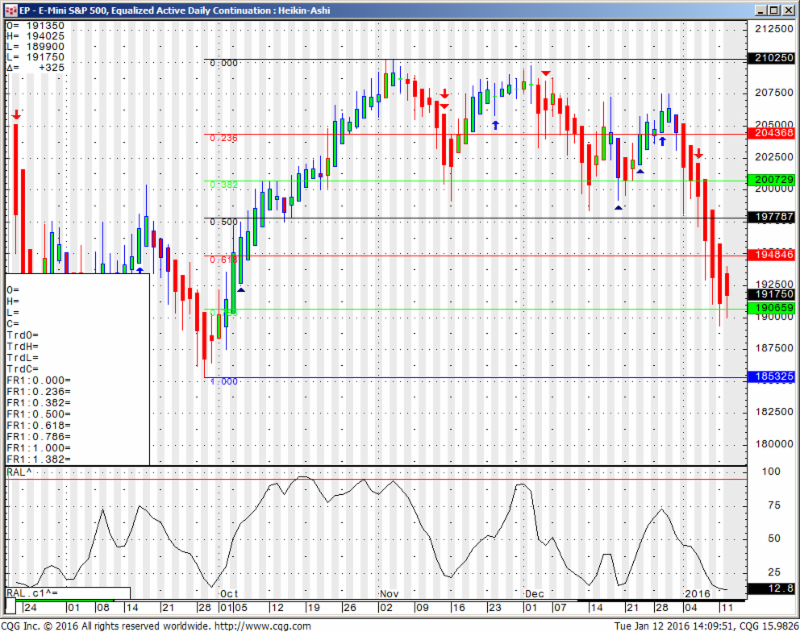

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday January 5, 2016

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Voted #1 futures trading blog!

Hope everyone had a great holiday season and some time off with family and friends. I wish all of you the best in trading in 2016 specifically and in all aspects of life in general.

Great article to start your trading in 2016:

Walk before you run

By Cannon Trading staff

The image of a successful futures trader is that of a lone wolf surveying the landscape looking for an opportunity to attack and seize quick and substantial profits. We all know about the potential for making a fortune in the futures markets. Yet, few do so. Why is that? What are some of the common pitfalls that prevent this dream from becoming a reality for most traders?

One of the most prevalent misconceptions for inexperienced traders is that they believe themselves to be smarter than the rest of the market participants. They under estimate the qualifications and abilities of the rest of the futures markets professionals. This business of trading is dominated by very dedicated, resourceful professionals who have invested lots of time and assets into their pursuit of trading profits. Competing against these seasoned professionals is not impossible but going it alone, especially initially, is usually not the most prudent course of action for new traders.

Continue reading “Walk Before You Run When Trading Futures 1.05.2016”

![]()

![]()

![]()

![]()

![]()

![]()